A recent study by the OECD into the state of financing for small to medium enterprises (SMEs) in the aftermath of the Global Financial Crisis (GFC) provides an interesting international perspective.

The ability for small firms to access finance is one of the most significant issues affecting the health of our economy. Small businesses typically obtain their funding for start-up and early stage growth from a combination of the founder’s savings, credit cards and investments by family and friends.

Bank loans are often harder to secure for start-up ventures, but personal loans taken out by the directors are common. Very few small firms secure venture capital funding, despite the high profile that it receives in the media.

Impact of the GFC

The GFC of 2008-2009 had a significant impact on small businesses around the world. Across the 34 advanced economies that comprise the OECD, the GFC saw GDP contract by an average of 3.5% and unemployment jump by around 9% (much higher in some countries). Apart from the negative impact the GFC has had on public sector debt; its effects within the SME sector have been significant.

According to the OECD the performance of SMEs was severely impacted by the GFC. Significant declines have been recorded in output, sales, employment and exports. While the deepest impacts occurred in 2009, the effects continued well into 2010, and the ripples are still being felt.

Bankruptcies

One example of this impact was the rate of bankruptcies among businesses. Between 2007 and 2010 the level of bankruptcies across the OECD rose significantly. For example, in the United States the total number of bankruptcies jumped from 28,322 in 2007 to a peak of 60,837 in 2009, and was still at 56,282 in 2010.

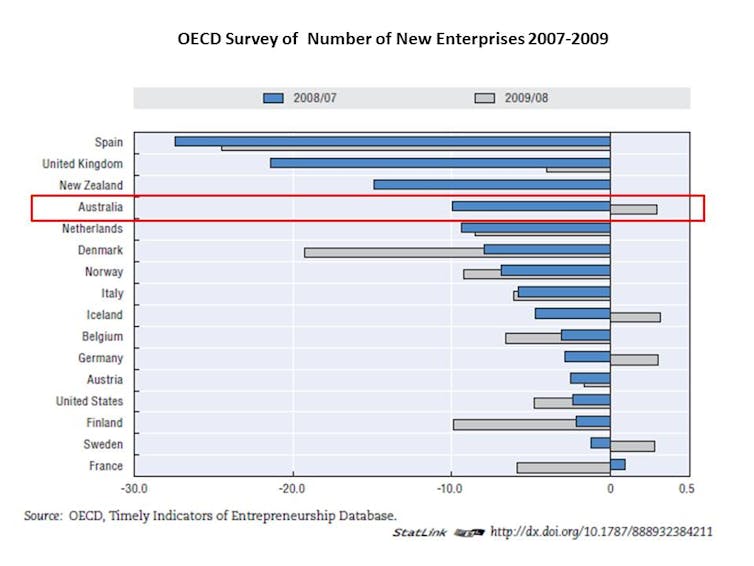

The figure shown above is from the OECD and shows the number of new enterprises and percentage change across a range of countries over the period from 2007 to 2009. It can be seen that the total number of enterprises fell dramatically across all countries with the exception of France in 2007-2008 and generally continued through 2008-2009. On a positive note Australia, along with Iceland, Germany and Sweden managed to buck this trend.

Access to Bank Financing

The OECD survey suggests that overall SMEs faced tougher times in securing bank and other forms of debt financing than large firms. Even though interest rates fell over the period from 2007-2010, the gap between interest paid by large and small firms widened. This suggests that large companies found it easier to secure more attractive lines of credit than SMEs.

Access to Equity Financing

Venture capital funding took an even bigger hit as a result of the GFC. Formal venture capital financing fell significantly over the period from 2007 to 2010 and has shown little sign of recovery. However, it should be noted that most small firms are not seeking this type of financing. Over 78% of SMEs surveyed by the OECD stated that this type of financing was not relevant to their business.

Despite the fact that venture capital financing is of limited interest to the majority of SMEs it remains an important component of the overall funding system. For fast growth and high technology firms that need to access national and international markets quickly, venture capital funding is often essential.

Government reactions

Faced with these conditions it is to be expected that governments would have responded with some measures designed to assist SMEs. The OECD notes that most responses fell into one of ten categories. The first involved increasing the amount of government loan guarantees. This was often combined with special guarantees and loans for start-ups, usually comprising some business advisory support services. Many countries increased the level of support financing for exporters, and in Sweden there was some government co-financing of businesses.

Direct lending to SMEs by government was observed in Chile, Hungary, Korea and Slovenia, while Portugal and Thailand offered subsidized interest rates. Other schemes included credit mediation, tax exemptions and tax deferments, venture capital equity funding, and business advice services.

How did Australia fare?

So how did Australia perform in relation to these issues you may ask?

Unfortunately the OECD survey did not specifically examine Australia; however we can get some insights from other data sources. According to a study undertaken by CPA Australia, the Certified General Accountants Association of Canada (CGA-Canada) and the Association of Chartered Certified Accountants (ACCA) published in 2009, Australia’s SMEs fared better than most.

However, there was a squeezing of credit supply to small firms as a result of the GFC. For micro enterprises (e.g. those with fewer than 5 employees), the need for bank financing is generally low. As a result these firms were less affected. However, for the larger end of the SME sector the lack of access to bank financing was a problem.

Small and medium sized firms are important members of industry supply chains and we have seen some recent examples of such firms being forced into administration or bankruptcy in the automotive parts and transport sectors. The Insolvency and Trustee Service Australia provides data on bankruptcies. Over the period 2007-2010 bankruptcies rose from 25,249 to 27,509. They have subsequently fallen to 23,093 last year.

The CPA/GCA-Canada/ACCA report also noted that many SMEs were responding to the GFC by seeking to cut costs and manage cash flow more effectively. Yet while efficiency and good cash flow management is to be encouraged, their study also shows that SMEs were postponing investment in order to conserve cash. Over the longer term this failure to invest in plant and equipment or computer systems and related areas will have negative impacts.

Where to from here?

Compared to most other OECD economies Australia is doing pretty well. The GFC had a much less severe impact and the recovery has been stronger than in other countries. Despite this the general mood across the small business sector seems gloomy. The Telstra Sensis Business Index of SMEs published in March 2012 shows a decline in business confidence. In fact the trend over the past 12 months has been significantly falling at rates not seen since the height of the GFC back in 2008.

In March 2011 63% of SMEs were optimistic about the future compared to only 53% in March this year. Furthermore, those with pessimistic outlooks rose from 19% to 28% over the same period. This gloomy outlook is likely to be a reflection of the two-speed economy that has become a feature of Australia since the GFC. The high Aussie dollar impacts on exporters and subdued spending by households impacts on retailers.

The challenge for the Federal Government is to convince everyone that things are going to be better and the gap between the two tracks in the economy is closing not widening.