Advent – the season of preparing for Christmas – has only just begun. But the build up to the consumption bonanza that Christmas has come to represent, started weeks ago. And to give retailers a December boost as they enter the holiday home straight, there’s now Black Friday and Cyber Monday to get and keep us spending.

Retailers love events as they generate interest and therefore sales and profit. And events don’t come any bigger than Christmas – the season of over-indulgence, gift giving, Boxing Day and New Year Sales and the inevitable returns. For retailers this consumption frenzy is where they make a large chunk of their annual profits. The sheer scale of the seasonal spending has focused retailers’ attention on generating excitement and capturing as much of these sales as possible with the kinds of deals that are offered as part of Black Friday and Cyber Monday.

High risks and rewards

But in the same way that the rewards are great, the risks are commensurately large. Do retailers have the right stock in the right amounts at the right places? Will consumers be attracted to their store or place and not to the competition? Will their websites cope? Can the stock overhang, if any, be moved in the later sales? And as the intensity of sales increases, so operational costs also increase.

Retailers are engaged in a never-ending fight for consumers, and as much certainty as they can generate in the system, in order to protect their profits. There are a number of dimensions of this, some more modern than others. A big reason for encouraging the early start of sales is so that retailers know they have sold product, but also can get clues over what is selling, and can make more informed decisions over re-supply if possible.

The battle for consumers has become ever more fierce. Sometimes this is focused simply on discounts; in some chains it is linked to loyalty points and vouchers; and in others it is the Christmas advert, which seems to have become an event in itself. Launched ever earlier, with ever more hype, the flagship Christmas TV advert, a la John Lewis or Sainsbury is focused on generating column inches, interest and attention and of course sales.

Rise of the internet

Retailers have also embraced other events which can generate and add some degree of certainty to their sales. So Halloween has become a major event, but even more significant in the past couple of years is Black Friday. The US public holiday after Thanksgiving, Black Friday has been the starting gun for Christmas in the US and its own sales frenzy. And now British retailers have taken it on and launched it as their own. Apocryphally this Black Friday sales frenzy in the US is what turns retailers’ accounts from red to black, and is undoubtedly a critical point for many.

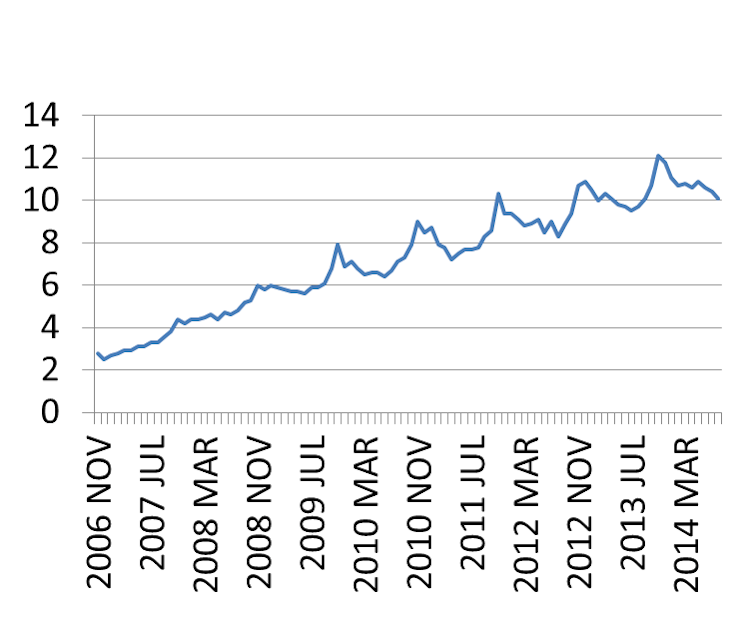

And then there is Cyber Monday, the first Monday in December when internet retailing supposedly reaches its peak. As the following figure shows, the internet is posing a significant challenge to the traditional high street in terms of where we are doing our shopping. The Christmas peak for sales is also notable in the internet’s ongoing march.

For retailers this is double edged; they get sales and certainty early, but they have to hope that their delivery services are up to the volume. So Amazon employs thousands more people for this peak, as do many high street stores who are also driving their growth through online sales.

For retailers, the significance derives from the scale and importance of Christmas to their bottom line. Get Christmas wrong and the business really suffers. But consumers are increasingly aware of this and indulge in a game of chicken with retailers, with the knowledge that no sales means likely future discounting.

It is only when possible scarcity occurs (such as Waitrose’s Christmas Pudding by Heston) that consumers really want to spend at full price, early. And it is this space that retailers have used Black Friday/Cyber Monday to enter. They offer attractive headline discounts to draw people in with the hope they both buy other products (at full price) and keep that retailer top of mind for further Christmas spending.

For us consumers, the chance of a bargain is always important as a driver. Consumers want to be as certain as they can that they have the product and the price is right. Early purchase via Black Friday or the internet helps them feel reassured they are in control of Christmas to an extent.

A Silver lining?

This commoditisation of Christmas continues apace and the internet is an increasing feature of this behaviour – especially with mobile technology putting it increasingly at our fingertips. But maybe there is a silver lining for other alternatives. With more shopping moved online and taken care of ahead of time, shoppers have space now to explore.

The rise of convenience and local culture, due to technology and consumer behaviour change, is now well recognised. And at Christmas this may just reveal itself by the search for the different and the local. The distinctiveness of the local craft or food market (though not the sometimes ersatz Christmas market) is what brings the difference, the sparkle, the magic back into what should be a festive, distinctive season. We can’t put the consumer Christmas genie back in the bottle, but we can think more carefully about how, where, and indeed why, we spend our money.