The past three decades have seen an unprecedented explosion of activity in a new sub-discipline of mathematics: financial mathematics. The emergence of this field has parallelled the expansion of the quantitative financial services industry, the arm of banking that uses mathematical models to value, regulate and contrive trading strategies for complex financial derivatives such as options and futures. And it has transformed the role that university mathematics departments now play in feeding the financial services industry with its students.

For many universities, the volume of demand for courses relating to financial mathematics, in particular at the postgraduate level, has proved to be a gift from the gods. In the UK, MSc courses on the topic of financial mathematics are taught at well over 30 of the leading universities.

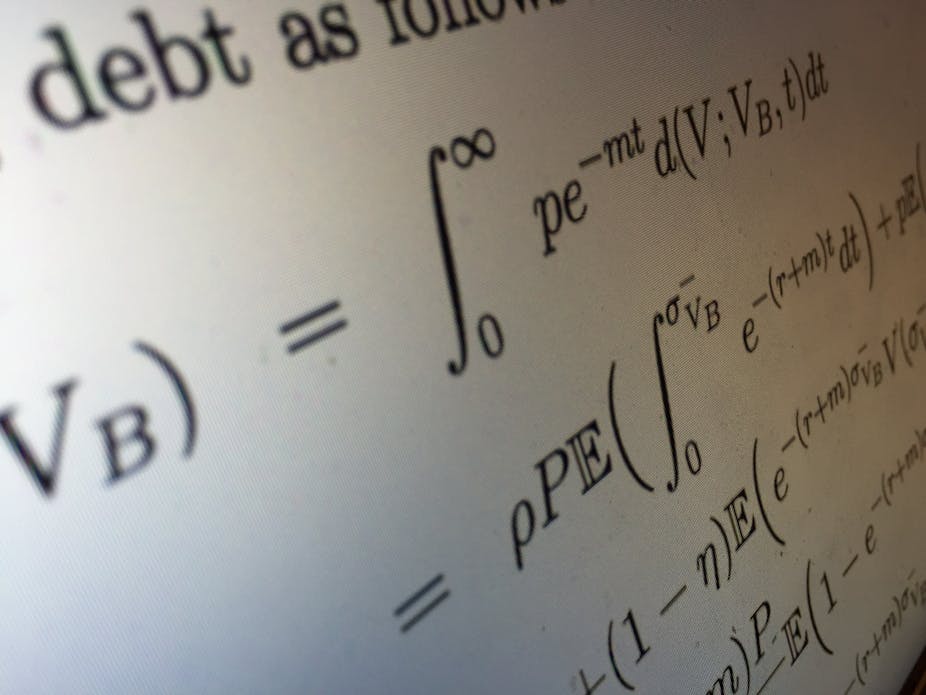

These masters’ programmes – a fusion of advanced probability theory, differential equations, Monte-Carlo simulation and statistical analysis of data – are marketed as premium postgraduate education and burnished by the allure of a well-paid career in the banking industry thereafter.

Around two thirds of them demand fees the range £15,000-£31,000. Fees are often double, treble or even quadruple those of other masters’ programmes in the same department. Can such eye-watering figures be justified?

Value judgement

The institutions promoting these courses like to talk about three key drivers for potential students: vocational specialism, opportunity and demand. However, at least two of these seem questionable.

A lot of the specialism within the courses in question, over and above what a general masters-level mathematical education has to offer, tends to be focused around recent academic research in financial mathematics. However, much of this turns out to be no longer relevant to the working practice of a typical modern-day quantitative analyst – known as “quants” – the job whose technical requirements should most closely align with the aspirations of the typical financial mathematics postgrad course. Many academics teaching and supervising students have, at best, rare contact with the hands-on interests and daily challenges of the quant employer, if at all.

I have spent a modest amount of time engaging with quants in banks and financial institutions in several different countries and, in terms of opportunity, very few seem to care if a hire is in possession of an MSc in financial mathematics. Indeed, hiring strategies for quants look for sharp problem solvers who can deal with the fast pace of work and learn and develop in-house technical procedures. Therefore there is a strong bias in these roles towards numerate graduates (mathematics, physics, computer science), predominantly those in possession of a PhD.

End justify the fees?

This does not contradict the observation from those promoting the postgrad courses, that many of their graduates go on to work in the financial services industry. It is simply the case that the relatively soft technical needs of the roles they are hired into (for example careers in risk management or trading) are not specific to the masters they have gained. Moreover, self-selection plays a role here; commitment to an expensive postgraduate certificate shows a strong desire to work in the financial services industry.

All the same, as long as students are keen to pay the current level of fees, one could assert that the product speaks for itself. But is this an acceptable justification for the extent of the pricing differential in fees? What future precedent does it set and what incongruities does it establish within the current system?

The packaging, marketing and selling of education is one of the many challenges that universities now confront as a simple matter of survival. However, one has to question the motivation behind the scramble to offer postgraduate education in financial mathematics which imposes relatively (in some cases, exceptionally) high fees, when there isn’t necessarily clear evidence of value for money. There is a danger that the answer to the question “why are fees for financial mathematics postgraduate taught courses so high?” may simply be: “because universities can get away with it”.

Undesirable precedent

Financial mathematics is a theory that aims to quantify randomness (or risk) within economic scenarios with a view to characterising rational behaviour, thereby promoting fairness. In this respect, it very much deserves to be researched and taught at depth in an academic environment. There can be no doubt that the MSc courses are rewarding in their intellectual content and many programmes in the UK are exemplary in this respect.

There is a danger, however, that the financial mathematics MSc has become an iconic symbol of an overzealous attitude towards the commercialisation of education. Marketing for masters’ programmes in financial mathematics often confuses the high-level skills needed by an elite core of quants in large banks and specialist consultancies with other softer quantitative roles in banking, for which a whole array of other qualifications are equally relevant.

Mathematicians like to think that they are part of the solution and not part of the problem when it comes to the fall-out of the financial crisis. But by arguing the case for a sellers’ market, the business model of these MSc courses sets an undesirable precedent. Take, for example a masters degree in statistics, which, nationally, is set at standard fees. One can make a much stronger case here that there is directly relevant, high-level vocational training taking place. This qualification is needed by a whole variety of industries which hire students into well-paid jobs as statisticians because of it. What is now stopping universities charging above average fees for these degrees?

Twenty years ago, when the profession of the quantitative analyst was still young, financial mathematics courses meant something completely different to what they do today. The financial services industry has matured to have a much clearer understanding of how it interacts with high-end mathematics. The role that universities play in the vocational training has accordingly changed. But in the meantime, the UK MSc in financial mathematics appears to have been instituted as a valuable, but hard to justify, cash cow.