Welcome to Some Sports Economics, a six-part video series explaining economic concepts through sport, by La Trobe University senior lecturer, Liam Lenten.

In the fifth part of this series, Liam looks at media broadcast rights in the sports industry and why it faces what is called the “Prisoner’s Dilemma”.

You can watch Liam explain the video.

Or read through the transcript below.

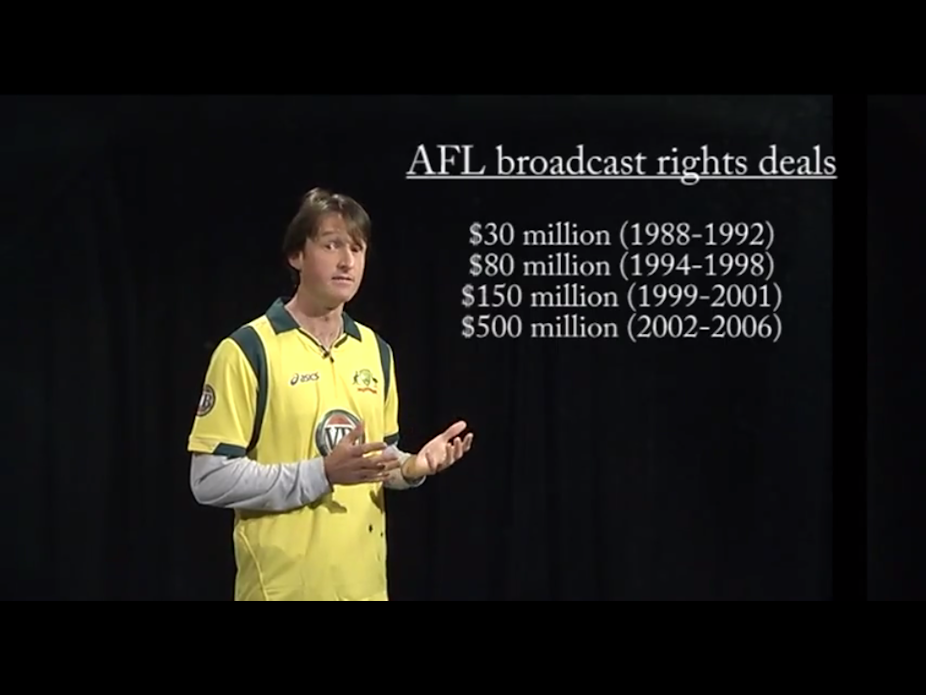

One of the most amazing phenomena in the sports industry over the last generation has been the seemingly unabated ‘rise and rise’ of the value of broadcast rights. Indeed, in 1999 top Sports Economists Rod Fort and James Quirk wrote: ‘It’s a no-brainer…Over the past 20 years, from 1980 on, the most important single factor responsible for the wild explosion in franchise prices and in player and coaching salaries is the huge increase in pro sports’ television income’. And in the last decade or so, we’ve seen more of the same. With reference to the AFL, from 1988, the rights deals increased in successive waves from $30 m to around $80 m to $150 m to $500 m, then to $780 m over the period 2007-11. And just when you think they’ve plateaued, they manage to pull yet another rabbit out of the hat – the most recent rights sold for a staggering $1.253 b, and the experience is similar in the NRL, not to mention many other analogous stories across European football and the North American Major Leagues.

So what causes media networks to bid ever-increasing amounts to secure the rights? Well, they believe these sports will help boost ratings and provide other benefits, but proceed down the chain by a level, and the funds come from advertisers who want to get you to consume their product. In that desire, these advertisers have been willing to throw more and more funds into advertising.

Let’s try to drill down into this aspect, by modelling firms and advertising choice. The ‘worth’ of advertising is related to its marginal revenue product. But what if advertising’s impact falls directly on brand switching (not really on overall consumption increases)? Then, the net result depends not only on how much advertising we do (firm X), but also on how much our rivals do (firm Y). We can write this formally as:

MRPX(AX,AY,Z) = MPX(AX,AY) × MRX(Z)

where: AX,AY = amount of advertising by firms; Z = level of sales of product advertised

Marginal revenue product equals marginal product, which is a function of the amount of advertising by both firms, multiplied by marginal revenue (a function of level of sales of the advertised product), meaning that marginal revenue product is a function of all three variables.

We can use Game Theory – a field of economics somewhat popularised by the portrayal of joint 1994 Nobel Laureate John Nash in the Oscar-winning film, A Beautiful Mind. OK, let’s take a duopoly for a product ‘thingamyjigs’, assume both producers, X and Y, start with $50m each. Consider the following (one-shot) game – both face a simultaneous choice; and $10 m cost of advertising, but if they advertise and the other does not, they succeed in switching $15m worth of consumption from their rival. The full set of payoffs are summarised in the grid, and the initial status quo is the bottom-right cell.

Consider what the best strategy is for Firm X (Lentex): If Firm Y were to increase, we get $40m if we had increased, $35m if we did not. If Firm Y were not to increase, we get $55m if we had increased, but only $50m otherwise. Therefore, the conclusion is Firm X should increase irrespective of Firm Y’s action (it’s called the ‘dominant strategy’). However, using the same reasoning, Firm Y’s dominant strategy is likewise to increase. The upshot – both end up with $40m. Note of course that both would prefer $50m.

This outcome is a concept known as Prisoner’s Dilemma, or perhaps here an advertising dilemma, it’s applicable not only to many scenarios in sport, but also many other phenomena, even an international arms race.

All this spending does neither firm any good, so how to “escape” the ‘dilemma’? Well, you can’t collude with the other firm (that’s illegal in most developed industrialised nations), so without outside intervention, your only hope is to come to some kind of tacit understanding not to advertise, at least at the same time – that is, if it’s a repeated game, (let’s say advertising for the AFL Grand Final, which is every year), each firm might just be able to work out over time what the other is going to do.

With outside intervention, however, it’s easy – if we take the government-imposed ban on tobacco advertising on television in the 1970s, firms no longer had to worry about preserving sales in the face of rival advertising, and subsequently profits skyrocketed (albeit temporarily).

In summary: one thing for certain is that media rights are here to stay, and probably to rise even further still.

Watch previous videos from Some Sports Economics:

When scoring an own-goal is the only way to win (VIDEO)

Full versus half-full stadiums in maximising profits (VIDEO)

The economics behind inelastic ticket pricing (VIDEO)

The economics of comparative advantage and Usain Bolt (VIDEO)