Millions of Britain’s self-employed workers can now apply for financial aid to help them through the coronavirus crisis. The government has announced support of 80% of their average monthly earnings up to a cap of £7,500. It comes as a relief for many – there are 5.2 million registered self-employed people in the UK. But a large number will not be able to benefit.

This is because of the phenomenon of bogus self-employment, which has many workers registered as self-employed but actually working on insecure contracts for the same employers day in day out. It has been an issue in Britain for decades and escalated significantly following the 2008 financial crisis. Now the coronavirus crisis has hit and the issue is coming home to roost.

I wrote about this in 1995 in relation to the construction industry. Self-employment exonerated employers from paying any National Insurance for the labour services they engaged, and with lower rates of tax and insurance for the self-employed, a powerful fiscal drive pushed millions of building workers into false self-employment. It has become a uniquely British disease, unparalleled in Europe, with 60% of manual construction workers self-employed.

Read more: Jobs figures mask bogus self-employment in the shadow economy

With self-employment comes no employment rights, no security, no holiday pay, no safety training, no apprenticeships and no pensions. Most construction workers work for the same contractors year in year out, under their instruction and using their equipment.

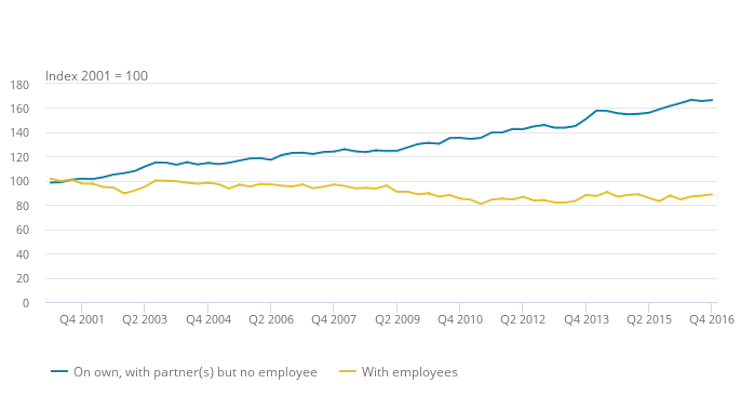

This type of bogus self-employment has spread to lots of other areas of the economy. Since 2008, the overall number of self-employed has grown from 3.8 million to over 5 million, jumping from 13% of the labour force to 18%. Building workers still dominate, with just under a million, but they are joined now by warehouse workers, delivery and Uber drivers. Many are paid an hourly income below the minimum wage, because they are self-employed and so officially are not paid wages and have no stipulated working hours. Their employers are thus able to evade the minimum wage law

It is important to distinguish between the genuinely self-employed and the fake self-employed. The genuine include small businesses and professional individuals providing services direct to clients and customers. The fake self-employed effectively work for a contractor or company, under their control, paid at their dictated rates of remuneration, and often using equipment they own (such as company-branded vehicles or software platforms).

Government losses

As well as making employment insecure for lots of workers, this type of self-employment also undermines the viability of the tax system on which the very existence of the welfare state is based. There is an immediate saving of 13.8% of the wage bill for companies that hire self-employed workers, because they don’t have to pay any National Insurance for them. But with this saving for companies comes a corresponding loss to the Treasury.

In 2015, I calculated the Treasury lost at least £1.5 billion per year in lost National Insurance and taxation from bogus self-employment. That’s just for the construction industry.

It is impossible to provide an accurate figure for the loss of revenue arising from bogus self-employment across all sectors. But let us assume, generously, that 25% of the people registered as self-employed are genuinely self-employed businesses. That leaves 3.75 million bogus self-employed, with a median income of around £300 per week according to government data. The annual loss of revenue to the Treasury from employers of the self-employed, at 13.8% of the remuneration bill, amounts to £7.8 billion. This is an indicative figure, frankly a guesstimate. It is unlikely to be substantially lower, but could well be substantially higher.

Read more: The rise of the low-pay workforce – when seven jobs just isn't enough

Now this bogus self-employment epidemic has collided with the coronavirus crisis. By the government’s own calculations, only 3.5 million of the country’s 5.2 million self-employed are eligible to even apply for its new support scheme. So millions are threatened with the abyss of no financial protection. The moment they stop work, they lose all income. It would be like instant dismissal for an employee.

Moreover, many survive on under-declared or undeclared income, reducing their tax and National Insurance burden. Some will switch from employment to self-employment in the course of the year. Many will not be able to claim their full entitlement under the Treasury’s coronavirus support scheme as a result.

The sad irony, of course, is that the government has lost out on billions over the years to this bogus self-employment and is now being asked to bail out the bottomless pit of which it was architect. The latest figure for this bailout, covering only a proportion of those impacted by a sudden loss of income, is £30 billion.

If there could be a silver lining to this crisis, the underlying epidemic of bogus self-employment and the vulnerability it has created needs to be suppressed once and for all – above all for the workers themselves, but also for the economy at large. Not by any vaccine, but by the justice of good law that clarifies the distinction between employment and self-employment and equitable tax regimes.

Self-employment should never be the cheap option of a tax free gift to employers of their services, and clients who purchase self-employment services should pay the price to protect the self-employed from the abyss into which they have been so cruelly thrown.