Good policy should be free of surprises. Households have to make decisions about how much to spend, how much to save, how to finance their retirement, whether to take out health insurance, and so on.

Businesses need to make decisions on how much to produce, how many workers to employ, whether to invest in new capital, the way to finance these decisions, and so on.

All of these decisions have to be made on the basis of prices, wages, interest rates, exchange rates, taxation rules, workplace laws and a whole host of government regulation.

If the government keeps changing the rules in a surprising fashion it is very difficult for households and businesses to make sensible decisions, particularly long-term decisions.

The point is that fiscal policy should be made in the context of a long-term vision for the economy, including getting everyone who wants to work, into work, providing the public infrastructure needed to increase productivity, the right mix of private and government provision of health and education; and reform of the regulatory environment.

However, we still have to go through this charade of locking up journalists until 7pm on Budget night as if a “leak” would make any difference to the economy. This is particularly strange given the stage-managed release of most of the Budget’s content over the last few weeks.

We should see differences between the major parties with regard to their philosophy. Alas, this does not happen, and we have both sides of politics scrambling to grab the vote of “battlers” or “working Australians”, whoever they may be.

Apart from mining, the rest of the economy looks vulnerable and, although China’s thirst for our minerals and energy is very welcome, it does leave the economy precariously dependent on its economic fortunes. Despite Monday’s retail and housing starts figures showing improvement, business and consumer confidence remain low and the European situation is very unpredictable.

The major components of government expenditure tell you where cuts would need to be made to significantly reduce total expenditure. About one-third of federal government expenditure is on social security and welfare. Part of this is due to the worst-off Australians not being in work – more than 1.5 million people of working age (not seniors) currently rely almost entirely on government benefits for their income.

Measures to reduce payments to single parents are designed to increase the “stick” to the jobless, but it is not clear where the “carrot” of more job opportunities is coming from.

Certainly, the Fair Work Act has significantly reduced incentives for firms to hire workers and hinders productivity growth, recognised as a major problem in Australia. The “jobless problem” has been recognised for over 30 years so governments have no excuses for not doing something about it. This would require long-term vision (and yes, more expenditure) but its impact on reducing government expenditure in the long-term would be enormous. There is a grave danger the jobless problem could get seriously worse.

Both ALP and Coalition governments have increased middle-class welfare to couples with children who get most of what they pay in tax back from the government in handouts, and who make greater use of education and health facilities.

This represents a huge degree of inefficient “churning” - taking with one hand and giving it back with another. The latest is the increase in Family Tax Benefit Part A, plus cash payment of $820 for each high school student and $410 for each primary school student paid directly to parents – although they could have previously got the money as a tax rebate. The issue is further confused by the press linking these payments to compensation for price rises induced by the carbon tax.

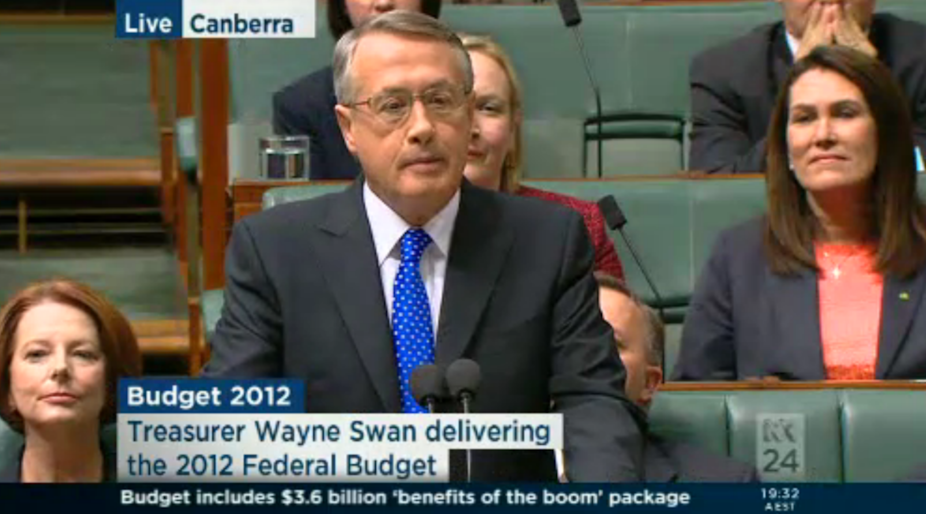

Will Swan be able to convince the public that his surplus is genuine and part of a long-term strategy, and not a result of creative accounting? For instance, there has been much publicity regarding defence cuts but the suspicion is that the motive is to engineer a surplus by deferring, or slowing down planned purchases, leaving the Abbott government to pick up the tab when it inevitably comes to power.

The payments for school kids will be paid as refunds for the current financial year to parents in June, bringing forward expenditure to this year and reducing expenditure next year.

Will Swan be able to convince us the predicted revenue will be achieved? Mining experts are saying revenue from the mining tax will be lower than predicted given the huge investment spending which can be claimed against profits.

The fragile nature of the non-mining economy, with low consumer and business confidence, may significantly reduce revenue growth. Nobody really knows what the full impact of the carbon tax will be and there is still a strong suspicion that compensation won’t cover the increased power costs.

Finally, a surplus is only the difference between two very large and imprecise numbers (revenue and expenditure) so nobody could possibly be right in forecasting a surplus of $1.5 billion (less than 0.5% of the Budget) with any accuracy.

Confidence is extremely important for an economy. This comes to a large extent from trust in the government as an economic manager; that it has a clear strategy, that it is being honest; and it is doing what’s right, not what’s popular. Trust in politicians, particularly the government, is one commodity Australia has in short supply at the moment.