Charitable giving is big business, with many organisations handling millions in revenue. But big charities have come under fire for issues from bad accounting to actually doing more harm than good. In our short series on The Problem with Big Charity, Paul Palmer looks at how to make good investments.

Charitable organisations by definition aim to do good with the money they receive and spend. But what about the investments they make? What if these investments don’t appear to match the aims that the organisation promotes? For example, a charity that promotes conservation would raise eyebrows if they invested and received returns from an oil company. Some charities have come under particular scrutiny for this mismatch, while others have faced calls to divest their money from uncomfortable concerns. Others use ethical investing as a guide.

Ethical or Socially Responsible Investment (SRI), sometimes also referred to as sustainable investment, is about taking steps to ensure that an organisation’s investments reflect its values and ethos and do not run counter to its aims. This kind of investment takes environmental, social, ethical and governance factors into consideration and is based on achieving the greatest impact from investments by both pursuing maximum financial return and ensuring investments complement, rather than undermine, the wider aims of the organisation. There is no one-size-fits-all model for how to do this – instead, there are a number of approaches that can be used separately or in combination.

Three ways to do it

Positive screening involves selecting companies for investment that have a commitment to responsible business practices and/or that produce positive products or services. This approach can include selecting companies whose products help to combat climate change, such as technologies for generating renewable energy. Positive screening can also mean selecting only the best performers in a sector on a range of criteria such as their record on human rights or pollution.

Negative screening excludes companies or sectors that do not meet the ethical criteria that a charity has set. For example, a health charity not wishing to invest in the tobacco industry.

Engagement, or shareholder activism, is using the influence and rights of ownership to encourage more responsible business practices. This mainly takes the form of dialogue, but it can also extend to using voting rights to enact change.

Legal obligations for charities

Charity trustees are responsible for making investment decisions and are required under charity law and guidance from the Charity Commission (CC14) to do what is in the best interests of the organisation. Generally speaking, this means maximising financial return; however, CC14 allows an organisation to choose to take a lower rate of return if: a particular investment conflicts with the aims of the organisation; the organisation may lose supporters if it does not invest ethically; or there is no significant financial detriment.

Those responsible for the investments must clearly articulate why certain companies or sectors are excluded or included. With their professional advisers, trustees should also evaluate the effect of any proposed policy on potential returns and balance any risk of lower returns against the risk of alienating support or damaging its reputation.

The leading case law in this area is the 1991 Bishop of Oxford Case, a test case to clarify the law on the conflict between the maximisation of return and the primary principle of the charity’s mission. It clarified that an ethical constraint based on the charity’s mission takes precedence over the fiduciary maximisation duty, so cancer charities can exclude tobacco company shares, for example.

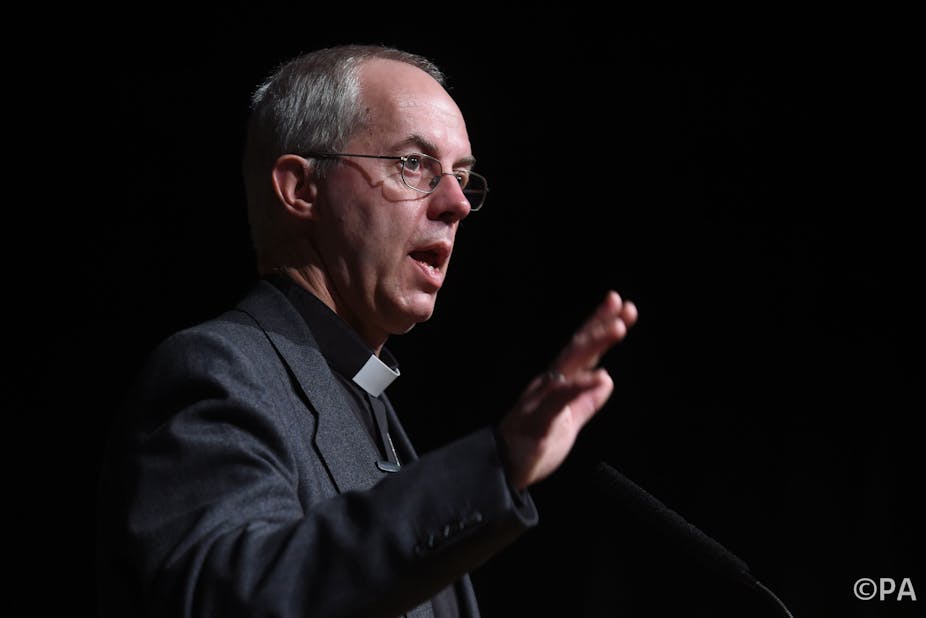

Failing to adhere to principles certainly runs a reputational risk, as Archbishop of Canterbury, Justin Welby, discovered when in 2013 he said he wanted to “compete Wonga out of business” – the online payday loan company was subject to criticism over its very high interest rates. But hardly a day later, an investigative journalist found that the Church Commission, which looks after the £6 billion investments of the Church of England, held an £80,000 stake in Wonga. Comic Relief also reportedly invested millions in funds with shares in arms, tobacco and alcohol, according to a 2013 Panorama investigation.

Avoiding a media storm and reputational damage

So if a charitable organisation wants to set up a practical ethical policy on exclusions it needs to work out what activities should be avoided, what constitutes a material involvement, and where information – such as how much profit a company makes from an undesired product – should be obtained.

Defining the activities for exclusion is the first step but isn’t always straightforward. For example, with alcohol-related investments, should the exclusion apply to companies which manufacture alcoholic products or to distributors and retailers? Trustees must come to an objective agreement as to precisely what activities to exclude and why these conflict with their charity’s objectives.

In principle, a company with any involvement in an excluded activity should be avoided but in practice some definition of materiality is normally applied. Such tests can include proportions of sales, profits or numbers of employees. However, obtaining information is particularly problematic when a strict materiality test is used. For example, a fund manager will clearly know when a company earns 50% of its profits from alcohol but may not if the figure is just 0.05%. Annual reports and accounts can be informative, but of course accentuate the positive and bury the negative.

Screening services provided by specialist ethical services can help. There is however a cost to screening funds, and charities need to ensure that costs versus benefits and risks are properly assessed. Until recently, most large investment managers did not offer cost effective funds but this is changing, with major players, including UBS and Blackrock, now entering the market to offer a range of active strategies and passive funds, using socially responsible, exchange-traded funds.