In Britain budget day can prove a non-event or a shock to the political and economic system. Most of Gordon Brown’s budgets fell into the former category, serving as vehicles for the Labour chancellor to remind one and all of the great job he was doing rescuing the UK economy from boom and bust (and sometimes the world economy too).

In contrast, the current chancellor opts more for the “shock therapy” approach in his handling of the UK economy. Notable was his “emergency” budget statement in June 2010 that – to the surprise of most people in Britain – he embarked upon the most severe expenditure cuts since Labour prime minister Ramsay MacDonald’s national government in the 1930s.

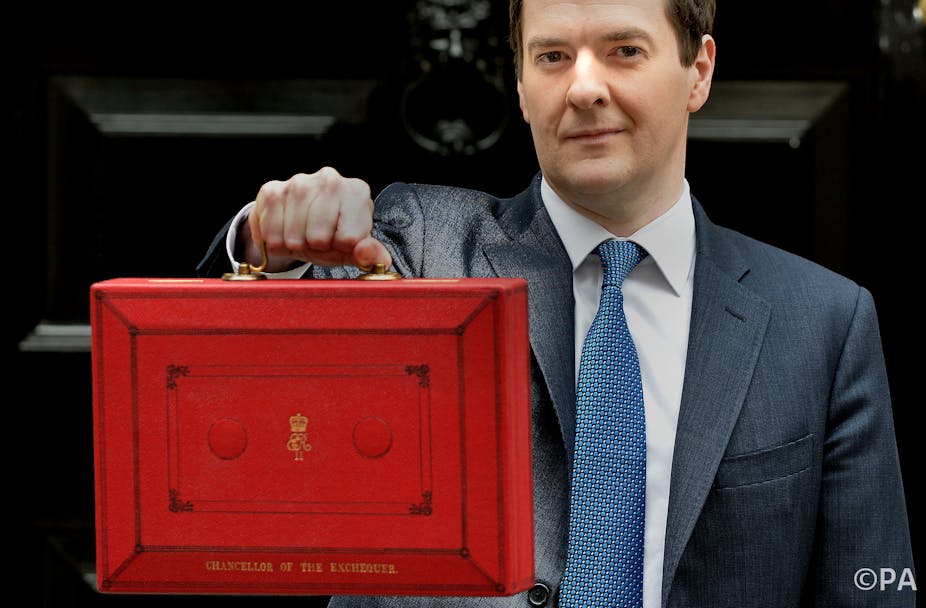

Ahead of the big event, some effort is necessary to clear away the fog that veils what is a particularly political budget, coming as it does so close to the general election. Some have predicted that recent improvements in the UK’s public finances (largely due to the fall in oil prices) means Osborne can afford to be more flexible and less severe in wielding his austerity axe.

Those who predict the chancellor’s swing towards moderation point to the quite extraordinary warning by the head of the National Audit Office that the cuts in public expenditure over the last five years have been too much too fast (“radical surgery” is the term used). Indeed, consensus among economists is that austerity stunted the UK’s GDP growth.

Austerity corner

But Osborne has painted himself into an austerity corner. As I and others have written, the chancellor is certain to miss his target for deficit reduction, thereby failing to meet his June 2010 budget promise to reach a small budget surplus in 2015-2016.

So Osborne finds himself in a quandary. Unless we allow him to conveniently ignore his 2010 promise, a flexible budget will contradict his five-year effort to eliminate borrowing. Flexibility implies he would allow more expenditure than planned just when the planned expenditure is too much to achieve his long-sought goal.

A second problem facing the chancellor is whether to boast of his prowess in generating a recovery of the UK economy. Much of the media has given him a free ride for his unlikely claim. Rarely do journalists point out that according to research by the UK Office of National Statistics, this has been the slowest recovery on record. However, a danger considerably greater than the ONS study lurks in the near future.

Slowing economy

Several economic indicators suggest the economy will slow down. First, the level of construction activity was down by 3.1% this January compared to January 2014. Worse for immediate prospects of recovery, latest statistics show it down by 2.5% from December to January alone.

Second, while up by a rather meagre 1.3% compared to a year before, manufacturing output was down by 0.5% between December and January. This is a blow to hopes that the sector, a marker of the country’s economic health, is recovering.

Third, from November 2014 to January 2015, the UK trade deficit was at its lowest in 14 years. Usually this would be good news, but not in this case. Half of the improvement resulted from the fall in oil prices (the UK being a net importer), and the other half from lower imports. In growing economies imports do not fall, they increase as households buy more goods and companies purchase inputs from abroad. And here again the December to January news is bad for recovery – exports were down by 3.1%.

Dilemma

The chancellor’s dilemma is obvious. Does he boast of recovery, only to have the Office of National Statistics a week before the election release statistics (due on April 28) showing a major slowdown in the economy for the first quarter of 2015? Or does he hedge on the boast and face the slings, arrows and ridicule of the opposition?

It is quite possible that Osborne can finesse, obscure and escape these problems through well-designed spin. He might handle the austerity/flexibility contradiction by a bit of smoke-and-mirrors arithmetic that allows him to claim both deficit reduction and gentler cuts. In the case of a fall in the quarterly growth rate he could play up the year-on-year result, certain to be over 2% unless the first quarter numbers are very bad indeed.

How successful he is in avoiding the pitfalls and hostages to fortune will depend on the vigilance of the mainstream press. The opposition, meanwhile, should be prepared to jump on these two issues.