The government’s draft direction this week to the Clean Energy Finance Corporation to invest in “emerging” clean energy over mature sources such as wind and rooftop solar has added yet more uncertainty to the renewable sector in Australia.

Bioenergy (renewable energy derived from plants or animals) is one such emerging technology. It currently makes up 7.9% of total clean energy generation, or about 1%, of Australia’s total energy generation.

From media reports to date it remains unclear whether technologies included under the bioenergy banner will be included in the investment mandate for “new and emerging technology”.

So what are the prospects for bioenergy?

Bioenergy’s popularity on the rise

The Clean Energy Council ranks bioenergy as Australia’s fourth-largest generator of renewables energy behind hydro, wind and solar.

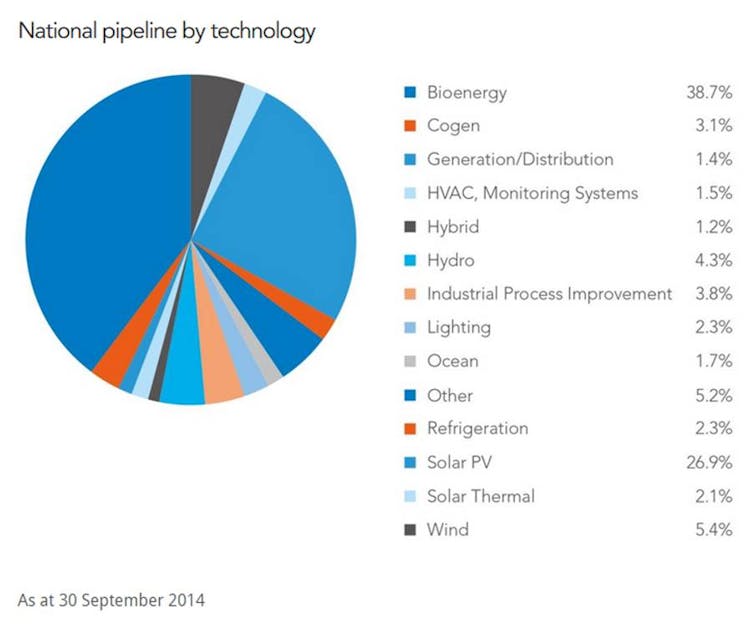

Clearly bioenergy is getting bigger. As of September 2014 renewable energy projects in the CEFC pipeline are headed by bioenergy at 38%, well ahead of solar photovoltaics at 27% in second place.

At a Bioenergy Australia business breakfast last month, the CEFC said it was considering A$800 million in investment in bioenergy to accelerate A$3 billion in projects.

While bioenergy is common and hugely popular in other parts of the world including Germany, the United States and China, it remains a relatively new technology in Australia.

Despite its relatively small scale, bioenergy has a nationwide footprint, with 139 plants across Australia in operation as of late 2014.

Sector attracts private, government investment

One of the key questions for financing clean energy is the return on investment. The CEFC’s contracted investments are currently expected to earn a portfolio weighted average yield of around 6% across their lifetime. How does bioenergy stack up?

The CEFC has forecast a 8.9% rate of return over six years for one New South Wales investment, while a Western Australian project is expected to return 8.2% over 10 years.

This figure relates to the debt component of the transaction and CEFC assumes the return on equity will be higher, giving a higher weighted average total return on the project.

While some of these bioenergy projects have been wholly funded by the businesses themselves, many have attracted funding from state and or federal government.

This funding has been granted because governments see the wisdom in underpinning investment in key businesses, some of which employ hundreds of people.

It has also come about because local, state and federal governments are concerned about the pressures of a growing population, waste accumulation and odour from landfill and industry.

Technologies active in alleviating waste problems

Bioenergy technologies such as biogas can be incorporated into existing operations to provide elegant solutions to turn waste into power, heat and other valuable by products such as fertiliser.

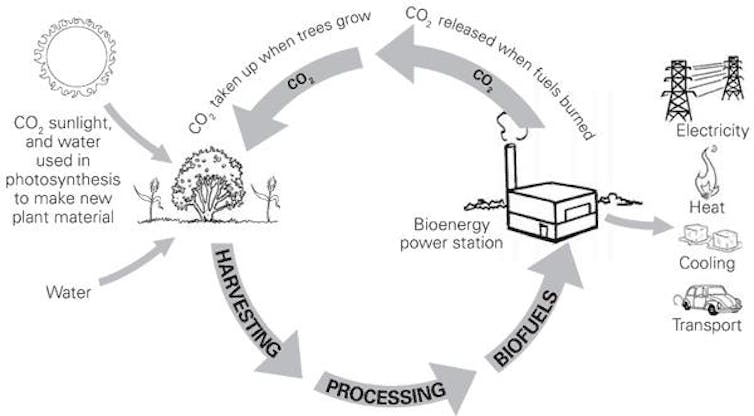

These technologies can be introduced in “closed-loop” systems and operate regardless of whether the sun is shining or the wind is blowing. The figure below shows the principles of a closed “carbon-loop” system.

With CEFC funding of up to 50% in some cases, bioenergy is now in use in sectors which include meat processing at plants like Bindaree Beef at Inverell, piggeries, egg production and the garden products industry.

Australian bioenergy sources feedstocks from a number of sectors, including:

agricultural-related wastes like sugarcane residue (bagasse) and manure

municipal wastes including sewage and landfill

energy crops such as sorghum used to produce ethanol.

Bioenergy has the ability to literally swallow waste created by humans in municipalities, animals in intensive livestock operations, and crop production.

Outside the square is the biggest and longest-running user of bioenergy in Australia, the sugarcane industry.

For decades, selected mills in Queensland and NSW have been burning bagasse, the woody pulp left after sugar has been extracted from cane, to generate heat and electricity for use in in sugar processing, and selling surplus electricity to the grid.

The massive Integrated Food and Energy Developments project proposed for North Queensland includes sugarcane production incorporating steam and electricity production from bagasse. This could be a prime candidate for CEFC funding.