Articles on Cryptocurrency

Displaying 1 - 20 of 252 articles

Donald Trump’s social media platform, Truth Social, went public on Tuesday March 26. Shares in parent company Trump Media & Technology Group surged 15% after its first day of trading on the Nasdaq…

Food fraud costs billions globally. But blockchain and machine learning offer hope for a more transparent and safer food system.

Often dismissed as a libertarian ponzi scheme, why has crypto bounced back yet again?

Africa’s largest economy is in crisis, and unrest is growing.

Twelve months ago, bitcoin looked dead in the water. Now it could be heading to all-time highs.

AI is one of many reasons the tech company mantra should be reconsidered, says an expert.

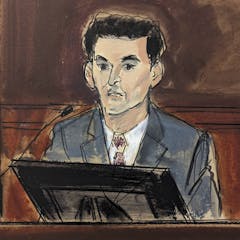

The downfall of the onetime multibillionaire holds lessons for investors and regulators alike.

Cryptocurrency tycoon Sam Bankman-Fried may face a jail term of more than a century after conviction on seven counts of fraud and money laundering.

This is why no one is buying your cartoon ape.

Worldcoin wants to provide ‘proof of personhood’ in an AI-filled future, but critics and governments are unimpressed

New Zealand’s central bank is taking a long, hard look at cryptocurrencies and the role they will play in future business. Here’s what businesses had to say about our digital future.

Up to one in five Australian adults owns cryptocurrency. A tax expert (and crypto owner) explains what you need to know about claiming losses on your tax return, and a possible discount on your gains.

A Welsh mining company was the first to issue tokens to workers as an alternative form of payment.

While a digital national currency does have the potential to mitigate key financial issues, we cannot ignore the democratic risks such a currency could introduce without safeguards.

Barely 2% of Australians or Americans use Bitcoin for its intended purpose: to buy things. Should we even call it a cryptocurrency?

Central banks are now taking digital currencies seriously, and the EU is exploring the idea. While an “e-euro” could increase monetary security and stability, the venture is not without risks.

It needs to be treated like the new class of assets that it is.

The new UK white paper reforming the gambling laws for the digital age says nothing about one of the most concerning new developments in this field in the past 20 years.

Web3 has become a catch-all term for the next iteration of the internet. But what does it mean exactly?

The UK economy could benefit from a digital pound, but is there a role for crypto?