Debates over the call for a royal commission into the banking industry have brought to the fore the real battle in Australian politics – and it’s not about partisan rivalry.

At stake is whether Australia is committed to being a democracy ruled by the people as represented by government, or a corporatocracy where government is the political arm of big business.

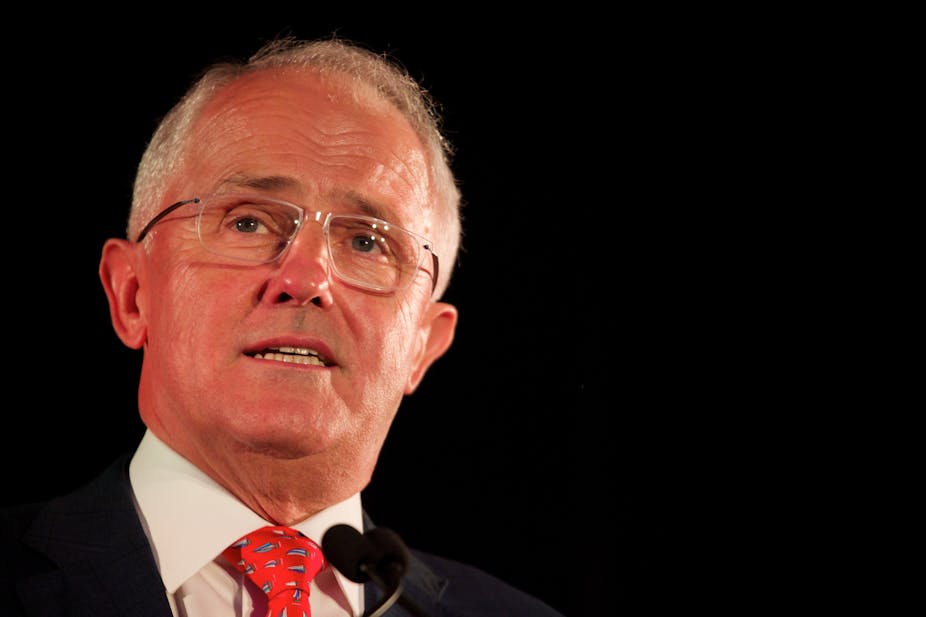

When Tony “open for business” Abbott was running the show it was about the state kowtowing to the market. Remarkably, his successor as prime minister, Malcolm Turnbull, has moved to a whole new level. Businesses and political interests are now being treated as one and the same. Democracy is at stake.

Smoke and fire

Australia has suffered a raft of scandals at the hands of its major banks. Headline news is dominated by stories of blatant insurance fraud, high-level rate fixing, and dodgy financial planning. When it’s not downright criminal it is conscience-free profiteering

ANZ boss Shayne Elliot fears that a royal commission will spook international investors; that they will think that “where there is smoke there is fire”. Given the overwhelming evidence that fires have been raging out of control in the banking sector, such a response beggars belief.

Westpac chimed in with its view that a royal commission could “impact confidence in the economy”. There is a warped logic at play. Why should we avoid holding corporations to account for clear evidence of wrongdoing? Because it’s bad for business.

Banking on culture

The scandals reflect a culture in banking and finance that runs on greed and is backed up by blatant disregard for any form of public responsibility.

Commonwealth Bank chief executive Ian Narev promises that all will be well because he and his managers are determined to build a culture:

… with the customer at the centre of what we do.

ANZ sings from the same songsheet with its explicit commitment to “culture, ethics and fairness”.

The scandals that have prompted calls for a royal commission tell us something completely different. Despite the fairytale corporate cultures claimed by the banks, the real cultures are ones that value transferring as much wealth as possible from the customer’s pockets into their own.

While Opposition Leader Bill Shorten may have committed to a royal commission if his party is elected, this debate is not driven by left-wing bank-bashing. The call has been backed by Industry Super Australia and by MPs across the political spectrum. Shorten’s announcement was also preceded by the Australian Shareholders’ Association’s demands for the insurance industry to be put under the same scrutiny.

Turnbull and the bankers

When it comes to the mooted royal commission, Turnbull – a former banker himself – downplays the problem. For him the scandals do not amount to a fundamental crisis in the system, just a few “troubling incidents” that can be tackled in the existing order.

This echoes the banks’ own responses. They adamantly claim that a business-as-usual approach is the best and that additional scrutiny is unnecessary. NAB boss Andrew Thorburn has condemned the debate as a “serious distraction” from his bank’s commitment to “help their customers”.

What unites Turnbull and the bankers is not just about side-stepping public scrutiny. It is about the fundamental political role of the Australian people. Narev might claim a deep commitment to Commonwealth Bank “being an ethical business”, but he only does so because:

… satisfied customers are good for shareholders as well.

Some may say Turnbull gave the banks a dressing down when he spoke at Westpac’s 199th birthday lunch recently, but only because they didn’t “put their customers’ interests first”. Ultimately he put his faith in the bank bosses’ ability to instil the ethical standards required.

Customers or citizens?

The politics that Turnbull and the bank chiefs support is one where people are robbed of citizenship. We are reduced to being economic functionaries in a world ruled by corporations. This is a world where vacuous corporate claims to self-governance through ethics and culture replace public accountability.

Turnbull has committed to fighting the upcoming election on what he defines as a single issue:

… whether we complete our transition to the new economy or we allow Labor to kill off that opportunity.

In pursuing this, Turnbull joins the banks in championing a politics that is entirely subservient to economic imperatives.

No talk here of justice, freedom, equality, participation or representation for the nation’s citizens. The only thing we are told to care about is delivering “our children and grandchildren the great jobs they deserve”.

No-one can deny that jobs are important. But rendering them as the only serious political issue defies democracy.

Beyond the royal commission

Turnbull’s political imagination is limited in that it construes people only as being defined in terms of markets. No more citizens, just customers in a consumer market, workers in a labour market, and investors in a financial market. The ultimate beneficiaries? The corporations who want to rule the world.

Time will tell if a royal commission into banking eventuates. Regardless, if the current trend continues we will keep suffering scandal after scandal. But the debate raging over the past week speaks to a much more significant challenge for Australian politics.

The question we need to ask is not just whether we need a royal commission, but whether or not it is too late to turn the tide of corporate rule.