Various organisations have modelled the likely fees and debts students are likely to face in a deregulated environment since the release of the budget last month. The National Tertiary Education Union (NTEU), the Greens, education minister Christopher Pyne’s office and Universities Australia have all released modelling on likely outcomes.

The Conversation has asked NATSEM to look at the various modelling attempts and how they came about, and do some numbers of our own.

The true extent of university fee increases is not yet known, but we do know the increases are likely to be significant and will mean that for many students the repayments of their HELP loans will be larger and take longer to pay off. Deregulation of fees will have different impacts on students depending on gender and the course of study.

For certain degrees, such as science, there is the potential for the time taken to repay a loan doubling and the total dollars repaid to almost triple.

What have other estimates said?

Immediately following the budget, a number of groups tried to unpack the impacts of the reforms. The response of the government suggested an increase of only “$5 per week” for a graduate.

This analysis assumed no increase in fees for students and that the interest rate charged would be the current Treasury bond rate of 3.8%. The current bond rate is at near-record lows and it is not realistic to assume this low rate will remain for decades to come.

The Greens created an online calculator that tells existing, future, and past students the changes they can expect to their fees and debt. They used calculations on reform impacts to repayment costs by Andrew Norton from the Grattan Institute. These estimates are based on a more realistic assumption of a 4.9% bond rate and assume strong fee increases relating to deregulation.

The NTEU’s analysis is a similar methodology to that of the Greens and finds significant increases in the repayment time and dollar repayment as a result of the reforms.

The main differences from the Greens analysis are the assumed graduate incomes and the extent of fee increases. The NTEU finds the most significant “maximum” impacts for high demand degrees such as business, law, and medicine and other health-related degrees. These maximum impacts will only become a reality if universities lift their degree prices significantly beyond current levels.

NATSEM’s calculations

Under the current fee structure, a new male business student at the University of Canberra would expect to pay off a three year degree in 7.3 years; a female would take 8.6 years.

Assuming the university simply recovered costs from the government’s planned funding reduction the payoff years would increase to 8.2 and 9.7 years respectively. Total repayments increase for males from around A$36,200 to A$45,700 and slightly higher for females ($37,100 to $48,400).

However, business students already pay a larger proportion of the cost of their degrees than many other courses. The payoff times and total repayments are significantly higher for science, nursing and teaching degrees – particularly for females. A female science graduate under a full fee scenario would pay off her degree in 13.9 years, up from 8.4 years. Her total repayments will increase by an estimated $51,500: from $44,200 to $95,700.

We took a similar approach to both the Greens and the NTEU, however we tried to use various fee scenarios, rather than trying to forecast what fees would be. The actual extent of fee increases is at this point unknowable although certainly expected to be significant.

Our modelling has shown that the impact will be felt most strongly for low-pay occupations such as nursing or education, and across the board the impacts are larger for females. The impact may be modest for some degrees with strong post graduate incomes and fees that already match up quite closely to the cost of the degree such as business or law.

We analysed a range of typical courses for the University of Canberra and considered the impact on repayments for students. We assumed that students will face a repayment interest rate of 5% which is around twice that of the CPI (the existing indexation) but lower than the typical 10 year Treasury bond rate (the proposed loan interest rate) of 6% over the past decade.

It is important to recognise that graduates from different fields and males and females have very different income trajectories. For example, we estimated in 2014 a male business graduate at 30 has an average income of around $112,000 per annum compared to $74,300 at 25 years. This compares very favourably to a female nurse who, at 30, earns $57,900 which is less than when she was 25 ($62,100).

An important driver of this difference is that female income trajectories are impacted by motherhood while males enjoy strong growth in incomes through their late twenties, thirties and beyond. Occupations that are dominated by females such as nursing and teaching are also occupations with relatively poor prospects for income growth.

What if unis raise their fees beyond just recovering lost government subsidies?

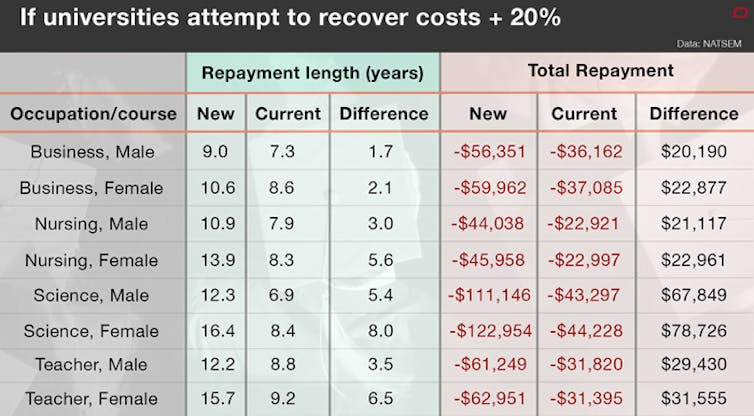

There is the possibility that universities in a deregulated market could increase fees beyond the current funding envelope. We estimated the impact of a price increase of 20% beyond current costs.

Here, the impacts are again strongest for degrees with relatively low income prospects and for females. Female science graduates would be expected to continue paying off their student debt for 16.4 years, up from the current 8.4 years. Her repayments would nearly triple from $44,200 to $123,000 and initial debt would double from $39,700 to $79,700.

These scenarios don’t include single parents who would be in a significantly worse position. With a higher interest rate and potentially several years out of the work force or working part-time (and thus not paying off the debt) it would be highly likely that such persons, particularly for high-fee and lower income occupations could be paying off their degrees for well in excess of 20 years.

In spite of the likelihood of large fee increases and longer repayment times the payoff from university degrees should be expected to remain higher than the costs. The AMP.NATSEM report What Price the Clever Country estimated that the average degree holder receives a dividend in lifetime earnings of around $1.5 million.

The potential wrinkle in the policy relates to degrees with lower income profiles and particularly so for parents (mostly females) who reduce their employment while looking after children. Certain degrees that are relatively high cost, such as science, will likely be impacted heavily if universities attempt to fully recover costs.