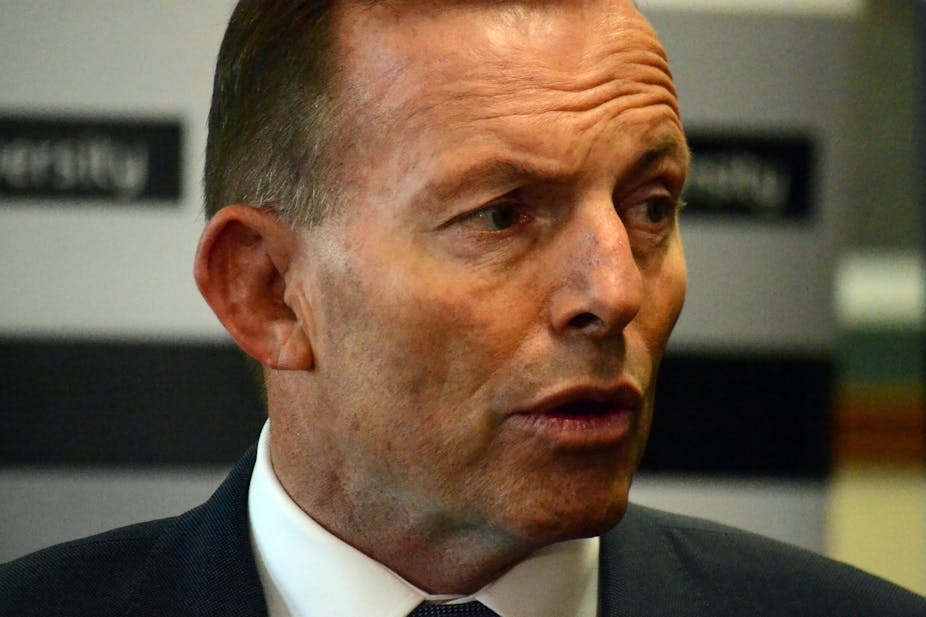

Last week’s giveaway budget has received the thumbs up from voters and boosted Tony Abbott’s personal rating in the Fairfax/Ipsos poll and Newspoll.

But the polls diverge in their two-party voting results. The Ipsos poll has the government lifting substantially to 50-50% with Labor while Newspoll, published in The Australian, sees a slight deterioration in the Coalition’s two-party vote.

The budget received ticks on several measures in the Ipsos poll, including an overwhelming 81% support for the tax concessions for small business.

Newspoll found the budget was the best received in seven years.

Four times more voters than last year (20% compared with 5%) said they’d be personally better off. While 30% said they would be worse off, this compared with 69% last year and was the lowest since 2010.

Both polls were taken Thursday to Saturday.

The Coalition’s two-party vote in the Ipsos poll – the best since March 2014 - has risen 4 points since April, with Labor falling 4 points.

The Coalition’s primary vote is up 4 points to 43%; Labor is down 3 points to 35%. The Greens are unchanged on 13%.

But Newspoll has the ALP extending its two-party lead by one point to 53-47% in the last fortnight. The Coalition’s primary vote is up a point to 40%; Labor is up 2 points to 37%, while the Greens stay at 12%.

In Ipsos Abbott’s approval has risen a dramatic 8 points to 42%; his disapproval is down 10 points to 50%. His net approval stands at minus 8.

Bill Shorten’s approval is 41%, down one point, while his disapproval is up a point to 45%, to give him a net approval of minus 4.

Abbott has established a lead over Shorten as preferred prime minister 44% (up 6 points since April) to Shorten’s 39% (down 7).

Newspoll, which previously had Abbott and Shorten level as better prime minister, sees Abbott now leading for the first time in six months – 41-40%.

Abbott’s satisfaction rose by 2 points to 39%, an eight month high; his dissatisfaction fell 4 points to 52%. His net satisfaction improved from minus 19 to minus 13.

Shorten’s satisfaction rating increased by a point to 35%, while his dissatisfaction fell by 4 to 46%. His net satisfaction went from minus 16 to minus 11.

In Ipsos, more than half (52%) are satisfied with this budget – this was 19 points higher than the satisfaction level with last year’s budget.

Also, 52% say the budget was fair, again 19 points above last year. Some 54% believe the budget good for Australia (12 points up), while 54% said it was economically responsible (5 points higher).

Far fewer people, compared with last year, believe they will be worse off – 33%, which is 41 points lower than 2014. Some 28% think they will be better off – 20 points up on 2014.

More than one in five (22%) say they will personally make use of the tax concessions for small business.

But voters oppose the cuts to the family tax benefits as a trade off for the higher child care subsidies (47% oppose, 39% support).

In Newspoll 46% said the budget would be good for the economy, with 28% saying it would be bad. Last year 48% said it would be bad economically, while 39% said it would benefit the economy. More than half (51%) said Labor would not have handed down a better budget for Australia’s current economic conditions – a rise of 5 points compared with last year.

Abbott at the weekend suggested there was more effort to be made in getting incentives to work into the system.

He was asked about the income disparity between a sole parent with two children under six who earns A$30,000 and after benefits ended up with $66,304 disposable income, and a single person on $80,000 working five days a week who had $60,853 disposable income.

“As far as the government is concerned you should always be better off in work than out of work,” Abbott said.

“That’s the whole objective of a decent social security system. It is to provide people with a basic level of support, but you should always be better off working than on welfare.” Ensuring that had to be the target of “any sensible government”.

He said the system needed to have appropriate incentives in it so that “where if you earn an extra dollar you get to keep a reasonable percentage of your earnings”.

The system had grown over the years like Topsy with different benefits having different withdrawal rates. People in different circumstances could find that when they earned an extra dollar they were worse off rather than better off.

“It’s right and proper that over time we should be going through the system to try to ensure that this is no longer the case.”