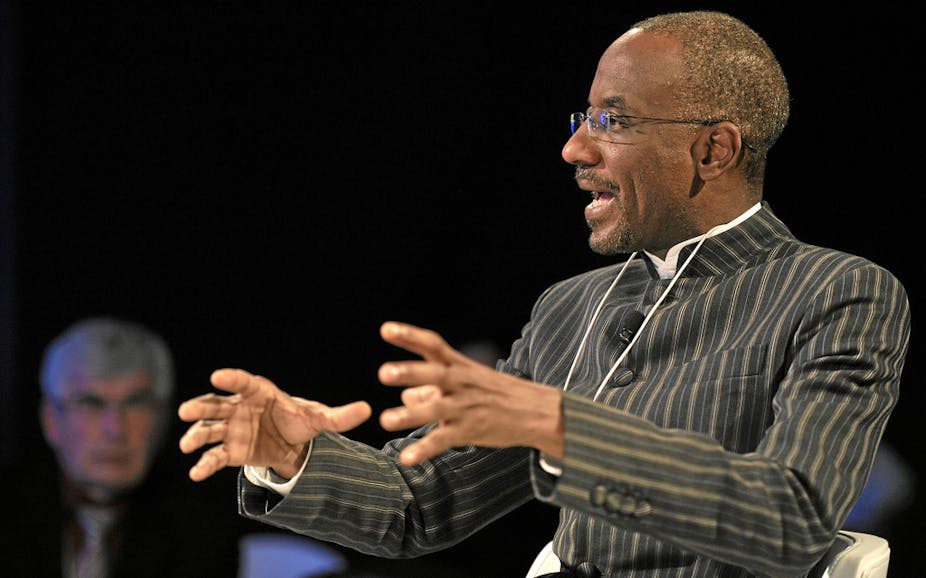

The Nigerian business community and international investors into Africa’s most populous country are still reeling from the shock of the suspension of Central Bank of Nigeria (CBN) governor Lamido Sanusi.

President Goodluck Ebele Jonathan claimed the suspension of the CBN governor came against the backdrop of a report from the Financial Reporting Council of Nigeria and other investigating bodies, which indicated that Sanusi’s tenure has been fraught with various act of financial recklessness and misconduct.

No one has ever fired a CBN governor in the past in Nigeria, let alone suspend the governor. The CBN Act 2007 makes clear that the removal of the governor must be supported by a two third majority in the senate on the grounds of incompetence or inability of the governor to perform his duties as the head of the apex bank.

Sanusi, the architect of sweeping reforms of Nigeria’s banking sector, had been due to step down in June. But he has already indicated he plans to contest his suspension in court. He says it is the only way to resolve the issue of autonomy of the office of governor.

Sentiment unsteady

The question now on the lips of political analysts, domestic investors and foreign investors, is what are the economic implications of his suspension, particularly as Nigeria heads towards an election in 2015.

Will it exert pressure on the already weak naira, Nigeria’s currency? What impact will the suspension have on ongoing financial sector reform. These include the merger of weak banks, the cashless policy which limits the level of withdrawal by individual to USD$3,000 and corporate bodies to USD$18,000, and the policy on currency restructuring.

How will the suspension affect the sentiment of foreign investors? Will the new governor rise up to the challenge if confirmed? What new priorities is the new governor likely to pursue? And what are the likely implications if Sanusi’s legal challenge to his removal drags out in court?

On the domestic front, Sanusi’s suspension produced mixed reaction from different quarters. Some commentators were of the view that the ousting was long overdue, following Sansusi’s recent attack and open criticism of the government over USD$20 billion alleged missing from the coffers of the Nigerian National Petroleum Corporation (NNPC). Others such as opposition politican Nasir El-Rufai were quick to fault the government action if it was linked to Sanusi’s whistleblowing.

Public reaction has continued to be polarised, with counter accusations coming from the government quarters on the financial recklessness of the suspended governor. While some see the suspension as a welcome development, others see Sanusi as a hero bold enough to stand against corruption.

Naira under pressure

The reaction of the market was sharp and decisive. The foreign exchange rate market immediately depreciated, by over 2% on the day of the announcement, though it rebounded by 1% a day later. In reaction to the depreciation of the naira, the deputy governor in charge of economic policy, Sarah Alade who has been appointed acting CBN governor, reassured Nigerians of the bank’s intention to continue to defend the naira and maintain stability in monetary policy.

But investors and speculators have continued to increase their dollar holdings in anticipation of a devaluation of the naira. The Lagos Stock Exchange, which had already slumped in January, also dipped, before recovering.

The CBN’s major goal is to maintain Nigeria’s macroeconomic stability. And there has been significant stability in the economy between 2010 and 2013. Overall, GDP growth grew by 6.87% in 2013 up from 6.58% growth in 2012, according to the CBN. This was supported by the moderation in inflation which narrowed to a single digit of 9.3% percent by end 2013.

Added to the stable price regime is the relatively stable exchange rate, achieved by the CBN’s tight monetary policy stance. However, there are ongoing concerns on the continous decline in the country’s external dollar reserves, which fell 2.24% in 2013. There is also continuing underperformance of oil production in the face of high international oil prices, alongside ongoing depletion of Nigeria’s excess crude account, a fund fed by profits from the state’s oil interests. It fell a whopping 72% in 2013 as the table below shows.

The macroeconomic environment under Sanusi’s tenure can at best be described as very stable, considering the poor performance of major world economies in 2010-2013.

Foreign investors are increasingly dissatisfied and mistrustful of the Jonathan administration’s ability to fight corruption in the Nigerian financial system. This loss of confidence in the system is what is currently exerting pressures on the FOREX and capital market.

The major concern of the incoming CBN governor will be how to win back the confidence of domestic and foreign investors through continuation of a monetary policy regime that guarantees foreign exchange stability. There is also a need to close the widening gap in the FOREX market between the official exchange rates and parallel market rates.

Should Sanusi prolong the legal action over his suspension, the outcome of the court proceedings is likely to expose the weakness in Nigeria’s judicial system and further polarise the economy. All this as Nigeria enters its election year, and tensions mount about challenges to Jonathan’s control of the ruling People’s Democratic Party. The economy could be in for a bout of turbulence.