The era of passive shareholding where investors patiently waited for companies to offer dividends (or simply sold their shares and moved on) is gone forever.

Shareholdings are no longer largely distributed among millions of small investors. Individual shareholdings have declined dramatically in all western economies, replaced by large institutional holdings of superannuation funds, insurance companies, and other mutual investment funds.

The institutions are often compelled to invest in all large listed corporations to balance their portfolios. The prospect of “doing the Wall St walk” and abandoning what appear to be poorly performing companies is no longer viable, as this would ultimately lead to an unbalanced portfolio.

And institutional investors have become increasingly sophisticated in determining the investment criteria they are looking for in the companies they invest in. They have become more active in engaging with companies to ensure these criteria are pursued.

Engagement between companies and institutional investors normally involves regular meetings, where issues can be explored. Market sensitive information must be released to the whole market before any such discussions, but there are always nuances to be examined.

If companies are not responsive to institutional concerns, then a final resort is the AGM resolution. This is often a virtuous form of shareholder activism – looking for positive long term strategies for sustainable wealth generation by responsible companies.

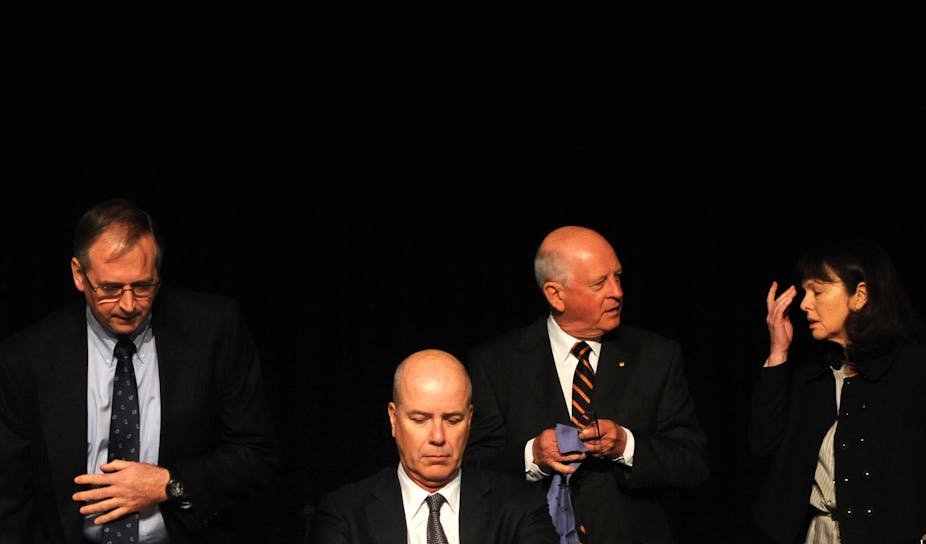

While there has been the occasional row between angry institutions and unresponsive CEOs and boards, the question of CEO pay has provoked more brutal confrontations, with a notable stoush at Telstra when Sol Trujillo was CEO.

The gloves really came off once the legislation allowing a “say over the pay” of senior executives and directors was introduced. It allowed for a two strikes rule: if 25% of shareholders vote against the remuneration report in two consecutive years, the entire board needs to stand for re-election.

Over 100 companies received a strike against their remuneration report in 2011 and 2012. For 22 companies, including Fairfax, Lend Lease and Cochlear, 2012 was their second strike.

Usually boards have listened to the concerns of shareholders rather than risk a bad spill. And in most cases, the majority of shareholders will simply re-elect the boards in question.

But this year there may be some unanticipated changes in the boards of Australian companies.

It is important to realise that the fury of shareholders over the rapid inflation of executive pay unrelated to company performance is based not on simply annoyance at excessive and unmerited rewards, but the realisation that this is a strong indication of a company out of control.

In these companies executive remuneration has become the main focus, rather than business success and wealth generated for all shareholders and stakeholders. Investors are no longer tolerant of “Emperor CEOs”, particularly when they don’t deliver for anyone but themselves.

But there is another type of activism which is just as reprehensible as self-interested CEOs: self-interested shareholder activism.

While this has always existed at the margins, there are increasing signs of the growing self-confidence and ambitions of activist hedge funds, predatory private equity, and other rogue investors who appear determinedly taking significant stakes in companies, bent on stripping their cash and other resources, leaving them vulnerable to break-up or takeover.

This phenomena has proved recurrent in the US market beginning with the junk-bond fuelled take-overs in the 1980s, and the more recent aggressive interventions of Carl Icahn, Daniel Loeb, Kirk Kerkorian and other corporate raiders.

These financiers are convinced they know more about any company they invest in than the executive management of the company concerned. They think that financial engineering such as share buy-backs, increased dividends, and asset disposal will miraculously transform the company, when it is their fortunes that are transformed by these techniques, not the company’s.

Eviscerating the financial resources of companies in this way has, for instance, systematically weakened the manufacturing sector of corporate America.

This venal form of shareholder activism adopts the clarion call of “shareholder value”, “shareholder primacy”, and sometimes “corporate governance” to justify a narrow pursuit of naked self-interest.

This is irresponsibility writ large, and the boards of companies are fully justified in mounting a robust defence against such practices.

Companies are faced therefore with raiders, traders and investors among their shareholders, and distinguishing who is who is a continuous source of concern for executives and directors.

While most companies would like in principle to be closer to their shareholder base, how can you be close to someone who simply wants to strip out your cash and other liquid assets as fast as possible?

Australian business does not need Emperor CEOs, nor predatory activist investors. What is required are executives and boards prepared to engage in a mature dialogue with their shareholders in a balanced and responsive manner. And shareholders committed to the long term future of sustainable corporations capable of generating wealth, not only for themselves, but for all stakeholders.

This is the fourth piece in our series on the 2013 AGM season. Click the links below to read the others.

Mixed result on sustainability reporting, but ASX proposes greater disclosure

The myth of merit and unconscious bias

Executive pay pain won’t go away

Stand by your woman: shareholders should demand more balanced boards