Copper is in the headlines after Australian mining giant BHP made a bid for UK-based rival Anglo American, valuing the company at US$39 billion (£31 billion). Together, the two companies would control around 10% of the world copper market.

Though Anglo American has rejected the offer as too low, the received wisdom is that it is the start of a takeover battle, and that it could also kick off a round of consolidation in the mining sector with copper at the centre. We asked commodities specialist and Professor of Economics Sambit Bhattacharyya of the University of Sussex to explain why copper is becoming so popular and what it means for the future.

Why the dash for copper?

The global economy is going through a transition in various ways. Emerging markets are expanding their industrial capacity quite rapidly and copper is a critical industrial metal, so that’s creating demand. Simultaneously, countries are moving away from fossil fuels to renewable energy to meet their targets to address climate change. For example, there’s a move to electric vehicles and solar panels, and copper is essential for both the electrical wiring and batteries.

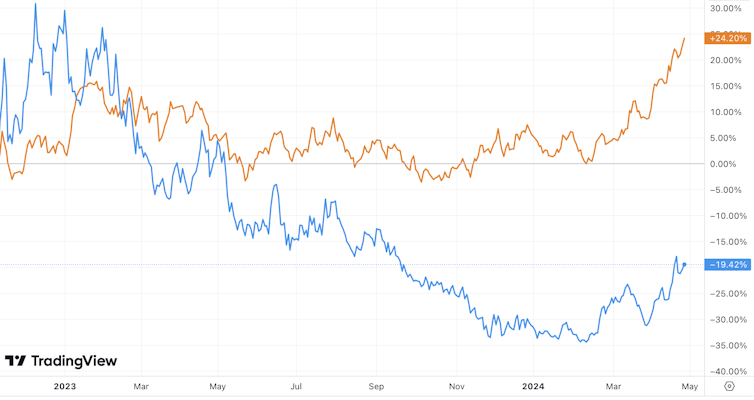

Copper price (US$/lb):

Furthermore, economies around the world are becoming increasingly digital, meaning more computer-based solutions and more dependence on computing power. Again, that means more electrification of the economy and therefore more need for copper. So the expectation is that demand for copper will increase rapidly over the next decade in both developed and developing markets. It’s quite likely that you could see a 5% annual growth rate in demand.

Why are the mining companies consolidating?

It allows them to reduce fixed costs and exploit economies of scale. In anticipation of increased demand for copper, the big miners would like a bigger market share to be able to set prices and provide higher returns to their shareholders.

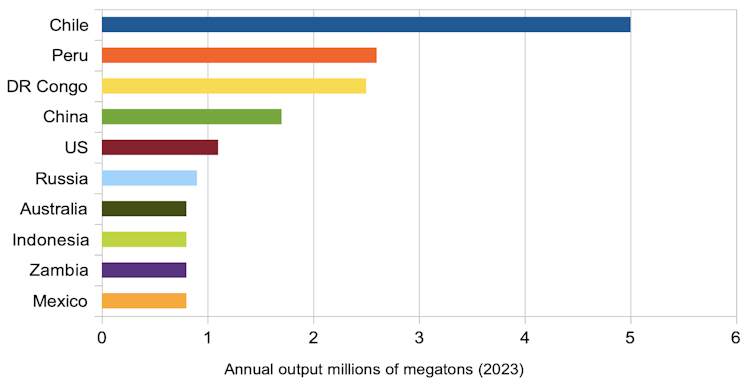

BHP is specifically attracted to Anglo American’s copper assets in Peru and Chile. Having said that, the game has only just started here. I am sure other major miners, including Rio Tinto and Glencore, are also watching and may be waiting to make their move.

There are also risks associated with this potential takeover. This relates to nickel, which is another highly important strategic mineral for the renewable energy industry. Its price has been down (before recovering a little recently), which has affected Anglo American for example.

Copper v nickel price change:

Nickel prices are under pressure because of Indonesia, whose mines are not controlled by the big mining companies. Indonesian nickel is relatively poor quality, but can be refined at a low cost, and has been undercutting demand for copper products from other countries.

Demand for copper and nickel runs hand-in-hand, since you need both if you are making electric vehicles, solar panels and so forth. Having seen what has happened with nickel, investors are likely to believe something similar could happen in the copper market.

For example, China might choose to pick up copper from Russia or South East Asia, and again those assets are not controlled by the western mining conglomerates. This could happen as a result of tense political relations between China and Australia, which is home to BHP and Rio Tinto. Although relations between these countries have improved somewhat, both companies are heavily reliant on the Chinese market so there’s a risk there.

So copper is not likely to become a geopolitical pawn in the same way as the rare earths?

It’s certainly possible, but my sense is that the market and the producers will be able to manage those risks. There could be trade restrictions and so on, but buyers and sellers will still find ways to conclude economic transactions. Trade restrictions typically lead to trade diversion – look at Russia exporting fossil fuels to Europe via India, for instance.

My sense is that the globalisation trends that were put in motion in the late 1980s are irreversible. The global supply chain is so diversified, and also many firms are adopting AI and other new technologies to become more efficient, which they won’t want to stop. Obstructionist policies are typically slow to react, and they are likely to fail. We will find out in ten years’ time that this is probably right.

Is a rising copper price likely to have implications for the green transition?

Copper is well spread across continents, and a 10% share of the market is not a massive share. So I wouldn’t say that a takeover like this would give the miners enough power to derail the green transition. In any case, national governments can influence prices by brokering favourable long-term deals with the miners for their industrial operations.

How are the major copper-producing countries likely to be affected by surging demand?

It depends on the contracts. For example, Chile has benefited quite a lot from its mining operations. It has modernised rapidly and transformed itself from a low income to a high income country. It has a highly sophisticated, well functioning government which is able to handle these contracts well to ensure benefits for its own people while not harming investments in its mining industry.

Top 10 copper producers:

Africa is probably the wild card. Many countries have struggled during the post-colonial era to offer well-functioning government to their populations. Of course the continent has been a victim of injustice and pillage both during the colonial era and the pre-colonial slave trade.

These days, African countries don’t seem to have national champions in their mining industries to the same extent as others. They also tend to have weaker institutions and fragile governments.

Large multinationals have a strong incentive to exploit these weaknesses and take home even bigger profits. Needless to say that this is not beneficial for the local population. I can only hope that we will see more representative and effective governments in that region, so that people can benefit from their mining assets.