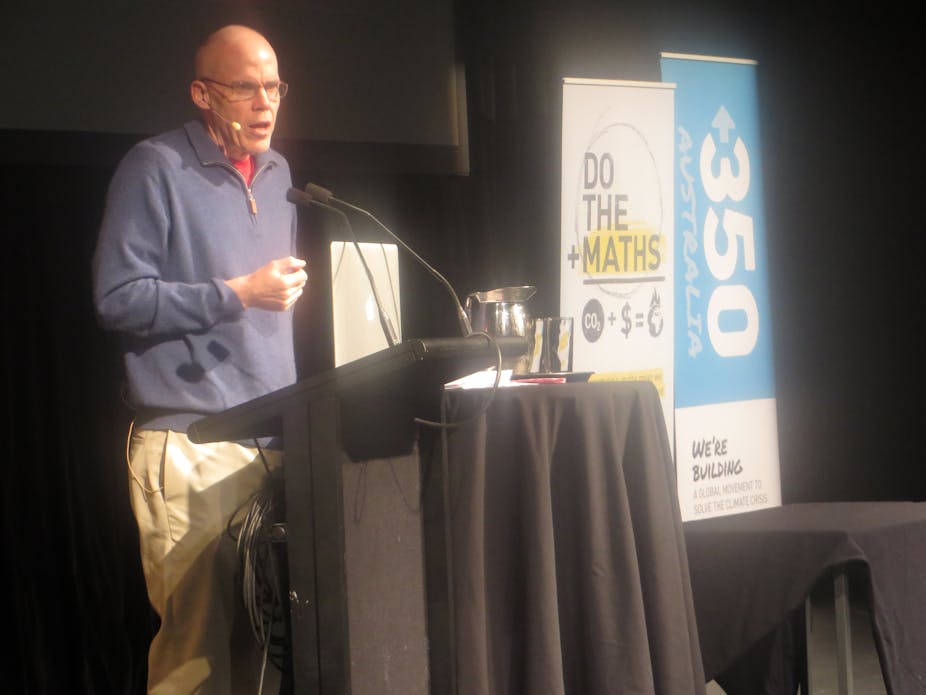

In June 2013, author, activist and academic Bill McKibben is visiting Australia and New Zealand as part of the Do the Maths tour. He has been discussing the carbon bubble, fossil fuels, climate change, civil disobedience, and how we can get away from investing in coal.

His call for divestment has been picked up by the Greens, with Christine Milne asking the Future Fund to stop its “risky investment” in coal industries.

On Monday, McKibben appeared on an unruly episode of the ABC’s Q & A, defending climate science against sceptic politician, Cory Bernardi. On Tuesday he appeared at the University of Sydney; on Wednesday, he presented at the Australian National University; and on Thursday, he discussed climate change in an address to the National Press Club.

Big coal down under: fossil fuels and the carbon bubble

In this presentation, Bill McKibben observed: “The fossil fuel industry are outlaws against the laws of physics.” He contended that the fossil fuel industry needed to lose their veneer of respectability, the way the tobacco industry has. “If it is wrong to wreck the climate,” he said, “then it is wrong to profit from that wreckage”.

In 2012, the Carbon Tracker Initiative released a disturbing report on Unburnable Carbon: Are the World’s Financial Markets Carrying a Carbon Bubble?. The report concluded that investors were exposed to the risk of unburnable carbon: “If the 2°C target is rigorously applied, then up to 80% of declared reserves owned by the world’s largest listed coal, oil and gas companies and their investors would be subject to impairment as these assets become stranded.”

This year, the Carbon Tracker Initiative and the Climate Institute produced a report on Australia’s Carbon Bubble, with similar findings for this country.

Bill McKibben launched his visit to Australia with a feisty piece in the Monthly which contends “The truth is that Australia’s coal has to stay in the ground, along with Canada’s oil, and the huge reserves of gas in the US, and so on … If that carbon is poured into the atmosphere, the equation laid out above won’t work, and the planet will overheat disastrously.”

McKibben concluded that, if you invest in fossil fuels, “You’re betting that we’re going to tank the earth.”

Stop investing in coal

In April 2013, the Board of Supervisors in the city of San Francisco supported divestment from fossil fuels. A dozen more cities and municipalities in the United States have passed policies on fossil fuel divestment. Bill McKibben suggested to Sydney Lord Mayor Clover Moore that Sydney should follow the lead of San Francisco and Seattle.

Bill McKibben has warned the carbon bubble means “your pension is being used in a $6 trillion climate gamble.” He encourages universities and colleges to divest themselves of fossil fuel investments. He commented that “students are demanding that their boards of trustees end their investments in the fossil fuel industry whose business plan guarantees these kids will not have a future really in which to carry out their educations.”

Many US universities, led by the Unity College Board of Trustees, have voted to divest itself of fossil fuel investments. Most recently, in May 2013, the University of California Santa Barbara Faculty Senate voted in favour of fossil fuel divestment.

Divestment movements have also sprung up in Australia and Canada in the higher education sectors. The Uniting Church in Australia has pledged to divest itself of fossil fuel investments.

Internationally, Archbishop Desmond Tutu has been a vocal advocate for fossil fuel divestment:

Bill McKibben highlighted the investments by Australian financial institutions in fossil fuel projects. In Australia, there has been much debate about investments by banks in respect of fossil fuel projects - particularly by the Big Four (Westpac, ANZ, the Commonwealth Bank, and the National Australia Bank).

The Whitehaven controversy and the ANZ Out of Order campaign certainly highlighted mining investments by financial institutions. The Future Fund has also come under scrutiny for its accounting of climate risks, in Freedom of Information applications by the Climate Institute.

In Australia, health advocates were successful in pushing for the Future Fund to divest itself of tobacco. Isn’t it time we took the next step? In the middle of Bill McKibben’s “Do The Maths” Tour, the Greens have announced a new campaign for the Future Fund to divest itself of fossil fuels. John Hewson - economist and former Coalition leader - has argued that the Future Fund should take into account climate risks.

In my own view, the Future Fund should not invest in a future of angry summers and extreme weather.

Divesting from coal will take international action

Bill McKibben has been an advocate for substantive international action on climate change. 350.org has been active at the recent climate summits at Copenhagen, Cancun, Durban, and Doha.

However, he has been disappointed by such international climate conferences. In his view, the outcomes of such meetings have lacked ambition, commitment, and enforcement.

During his visit to Australia, Bill McKibben has stressed that “climate change is driving inequality around the world”. He has highlighted the relationship between climate change, food security, hunger, and poverty.

Bill McKibben has argued that the Carbon Bubble “will require true global diplomacy, since no country can conquer climate change on its own.”