The pay gap in UK business is eye-watering. Bosses of the largest UK companies earn around 100 times more than the lowest-paid employees in their organisations, according to some estimates. This year, chief executives from the top 100 UK companies saw their pay rise by nearly a quarter on average, research from PwC shows. This is at a time when many employees are being offered below-inflation pay rises.

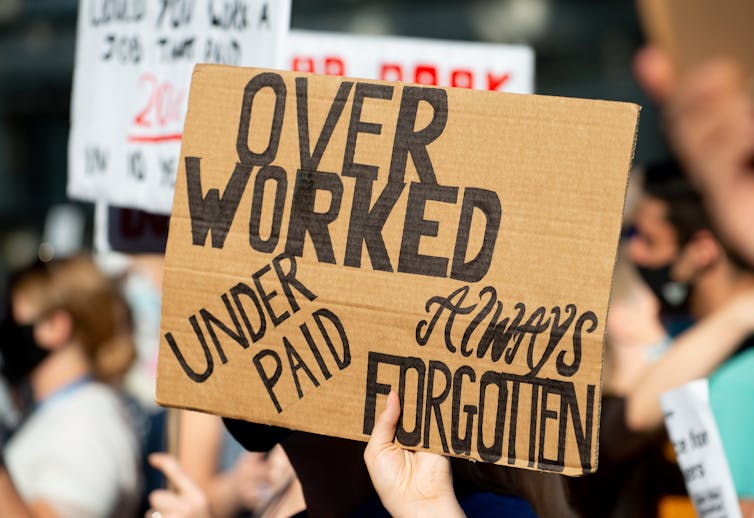

The sense of unfairness about this among workers is intensifying. We have seen this during the “summer of strikes” this year, which has continued into the colder months and does not look likely to let up any time soon.

The average gross salary in the UK at the moment is £38,131 for a full-time role, according to data from the Office for National Statistics. Not bad, you might think. But this figure obscures the dramatic variations in pay among UK workers in different industries and at various company levels. Indeed, the UK has a higher level of income inequality than many other developed countries.

The size of the pay gap varies with firm size. For the largest UK companies, such as those listed in the FTSE 100, the median CEO-to-employee pay ratio in 2020/21 was 67:1, while CEOs earned 93 times more than employees on the lowest levels of pay.

A growing gap

As stark as these ratios are, they might actually understate the magnitude of pay inequality.

First, the figures above fail to account for low-paid workers such as contractors or staff on zero hour contracts. A recent High Pay Centre analysis of 69 company reports in the first quarter of 2022 calculates that a CEO at the average UK company earns 117 times more than their lowest-paid employees when these so-called “indirectly employed” workers are taken into account.

Second, the above analysis reveals that median CEO to employee pay ratios almost doubled from 34:1 to 63:1 between 2021 and 2022. This indicates a significant pandemic rebound in top-level pay is widening the gap further. But even before the pandemic, the gap was widening, if at a slower pace. During the ten-year period to the end of the 2021 financial year, median incomes for the poorest fifth of the UK population have stayed broadly the same, versus a 9.1% increase in average pay for the richest fifth of the population.

Interestingly, the size of the gap is not constant across the spectrum of wages (or the income distribution) paid to people in the UK. It is wider towards the top, which means a very small fraction of individuals are earning a disproportionately large fraction of total pay in the UK.

Annual UK full-time gross pay by occupation, April 2022

Why is the pay gap so wide?

There are a number of reasons why we see such large and persistent differences in pay within UK companies, particularly at this upper end. First, an economic theory called tournament models argues that “winner-takes-all” pay arrangements – where CEO pay exceeds all other employees (including the next highest paid executive) by a large multiple – create the strongest incentives for leaders. This is the same principle used to justify offering massive lottery jackpots rather than multiple smaller wins.

Second, variable pay structures such as bonuses and options linked to company share prices, are more common for company executives. Established corporate governance codes recommend that salaries with large variable elements – typically, a low salary paired with a large performance-related component such as a bonus – incentivise performance.

But this means executives bear additional pay risk (that they may not make much of a bonus one year), and so are compensated for that with higher expected pay when performance conditions are met. In other words, when pay is directly linked to performance via a bonus, your level of remuneration will typically be higher.

Other factors could reinforce disproportionately high pay for senior executives, such as weak (too easy) performance conditions in executive pay contracts. Also, the labour market for executive talent tends to be more competitive than for other employees because it draws on a smaller talent pool. Pay is driven up when companies have to compete harder to attract potential candidates.

These competitive effects are magnified because consultants tend to advise that CEOs must receive above-median pay to be competitive, which leads to pay ratcheting. The gender pay gap may also play a role: men consistently earn more than women (even when holding roles constant) and men are disproportionately more likely to hold senior executive positions.

It is often said that sunlight is the best disinfectant. And with this in mind, UK companies with more than 250 employees have been subject to rules on pay ratio reporting since January 2019. This means that pay inequity is now more visible and so the debate should now be more informed.

But a potential consequence of a more informed debate is more conflict with employees. In the prevailing economic climate this could fuel pressure for strikes. But it’s hard to argue that keeping the scale of pay inequity in the shadows to reduce strike pressure is a better alternative. Increased conflict (in the form of debate) is almost certainly a necessary step on road to change.