All Australian governments, and ultimately all Australians, are faced with making tough decisions in their budgets. Without significant reductions in government expenditures and the services they provide or an increase in taxation to fund government expenditures, current policies will lead to larger and larger structural budget deficits.

For example, the Grattan Institute projects a combined structural deficit for the Commonwealth and the states (and territories) of at least 4% of national income, or $60 billion a year, by the early 2020s.

Another report from modelling firm Macroeconomics, commissioned by the Minerals Council of Australia, also predicts decades of structural deficits unless governments rein in their outlays.

An increasing structural deficit is inconsistent with the bi-partisan policy of budget balance over the economic cycle; it is unsustainable; and it threatens the ability of governments to assist the economy to recover from inevitable future international and domestic shocks.

Recurrent expenditure by the commonwealth and state governments in 2012-13 is about $500 billion, or 33% of GDP.

Intergenerational reports prepared by the Commonwealth and by some of the states project government expenditure share will increase over the next few decades under current policy programs.

With higher incomes and new technology, Australians are demanding more and more health expenditure, with most funded by governments; ageing of the population is considered to be a relatively small contributor to higher health costs.

The Grattan Institute projects an increase in government expenditure on health by the early 2020s of about the equivalent of 2% of GDP; and this is similar to the increase over the past decade.

Full implementation of the NDIS would be a major additional expenditure.

Ageing of the population is projected to increase welfare payments and aged care, even after allowing for the build-up of pre-paid superannuation. Proposed increases in parenting payments, Newstart, and so forth would add further to welfare outlays.

Government expenditure on education is expected to increase as a share of GDP, and more so if initiatives such as the Gonski proposals are implemented. State governments face a large backlog of expenditure on infrastructure for growing populations. Most other government expenditures, including on defence, law and order, are projected to draw about current shares of GDP in the future.

Most, if not all, current and proposed government expenditures are valued by citizens. However, their provision involves an opportunity cost of labour and other resources reallocated from private sector expenditures on food, housing, recreation, and so forth. Taxation is the process for this reallocation of income from private to public expenditure.

Taxation revenue as a share of national income has fallen from about 34.5% in 2007-08 to a low of just above 30% in 2010-11 and about 32% in 2012-13 for a number of reasons. Changes to the personal income tax rate schedule by each of the Howard, Rudd and Gillard governments, reduced personal income tax. Lower capital gains tax post the GFC also is likely to continue.

Company income tax has declined with slower growth of corporate incomes, and with increased depreciation allowances associated with the mining investment boom. Indirect tax revenues as a share of GDP have fallen in the case of the GST, due to an increase in the household saving ratio and also to tax base exemptions for income elastic products; from non-indexation of the petroleum excise rates; and the end of the property boom has reduced conveyance duty.

Revenue from the minerals resources rent tax has been much smaller than projected, and it seems likely that revenue from the carbon tax (or more accurately the sale of emission permits) will fall from 2015-16.

In the real world of economic cycles the ever widening gap between an increasing government expenditure share and at best a constant taxation share of national income prepared under average economic circumstances shown in the intergenerational reports and the Grattan Institute is likely to underestimate the budget deficit.

An economic downturn, either with international and domestic causes (or both), almost certainly will occur in the future as in the past. Downturns result in larger fiscal deficits and new expenditures which prove difficult to unwind.

Over the longer run, fiscal deficits, and more importantly increasing fiscal deficits, are unsustainable. They incur higher debt interest payments; higher interest rates for private sector investors; reduced flexibility and effectiveness in responding to economic recessions and crises; and their eventual repayment becomes higher taxes and imposts on future generations.

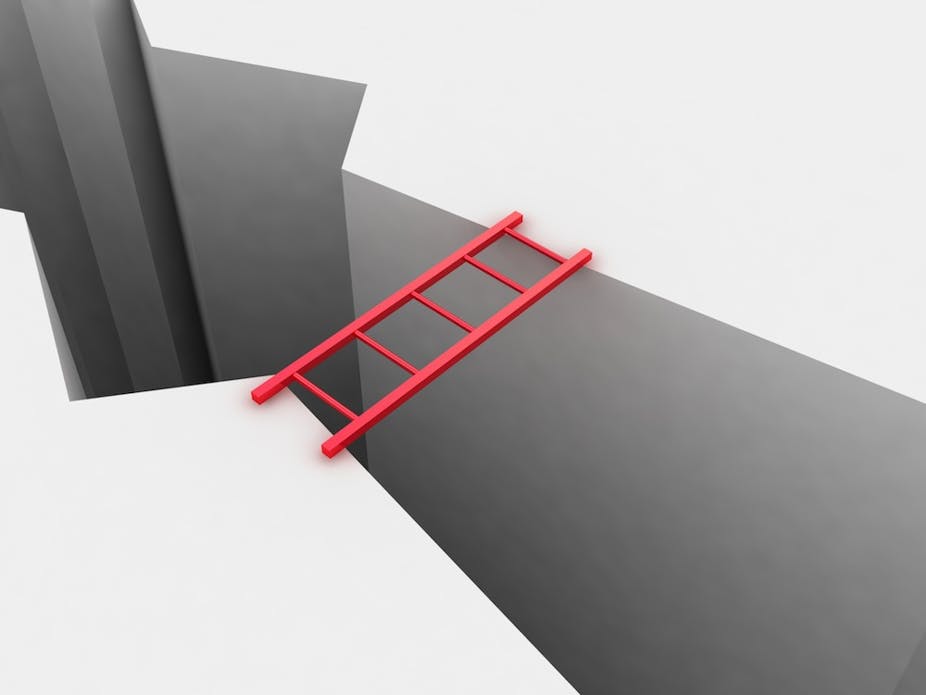

Governments at all levels and of all colours must involve themselves and the public in a serious policy discussion of how to turn around the trend to rising and unsustainable budget deficits. Improving government productivity, for example by reducing wasteful overlapping of commonwealth and state programs for education and health, can assist, but it would not be enough to bridge the gap.

Ultimately, a revaluation of different expenditure programs and their options and/or higher taxation will be required. The mix of tax increases and expenditure reductions require society to make judgements about the relative roles of government and the private sector, and about the relative merits of more or less limited income and resources allocated to government goods and services versus private sector provided goods and services.