Monetary policymaking is imperfect. When board members of a central bank such as the Reserve Bank of Australia sit down to set the appropriate target cash rate each month - as they did this week - there is considerable approximation implied.

Yesterday, the RBA opted to leave the cash rate unchanged. But today’s GDP figures showing an annual growth rate of 2.3% - weaker than the 2.75% expected by the RBA - will no doubt reignite debate on whether it made the right decision and whether further cuts should follow.

The imprecision of central bank deliberations stems from the uncertainties in real-time measurements, latent variables, the type of model, model parameters and the inherently unpredictable nature of the macroeconomy.

Whatever rate the central bank sets, there is considerable probability that a different rate would be more appropriate. Yet most central banks provide little quantifiable information on the uncertainty confronting policymakers or how that risk is considered.

Last year, the Australian National University’s Centre for Applied Macroeconomic Analysis (CAMA) established a Shadow Board, made up of a group of eminent academic and industry economists.

The CAMA Shadow Board members are: Paul Bloxham (Chief Economist, Australia & New Zealand, HSBC Bank Australia); Mark Crosby (Dean of the Global MBA Program and Professor of Economics, SP Jain Center of Management in Singapore); Mardi Dungey (Professor, University of Tasmania); Saul Eslake (Chief Economist, Bank of America-Merrill Lynch, Australia); Bob Gregory (Professor Emeritus, ANU); Warwick McKibbin (Professor, ANU); James Morley (Professor, University of New South Wales); Jeffrey Sheen (Professor, Macquarie University); and Mark Thirlwell (Director, International Economy Program, Lowy Institute for International Policy).

Each month, prior to the RBA board meeting to discuss the cash rate, the CAMA Shadow Board analyses the prevailing economic conditions and gives opinions about what the RBA board should do.

Deliberating before the latest GDP figures, the CAMA Shadow Board thought this month’s interest rate setting was “about right”, with a 70% chance that rates in March should not be cut from the February level.

This CAMA study is not aimed at the predicting RBA board behaviour. In common with shadowing exercises in other countries (such as the US Shadow Open Market Committee), this is a normative exercise in control, not forecasting.

It aims to resolve two outstanding issues: first, can individual Board members quantify their uncertainty about the appropriate target cash rate with probabilities?

Second, can the risks envisaged by individual decision-makers be aggregated to give a collective view about the appropriate cash rate?

Each CAMA Shadow Board member records the uncertainty by giving probablistic assessments of the appropriate (target cash) interest rate. Their probabilistic assessments are communicated directly to the public at an individual level via the CAMA website. So, disagreements between board members are communicated directly to the public, providing a range of views to the debate about contemporary economic policy in Australia.

Why is this important? The lack of information about the interest rate uncertainty contributes to the debate about the difficulty of predicting monetary policy decisions.

Central banks currently do not use probabilities to formally record either the uncertainty experienced by individuals, or by the board as a whole.

Until the beginning of the 1990s, central banks were somewhat secretive institutions, deliberately keeping the public guessing about monetary policy strategy. During the past two decades, coinciding with the widespread adoption of inflation targeting, and a move to greater transparency and accountability for policymakers generally, the emphasis has shifted towards greater openness.

Most major central banks publish regular “inflation reports” (or monetary policy statements), disclose the minutes of policy meetings, and communicate forecasts (and in some cases, forecast uncertainties) to the public.

But central banks provide little probabilistic information about the uncertainty in the setting of the current interest rate.

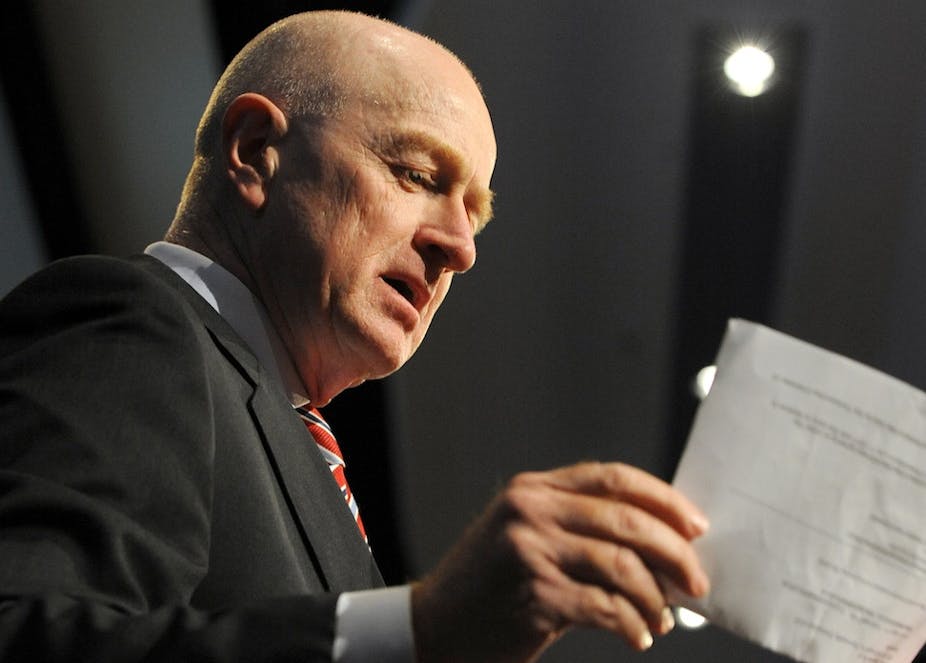

Indeed, RBA board members do not comment on policy in public at all, leaving the Governor, Glenn Stevens, and Deputy Governor Philip Lowe, to speak for the board. This approach contrasts with those frameworks adopted by the US Federal Reserve Bank, the European Central Bank and the Bank of England in which, through various channels, differences of opinion by policymakers are public knowledge.

In contrast to the CAMA Shadow Board members, who give normative probabilistic assessments (about what the interest rate ought to be), economists in the financial markets attempt to predict each monetary policy decision by the RBA.

If the markets call the interest rate incorrectly, there are allegations that the RBA has shifted its monetary stance. Some of these differences are insignificant though, given the uncertainty in setting interest rates.

If the public understood better the uncertainty in setting interest rates at any point in time, the debate about differences in strategy would be more meaningful.