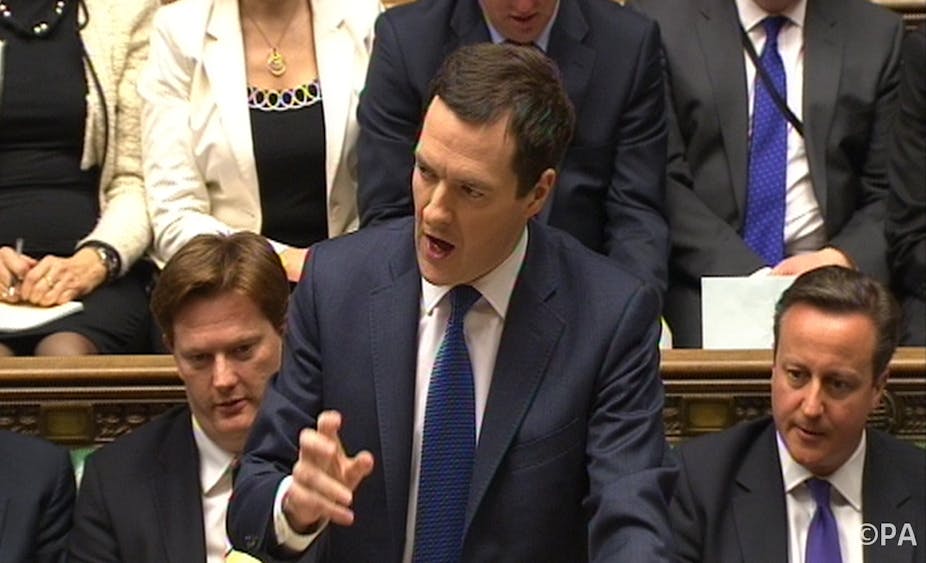

The final Budget before the general election is fast approaching. Separated from the election by just 50 days, it is not likely to lack political content. But the key issue remains the deficit – and how successful George Osborne can claim the government has been at tackling it.

In the forecasts produced for the June 2010 Budget, the Office for Budget Responsibility anticipated that the deficit on the government’s current budget would be eradicated by 2015-16. Its most recent forecast of the deficit in that year is £49.4 billion. If achieved, this would represent a substantial cut of the deficit (which, in 2009-10 was well over £100 billion), but it would represent a serious underachievement when set alongside the initial target.

Progress toward the goal of deficit eradication has been patchy. As a proportion of GDP, the deficit fell by more than 20% over 2010 and 2011, but has fallen slowly since. Put simply, in terms of rushing to cut the deficit, there was an unheralded U-turn in 2012. The effect of that U-turn on growth has been positive, but for a government determined to eradicate the deficit there remains unfinished business.

Indeed, with all major political parties committed to restoring something close to fiscal balance by the end of the next parliament, we can expect further savage cuts in government spending – and probably some subtle tax hikes too. Indeed whether the parties’ aspirations for public borrowing are achievable over the timescale of a (further) single parliament is moot.

What might appear curious is that, at a time when GDP is growing by almost 3% per annum, it should be possible for government to run a surplus. The ready reckoner of fiscal policy entails running a deficit to stimulate demand when times are bad, and pay that back when times are good. So why is it proving so difficult to reduce the deficit now?

The difficulty faced by the government is that, while demand management policy is usually achieved by some mix of monetary and fiscal policies, it currently has only one of those tools at its disposal. The Bank of England has held its interest rate at an all-time low of 0.5% since early 2009 – what some economists like to call the “zero lower bound”.

Using conventional monetary policy to stimulate the economy – by lowering the interest rate – has not been an option for the last six years. At other times it might have been possible to reduce the fiscal deficit while still stimulating the economy through monetary policy. Fiscal policy has had to do all the work on its own this time.

Investment, productivity and incomes

All of this adds up to a requirement that the government should be smart (smarter than usual, perhaps) in making its decisions about spending and taxation. Spending on investment to improve the nation’s infrastructure – where the return on that investment is high – should be welcome.

It should be doubly welcome where this investment can bring further increases in private sector investment, and where it can result in substantial gains in labour productivity. The flatlining of productivity in recent years largely explains the failure of real wages to recover from their post-recession low. Breaking out of the vicious circle in which low wages are paid to workers who are not equipped to become productive should be a priority.

So far, the recovery has largely been one of output and jobs – only very recently have wages increased (and even then only to a modest extent). This has, in itself, exacerbated the difficulties faced by the Treasury, since the sluggish growth in incomes has led to a disappointing recovery of tax revenues. The government could make it easier for businesses to raise wages by offering some targeted relief on national insurance contributions.

The speed at which the budget deficit is to be closed remains a contentious issue. The experience of the years before the 2012 U-turn confirmed that it is possible to go too fast, and that growth can be strangled by an excessive zeal in deficit reduction.

There is some difference between the main political parties on the appropriate speed of retrenchment – though arguably not as much as you might expect. Whatever the details of the Budget, voters will have a chance to have their say when it comes to this longer term decision in May. The Budget will chiefly be interesting for the rabbit that, for political reasons, the Chancellor will surely pull out of his hat. But it will only be the appetiser for the meal that will follow 50 days later.