Public concerns over levels of CEO pay – especially in the banking sector – have triggered a debate on both sides of the Atlantic. These worries are anything but unfounded, but solutions are too often being sought in the wrong places.

The State of Working America report released by the Washington-based Economic Policy Institute is telling. In 1965, the CEO pay was about 20 times higher than the average worker’s pay. By 2011 the CEO-worker pay ratio skyrocketed to 231. Even these figures conceal wider gaps that exist in household-name companies as calculated by a Bloomberg report. At the top of the list, the CEO of JCPenney earned 1765 times more than their average worker. How can we explain this gap between CEO and workers’ pay?

A study by Bruce Western (Harvard) and Jake Rosenfeld (Washington) confirmed that the single most important factor accounting for the rising pay inequality is the decline of trade unions’ power. This explanation echoes one of the key messages in Thomas Piketty’s Capital in the Twenty-First Century. Apart from a redistributive tax system, unions’ collective pay-setting kept wage inequalities in check for several years. But the unions’ bite at the workplace has been in steady decline since the 1980s and workers’ wages stagnated in most developed countries.

Talent show

The demand-led growth models that raised standards of living have given way to credit-based growth and an unprecedented financialization of the economy. The virtuous circle was effectively replaced by a vicious cycle. Linking CEO pay with stocks exacerbated these trends. It shifted the focus of managers from long-term productive investments to short-term profitability that increases shareholder value. The pressing question is: how can we possibly fix the widening pay gap?

There are some emerging remedies in response to public concerns. The Dodd–Frank “Wall Street Reform” in the US required that listed companies publicise the CEO-worker pay-gap ratios in the hope that this might alert shareholders and investors if they are overpaying. Opponents raise the argument that restricting CEO pay might limit options in the global “war for talent”. But these concerns are exaggerated, there’s plenty of “talent” available under conditions of high unemployment. The US legislation has been held up by haggling over the details, and very few companies have disclosed their ratios. The federation of US labour unions tried to fill in the blind spots and increase public awareness by publicizing CEO pay by state, but more is needed to crack this problem.

Swiss trade unions went a step further. They campaigned in favour of a proposal to cap executive pay at 12 times the wage of a firm’s lowest earner. This proved to be overly ambitious. Rather than imposing a legislated cap, a more “light touch” approach was favoured by Swiss citizens in a referendum that imposed controls on executive pay and forced public companies to give shareholders a binding vote on compensation.

Shareholder power?

Shareholders may have good reasons to put a lid on CEO pay. A recent report from the London-based High Pay Centre suggests that unequal workplaces suffer more industrial disputes, more work-related stress and higher staff turnover than more equitable employers. This is certainly not surprising, since large disparities in pay are likely to undermine the feelings of distributive justice, and eventually undermine company performance.

In the same vein, the European Commission in Brussels is drafting a proposal of EU regulations requiring that the European Union’s 10,000 listed companies reveal their pay ratios and allow shareholders to vote on whether they are appropriate. Enabling shareholders to tame the excess of CEO pay may go some way towards halting the trend. But, frankly, more drastic solutions are needed to reverse it.

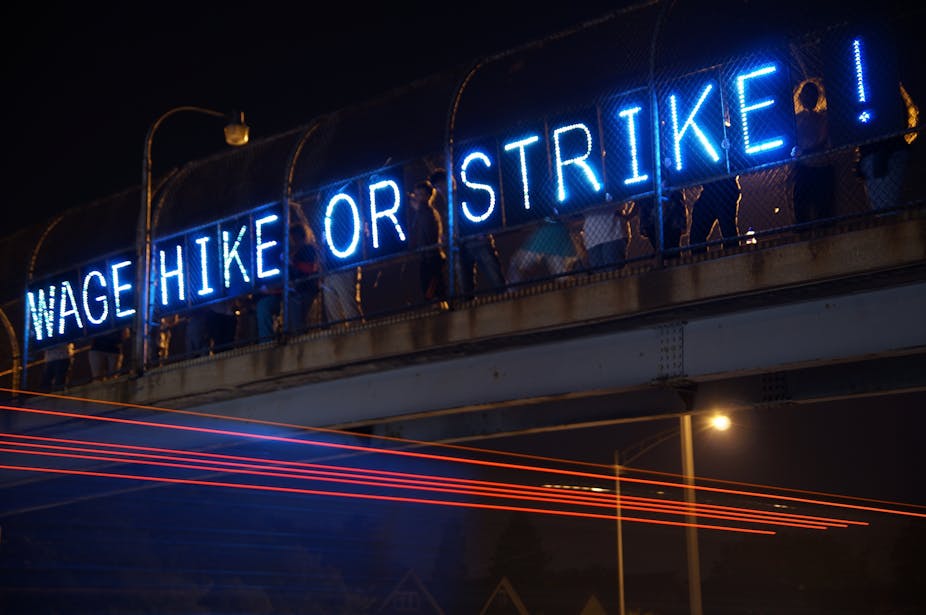

Empowering workers

Although shareholders may be interested in avoiding excess, at the end of the day, those who are affected by the inequity are the workers themselves. Reversing the pay gap would require drastic empowerment of workers; either through shared ownership or through shared decision-making. Modern models of industrial democracy appear promising. In a policy brief at the LSE’s Centre for Economic Performance, Alex Bryson (NIESR) and Richard Freeman (Harvard) presented evidence that “shared capitalism” models are not only favourable for workers’ pay, but also make good economic sense. On top of good performance, workplaces that have some form of institutionalised profit sharing or shared-ownership schemes are also renowned for low pay inequality.

Another drastic way to fix the pay gap would involve employees in management decision-making. Germany’s dual supervisory boards offer such a real world example. Workers’ representatives are involved in decision-making and may co-determine, or veto, important decisions affecting the workforce. Rather than imposing rigid legislated caps on executive pay, it might make more sense to institutionalize workers’ co-determination rights, including the right to approve CEO pay. In this case, CEOs will not only be accountable to shareholders, but also to another important stakeholder, the workers. This additional layer of accountability is likely to fix a pay gap that has gone too far.