Among the UK government’s pronouncements for the new parliamentary session were measures designed to boost zero-carbon home building in order to reap the benefits of lower emissions, lower household energy bills, and more comfortable homes.

It’s a shame then that the government’s flagship scheme for ensuring existing homes receive energy efficiency upgrades, the Green Deal, is languishing. The Department for Energy and Climate Change had estimated that by 2020 the Green Deal would have helped fund the retrofitting of 14m homes, almost 2m homes per year. But official figures from April 2014 show only 1,178 homes had been refurbished, with another 1,261 in the pipeline. While there have been more than 200,000 Green Deal assessments since the scheme’s start in January 2013, the vast majority of households decided against it, instead taking advantage of funding provided through the Energy Company Obligation (ECO) under which, for those homes that meet the criteria, the bill is picked up by energy supplier companies.

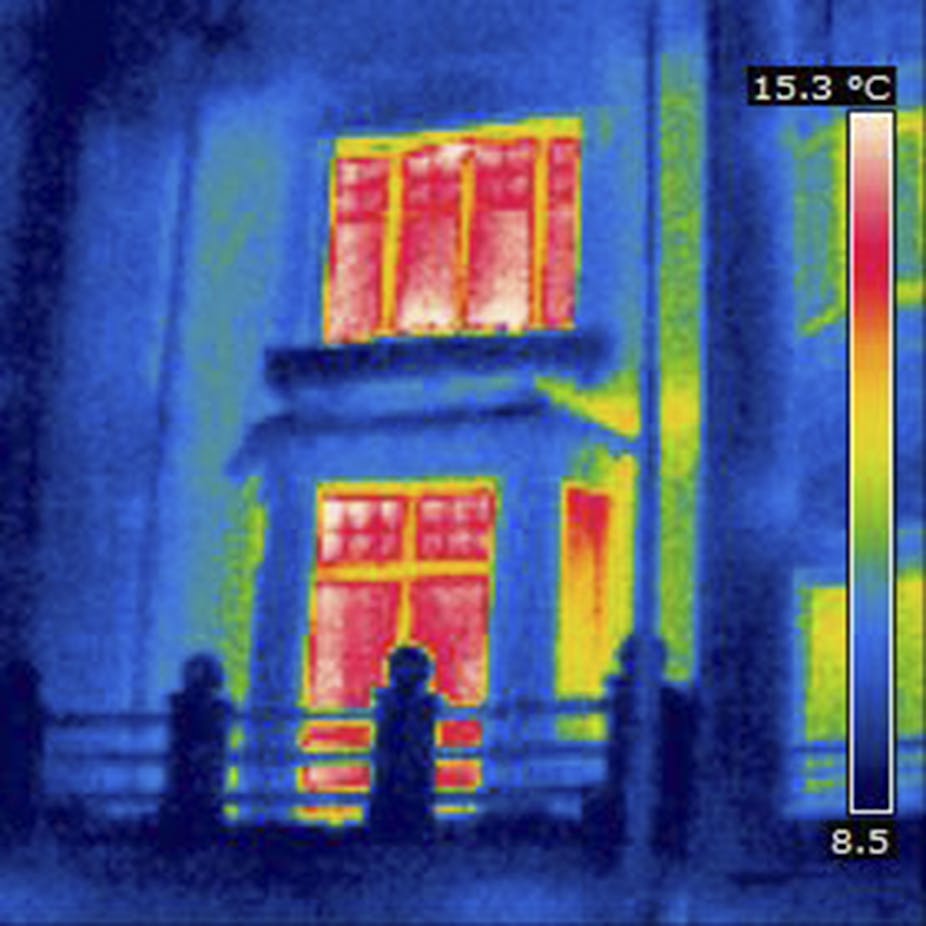

So there is no revolutionary upgrade of British homes taking place, and this is reflected in DECC’s estimate that the Green Deal will make up just 1% of predicted energy savings by 2020, as shown in the graph below. In comparison, the Carbon Emissions Reduction Target (the Green Deal’s predecessor) is projected to deliver almost 25% of all savings in 2020.

Despite these obvious failings, the government announced substantial cuts to ECO this year, requiring suppliers to deliver significantly less energy efficiency measures. Overall, there are far fewer energy efficiency retrofits taking place than before the Green Deal was introduced, something Dr Nick Eyre from Oxford University and I anticipated two years ago.

Cutting a new deal

So where do we go from here? The pay-as-you-save concept of the Green Deal – in which the cost of the loan for energy efficiency improvements is paid for from the monthly savings they provide from household energy bills – is compelling, particularly as it helps to solve the landlord-tenant dilemma where the landlord bears the costs of making improvements, but the tenant reaps the benefits. Governments across Europe were interested to see if it could work in their own countries.

The challenge is to take the best aspects of the scheme and make it work better. In my view, there are three main areas that need to be considered – a new marketing approach, a relaxed golden rule, and a more attractive interest rate.

Sell it well

The Green Deal was mainly sold as a means to save households money, but critics pointed out that, as repayments are calculated from estimated rather than actual energy bill savings, they might conceivably be larger than the savings made.

A new approach should emphasise the non-financial benefits, such as comfort or adding to the value of the house. For example, in Germany households take out huge loans of up to £60,000 provided by the publicly owned KfW Banking Group. While in most cases the bill savings do not pay back the loan over the time a household occupies the property, the programme has been successful because it is seen as a way of financing home improvements, making houses more saleable, and making people feel more comfortable in their homes.

Relax the golden rule

At the heart of the scheme is the golden rule, which stipulates that the cost of the repayments must not exceed the (estimated) energy savings. This implies that the scheme can only finance measures with a relatively short pay-back period – but such measures usually come with moderate up-front costs, and many of these are likely to be financed through ECO in the future. Experience shows that people are most likely to take out loans for measures that have high up-front costs and have long pay-back periods.

Proposed changes to ECO will leave significantly less support for more expensive measures such as solid wall insulation, meaning households will have to find other sources of finance for the remaining cost, which may put them off. The newly announced Green Deal Home Improvement Fund provides extra finance in the form of direct grants, but this is a one-off programme with only limited funding available. I don’t think this is a long-term solution.

For those households willing to take out loans, even if the costs of repayments are higher than the energy savings, government should relax the golden rule, leading to a wider range of measures being available on the scheme without the need for householders to find additional funding.

Cut the interest rate

The interest rate of a Green Deal loan at 7% is deemed commercially attractive against comparable unsecured loans. However, households are more likely to compare the Green Deal interest rate to that of their mortgage, or to high street loans, which means the interest rate needs to be set closer to 3% or less in order to appear attractive.

International experience with low-interest loan programmes has shown that if the interest rate is sufficiently low the market follows – the German KfW loan programme’s interest rate is 1%, for example, and the scheme has been oversubscribed for years. In France consumers have access to a 0% loan scheme for energy efficiency improvements. Establishing such schemes requires considerable public subsidies but research by Ricardo-AEA and others has shown that the Treasury could recoup some or even all of those costs. The Treasury could even end up profiting from the scheme as it is budget positive, creating more revenues and savings than it costs.

It does seem DECC is rethinking the Green Deal, with the new Home Improvement Fund providing attractive incentives to encourage home retrofits. It is a short-term measure but a step in the right direction as high take up in the first week already shows.

Making changes to the scheme quickly has the potential to turn it into a real success story. But if there’s no new deal soon, the Green Deal may not have a long term future.