The Bank of England believes that cryptocurrencies like Bitcoin could be big news and even UK chancellor George Osborne is tweeting about it. But it is important to note the detail in the central bank’s comments. It is talking about forming its own digital currencies in a trend which could yet see Bitcoin take a back seat in the future it helped to create.

At a recent meeting of the Social Media Leadership Forum in London on the theme of Bitcoin and cryptocurrencies, we watched a short film that portrays Bitcoin as a kind of moral alternative to traditional banks. Not only is Bitcoin the new, cool choice of Generation Z, but it is also a way to render third party profiteering from financial transactions irrelevant. Bitcoin is the answer! Bitcoin is the future. Bitcoin is the best way of transferring value digitally without a third party. No pal needed to pay …

There was a straw poll in the audience. Who, of these leaders of (mostly) large corporations in the UK, had any direct experience of Bitcoin? Three hands went up – and they belonged to three young terrier-like Bitcoin entrepreneurs who chatted freely and articulately about their wares and painted the Bitcoin story as a huge, unstoppable business opportunity.

Two contrasting views emerged at that meeting. One is of Bitcoin as a kind of moral revolution, setting us free from corporate greed, interference and snooping. The other is a more prosaic view, of Bitcoin as a new means of making money in a leaner and smarter way. (There is also a subsidiary view of course: of a below-the-radar gambling den, a shadow money-changing table for the Dark Web)

Morality play

The unscientific poll in that meeting room would appear to support findings elsewhere. One online survey found that only 8% of US retailers were planning to accept Bitcoin within the next 12 months. None was currently accepting Bitcoin. Another survey found 65% of people polled were not at all familiar with Bitcoin. Of those that were even slightly familiar, 80% had never used it before.

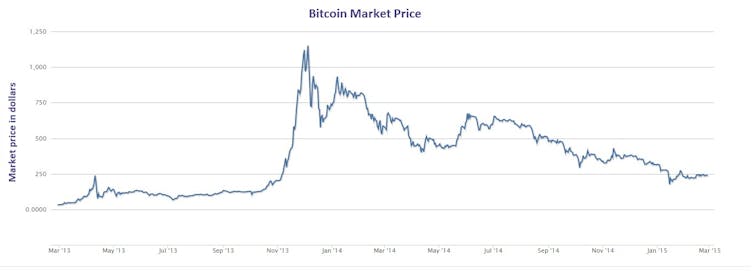

There has been a significant decline in the value of bitcoins, and questions have been raised about whether 2015 is Bitcoin’s make or break year. Whatever the prophets of doom say, there remain bullish young entrepreneurs, buoyed by the recent announcement that Dell will be the first major retailer to accept Bitcoin, as well as a survey that suggests lower income populations may well embrace it.

First draft of something greater?

The Bank of England is understandably circumspect about the feasibility and advantages of creating its own digital currency, but the simple fact of the discussion adds to the feeling that Bitcoin may be the “first draft” of something with broader application. Digital value doesn’t only have to mean money and the popular view of Bitcoin might just emphasise the “coin” a little too much.

At the meeting in London much discussion centred around the “blockchain”. This public ledger of all Bitcoin transactions effectively creates continuity for Bitcoin users, a context in which the currency can exist.

According to technology writer Nozomi Hayase:

When I say Bitcoin, I am talking about the underlying technology of the blockchain (which is much more than currency), along with its decentralized network, and also blockchain-based cryptocurrencies in general. Bitcoin might not be the final currency that ends up bringing us into a decentralized future, but it has opened the door.

Beyond Bitcoin

So, let’s say that Bitcoin is a good example of decentralisation and people power, but it is only a first example, and we will move on to using and innovating the underlying technology. It is no longer about cryptocurrencies really but about the potential of third party-free transfer. That can involve entirely different cultural interactions than just seeing value as meaning money. For example, we could see voting and collective decison-making without the use of third-party control. The future can involve all kinds of creative exchange between human (and even digital) beings that are direct, private when wanted, and totally in the hands of sender and receiver.

You might enact your will without lawyers. You might even ensure your driverless car isn’t mediated by Google but is just a direct relationship between you and the vehicle’s operating system. We will transfer all kinds of digital value and assets without third party control. Our artistic creations: our music, our digital art. With the advent of drones, even physical things.

One of the issues that Bitcoin has is its split personality. It is touted as a place of personal empowerment and direct, honest transacting that is private and yet also potentially seedy and criminal. It is billed as a moral reaction to greedy banks that, at the same time, offers ways to gamble in a money market not dissimilar in terms of underpinning ethics. It suggests freedom from governance even as that very lack of governance may throw up all kinds of social problems.

That puts our choice of future at a crossroads. For, even as we cut a direct channel from sender to receiver, between sharers of different kinds of meaning and value, we also potentially cut out the moral force that third parties have usefully played. Most users of Bitcoin are shocked to discover that if they are scammed into sending Bitcoins to a fake web site, their money is gone for good, with no way of getting it back.

Currently, there’s redress in the realm of conventional banking. If insurers spring up in the Bitcoin arena with hundred dollar excesses, aren’t we heading back into the realm of third party involvement again anyway? And if central banks start issuing their own digital currencies?

Bitcoin in 2020

Yet the opportunity is there to take Bitcoin away from a collusion of mediocrity around money metaphors and evolve into genuinely new and exciting ways to allow the sharing of value in ways that empower individuals, regardless of income. As Hayase, also points out: “Bitcoin makes possible open source governance. The power to decide the course of one’s own destiny is now in the hands of ordinary people.”

That huge claim implies the way crypto-value exchange is viewed and deployed is going to change significantly. Without third party governance, we will have to build ethical awareness and behaviour into new versions of the platform, and also research and educate ourselves in the new moral challenges and risks associated with it.

The technology promises much, but the whole thing may end up parked in wiring cash and simply buying and selling more stuff online. Yet it could be so much more. Blockchain technology could underpin the internet of things, safeguarding our privacy, reducing cost, and ensuring the next wave of change in the digital realm puts real control in the hands of people, not corporations. Whether it does will depend not on enthusiastic Bitcoin entrepreneurs, or opportunistic corporations like Dell, but on the users. You and me. And maybe the odd central bank.