The Pre-Election Economic and Fiscal Outlook (PEFO) was published this morning. Zareh Ghazarian provided a very readable account of the background to this document. But rather than being an update of the state of the books - I think it is an update of the state of the assumptions. Long story short, the assumptions have changed little since the Economic Statement was released some two weeks ago.

The value of this PEFO will emerge in time - certainly the last PEFO has not withstood the test of time very well. Let’s abstract from the electoral politics of this particular document and just consider the messages contained within the PEFO.

The news isn’t good for any government.

For a start, public debt will breach the debt limit of $300 billion in December of this year. While the opposition will use this event to further criticise the ALP, the fact remains that post-election the government will have to raise the debt limit. More importantly the government (of either side) will have to, at some point, provide a narrative about the appropriate level of public debt that Australia should maintain. While the net debt should be low - even negative - it isn’t clear what an appropriate level of gross debt should be.

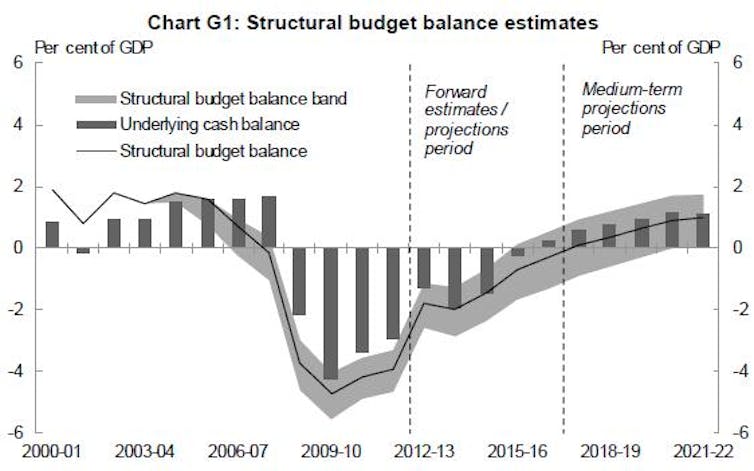

The PEFO has provided updates of Treasury modelling of the so-called structural budget balance. There is a lot of work that goes into this sort of thing and it does sound very sensible in theory. What we’re really looking at is a guess of what the budget balance could be if circumstances were different. In practice this sort of exercise is valuable to the extent that it alerts us to difficulties and risks. The picture below is taken from the PEFO at page 64.

The PEFO makes the point that the structural balance began the deteriorate during that last Howard government. In English - that reckless spending had to stop; as Kevin Rudd told us in 2007.

That is all ancient history - going forward it tells us that the budget recovery and the return to surplus is fragile. Small changes in economic conditions - or the assumptions that underpin our forecasts of those conditions - mean that we could be in structural deficit to 2020. The return to surplus in 2016-17 is close to being a best case scenario.

Both the government and the opposition face challenges in explaining what it is they intend to do about the severe debt and deficit challenges the PEFO reveals.