There seems to be no end to Fairfax’s restructuring saga. On Friday, the company’s management signalled they would continue to cut costs no matter what. CEO Greg Hywood said:

“We have made clear many times that we are managing a structural shift in publishing from print to digital. We continue to adapt business model to this reality, which involves an intense focus on cost reduction.”

This week Fairfax also said it would shed 70 jobs in New Zealand as it moves sub-editing work back to Pagemasters.

Figures published in Fairfax’s 2015 Annual Report show that between 2011 and 2015 the company cut 30% of its full-time employees. Today’s 2016 half-year results show that during the last four years Fairfax has cut its cost base by 34%, clearly on the back of staff reductions.

An internal restructure this week saw the departure of The Age’s editor-in-chief, Andrew Holden, and the abolition of AM and PM news directors. Commentators say the new structure will increase clickbait content on the Fairfax papers. Under the new structure, says Crikey media writer Myriam Robin, “editors of the papers will no longer work closely with journalists and commission stories; instead, the print editors will scrape together material already put on Fairfax’s websites to fill their papers”.

Cost cutting: ‘short-term cost, long-term benefits’

However, Fairfax is not the only news publisher focusing on cost cutting, or reinventing its newsroom strategies. The New York Times Company announced earlier in February that despite strong growth in digital revenue in the fourth quarter, it continued to “feel the impact of declines in parts of our print business”. Dean Baquet, the newspaper’s executive, said “the company must continue to carefully manage its costs”, and that “everything we do now has got to include a certain amount of thinking about costs”. He didn’t rule out layoffs.

Similarly, Rupert Murdoch’s News Corp is planning to further cut costs in its Australian and British mastheads after poor results in the 2016 second quarter. While commenting on News Corp results, chief executive Robert Thomson said that “for our Australian mastheads, it was clearly a difficult quarter in advertising and to that extent we’ve clearly embarked on a cost-cutting program”. He added that “cost cutting has a short-term cost and a long-term benefit”.

Following The Independent’s example?

We know that in 2013 Fairfax asked Bain & Co to undertake a “detailed analysis” of the benefits of going entirely digital, shrinking its editorial team from 503 to 205.

Now, a similar move actually underway at The Independent in the UK will see the loss of approximately 100 editorial jobs.

Is Fairfax ready for such a move?

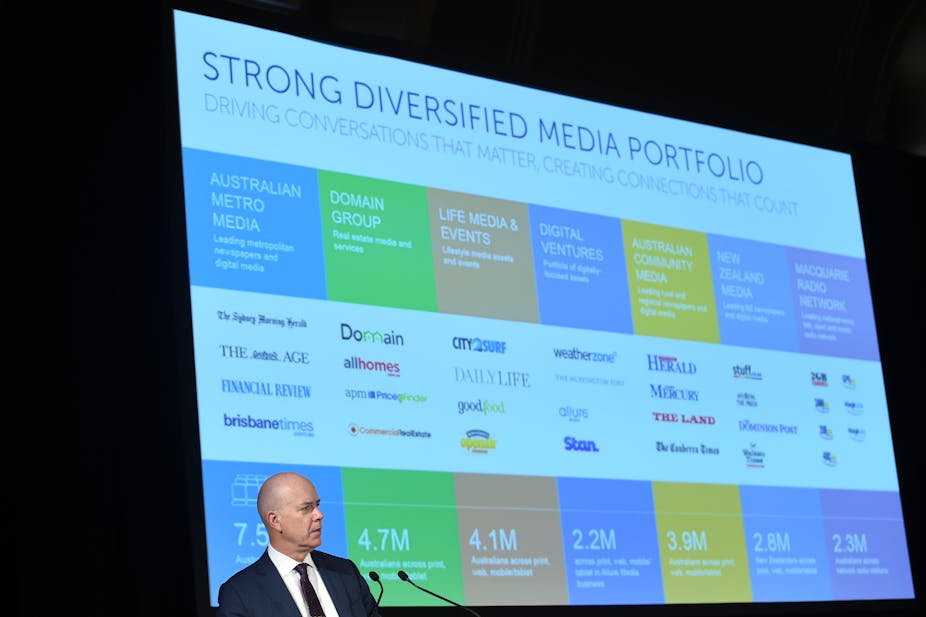

Fairfax’s numbers show it still has a long way to go to be truly digital-led.

The company’s digital subscription revenue rose 14.3% on the back of “around 162,000 digital subscribers across the SMH and The Age”. In 2015, the two papers had 158,000 digital subscribers. The real driver in its digital earnings was Domain, which saw digital advertising revenue growth of 37%.

To see if the digital-only model would work, let’s do some simple math.

In the first half of 2016, the combined digital advertising and subscription revenue of Fairfax’s metropolitan media was A$149 million, whereas revenue from its print advertising and circulation was A$252 million - a gap of A$103 million in favour of print.

The digital advertising income of metropolitan media rose A$24.3 million to A$131 million from the same time last year, and the digital subscription revenue A$2.2 million to A$18 million over the same period.

To simplify, in the first half of 2016, the digital revenue of Fairfax’s metropolitan media made 15.5% of the company’s total revenue of A$958 million. In comparison, print papers of metropolitan media made 26.3% of the total revenue.

Clearly Fairfax still needs the print for the revenue, but if it continues its heavy cost cutting, the digital-only model could be closer to reality.