Most consumers are concerned about the cost of food. We constantly look for bargains and the food industry knows it.

According to a recent survey by Dalhousie University, more than 60 per cent of all Canadian consumers consider price as one of the top three decision criteria when grocery shopping. Price is key, no matter what. Grocers play around with prices to keep all of us on our toes.

Pricing in the food processing sector is intricate. Ingredients, energy costs and wages are among the factors that weigh heavily on food manufacturers as they try to cultivate relationships with grocers and retain market shares.

For decades, to keep price points low, the shrinking package strategy has been employed by the food industry — known as shrinkflation, it’s the process of items shrinking in size or quantity while their prices remain the same or increase.

Everything is getting smaller, whether it’s cartons of ice cream, bags of chips, cookies, chocolate bars or boxes of pasta. There have been several media stories on this issue in recent years.

Thousands of products have shrunk

All over the world, food packages are shrinking. A recent U.K. study suggests there are almost 3,000 food products that can be found in a typical grocery store that have shrunk since 2012. This came at a period of time when annual food inflation hit a whopping six per cent. And so people were paying more for less and the food industry was accused of gouging consumers.

Similar numbers are coming out of the U.S. market. Many American food manufacturers have also admitted to shrinking packages to maintain prices at a competitive level. Many of these products enter the Canadian market. Based on what’s going on in the U.S. and Europe, we could estimate that anywhere between 15 to 20 per cent of all packaged food products have shrunk in the last five years, if not more.

Food companies have found a way to defend margins, largely without upsetting anyone.

Shrinkflation is almost the norm these days, but consumers are beginning to find it irritating. Yet food companies are not really misleading the public. Weight and volume information can easily be found on any labelled package. Habits make us believe we are purchasing the same thing as we zoom in on the one constant that motivates our behaviour when shopping: Price.

When costs rise in food manufacturing, a company has basically three options: Raise the price, make smaller packages or change the ingredients. Given our competitive food industry, hiking prices can be challenging. Since early 2018, prices in food stores have dropped because of higher competition.

Reformulating is dangerous

Yet changing ingredients can be risky. For 30 years, before the 2008 bump in commodity prices when food was considered an afterthought compared to today, companies were egregiously reformulating food products. This was at a time when taste and the quality of ingredients were not on the radar.

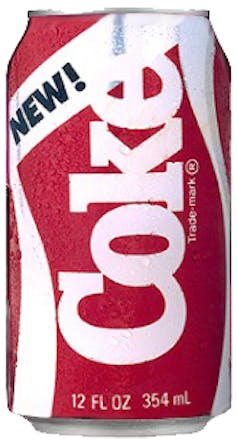

Some food manufacturers have paid the ultimate price for changing the taste of certain products just to save a few pennies. The so-called New Coke is a classic example of a misfire. And today, with social media, companies are one poor decision away from seeing an entire product line vanish.

The only viable option, really, is to downsize. With the arrival of many non-food investment firms and conglomerates that value food as much as bolts, tires or buildings, recalibrating ingredients and changing a package is almost second nature.

3G Capital, the Brazilian giant which gobbled up Heinz-Kraft, Burger King and Tim Horton’s in recent years under its holding company, Restaurant Brands International, is one good example. Most of these new players in the food space are not astute about the nuances of food products. They just look at the numbers knowing consumers are out there looking for the best price.

Whether or not we want to admit it, as food consumers, we value quantities for the lowest price. It’s challenging to get out of this way of thinking.

But there could be an opportunity for manufacturers looking at increased costs. Instead of downsizing products and hoping no one notices, emphasizing its superior taste and original package size could become a selling point.

Studies show that consumers who remember how good a product tastes are willing to pay more for less if given no other choice. Food manufacturers should try selling flavour over quantity.

Showing a more transparent approach to packaging, or emphasizing quality could let consumers appreciate that things do get complicated out there and some adjustments are required. But we all know that won’t happen.

Is shrinking packaging obscuring inflation?

It’s unclear how shrinkflation is captured by the StatsCan consumer price index. Certain quantities are taken into account by the index, but there’s no explanation on how data collection is adjusted as quantities change rapidly.

Shrinking package sizes could contribute to food inflation in a subtle way. In some cases, quantities have been reduced by 15 per cent in three years. By compounding real inflation, food prices may have gone up by more than six per cent in many cases, when the reported food inflation rate was anywhere between 1.5 to two per cent.

In the end, consumers can be outraged and condemn the practice of shrinking food products. But when you really think about it, food companies are really delivering what consumers are asking for — low prices.