Indonesia’s final round of presidential debates for the general election in April will discuss economic and financial issues.

We can expect that the two candidates – incumbent President Joko “Jokowi” Widodo and his rival, Prabowo Subianto – will talk about the country’s debts during the 13 April debate. This has become one of the most debated topics between the two camps.

Prabowo’s camp has criticised the increase in debt under Jokowi’s administration, blaming it on his poor leadership of the economic sector.

Jokowi’s administration has defended its decisions, arguing that the amount of debt is still at a normal level required by the law.

I am a lecturer and researcher in accounting and finance. Using basic accounting principles and financial theory, I would like to argue that debts are not that bad.

Understanding the debate on Indonesia’s debts

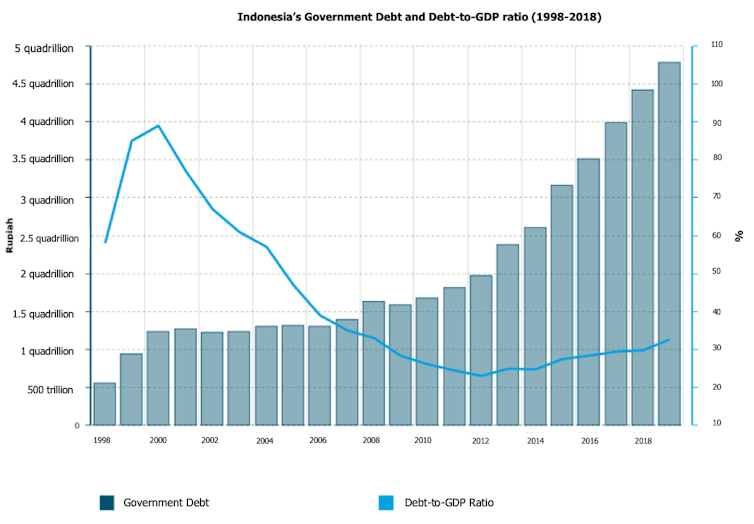

Indonesia’s debt has been increasing steadily over the past 10 years.

However, over the past seven years, the country’s ratio of debt to gross domestic product (GDP) has remained around 30%. This level is considered safe. The 2003 Law on State Finances stipulates that the government may take out a loan as long as debt does not exceed 60% of national GDP.

Indonesia’s 2018 debt-to-GDP ratio is lower than for neighbouring ASEAN countries such as Thailand (41.8%), Malaysia (50.9%) and Vietnam (61.5%).

Prabowo’s camp has repeatedly criticised Jokowi’s administration for taking on too many debts for, among other things, its infrastructure projects, deeming these decisions shortsighted. They say it will burden future generations.

On the contrary, I believe we should not rush to such a conclusion.

Understanding debts

In accounting, debts are one way to get assets.

Assets or resources owned by an entity for its business operations are equal to the sum of liabilities and equities. Liabilities are the amount of money that an entity owes to its creditors. Equity is the owner’s claim to the entity’s assets.

If an entity wants to add to its assets it can secure these by selling the entity’s capital (equity) or borrowing from creditors (debts/liabilities).

Imagine for a second that you need some cash to buy a new vehicle (an asset) for operations. You have two options:

The first option: visit the bank and borrow some money, therefore creating a liability.

The second option: if it is a small business owned by you, you can inject your money from your own pocket. Or ,in the case of a corporation, you can sell the company’s shares or stock to gain some money.

From the first option, we know that there is another side to debts as they can help companies to add more assets.

Pecking Order model

In 1984, economics experts Stewart Myers and Nicolas Majluf introduced the Pecking Order theory for corporate finance. This theory suggests companies use their internal funds to build assets.

However, internal resources are finite. Companies would then have no choice but to secure external funds. This can be done either by borrowing (debt) or by selling its equity as shares.

The Pecking Order theory prefers companies to seek debts rather than selling stocks. There are two reasons for this.

First, seeking debts is more beneficial for companies as it will reduce the amount of taxes they pay. How so?

Companies must pay interest on the debts they secure. These interest payments will cut the companies’ income, which in the end results in a tax reduction.

On the other hand, selling shares to new owners would reduce the original owners’ control over the company. New owners can dictate the direction of the company with their voting rights.

Stocks also generate future costs. While debt breeds interest, stock gives rise to dividends. Dividends are the portion of the company’s income distributed to its stockholders.

Putting into Indonesia’s context

While the Pecking Order theory describes the positive side of debt from the perspective of corporations, we should remember that a government does not operate to generate profit.

The government’s main objective is to protect and serve the public and increase their prosperity.

Seeking debts for the government is justified as long as the loans are allocated in sectors that will benefit the people. These sectors may include infrastructure and health.

For example, Indonesia needs to secure debts to fund its expensive infrastructure projects.

Indonesian people desperately need the government to complete its infrastructure projects to ensure growth and development are spread evenly throughout the country.

Also remember that the world’s largest economy has the world’s largest debt.

Debt, as it turns out, is not too bad at all.