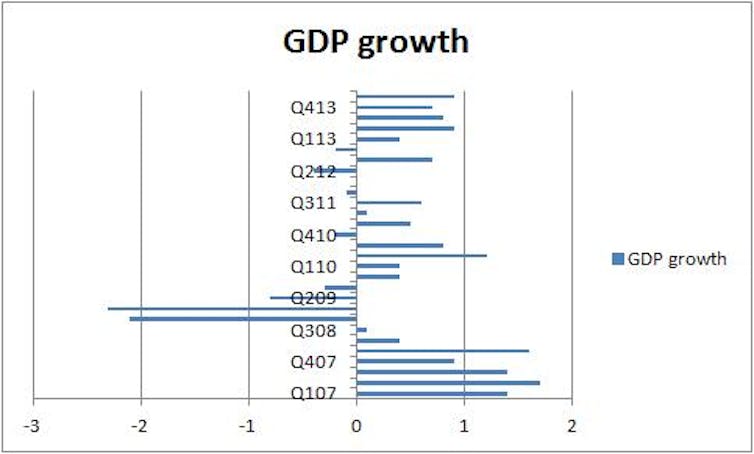

After all those years of flat-line economic performance in the UK economy and declining real incomes, we’ve seen quite a turn around. The growth rate is now one of the best in Europe, house prices are rising and there are signs of wages starting to recover.

Conclusion: the austerity programme may have hurt, but it worked. The gain was worth the pain. The siren voices calling for Keynesian borrowing and spending during the tough years have been proved wrong. We have been saved from a spending spree that would have saddled us with long-term debt.

This is the prevailing narrative from the right. If the recovery can be sustained in the run-up to the next election, it will be hugely helpful to the Tories. It reinforces the claim that they have a degree of economic credibility that Labour has lost. In the context of all the recent Labour anxiety that Ed Miliband does not look like a winner, the fact that he is less trusted on the economy than David Cameron underlines the damage that this narrative has done.

Grotesque caricature

You’d expect this story to be attractive to Cameron and George Osborne. But in a way, it’s also a convenient story for the left. It suits their grotesque caricature of a hard and uncaring regime that doesn’t understand the pain felt by the many; a useful counterpoint by which to make a comparison. “We would have done it differently,” they say. “Cut a bit less hard, prioritised spending on the vulnerable, and recovered faster.”

But has there really been a period of austerity? And is it the reason for the economic recovery? We were told that the point of the austerity measures was to reduce the national debt. If we could live within our means by spending no more than we receive in tax revenue and running a so-called balanced budget, we wouldn’t add to the nation’s debt. And if we could run a budget surplus – spend less than we receive in taxes – then we could even start to pay off that debt.

It is worth remembering that none of this has been achieved. In every year of the coalition government, spending has exceeded tax revenue. It is true that the deficit is getting smaller, down from its peak of £171bn in 2009/10 to a forecast £95bn in 2014/15. But the coalition pledged that it would be zero by the 2015 election and is now saying that it will not even have half-accomplished this task by that time. And each year’s budget deficit has added further to the national debt. Of course, there have been cuts and very tight spending rounds across departments, but these have been from a very high base in the pre-crisis period.

The income picture

But what does this mean for the individual? After all, our happiness today doesn’t depend on the size of the national debt. What matters for our well-being is our income: how much we have to work, and what we can spend it on.

UK real income per head today is roughly equivalent to its level in early 2007. So the purchasing power of our income is equivalent to that in the latter days of Tony Blair’s premiership. Of course, had the economy continued to grow at the same rate as it did pre-crisis, income per head would undoubtedly have been higher today. Some consequently argue that during the recession the economy “lost” income. But just because we could have been richer doesn’t negate the 2007 comparison. Were we that destitute in those heady days just before the financial crash?

To answer this in any meaningful way, you also have to consider whether income distribution has changed over this period. Has austerity hit the poor more than the rich? Again data reveals that, though income inequality rose sharply through the 1980s and then more gradually for most of the following two decades, it has actually fallen during the recession.

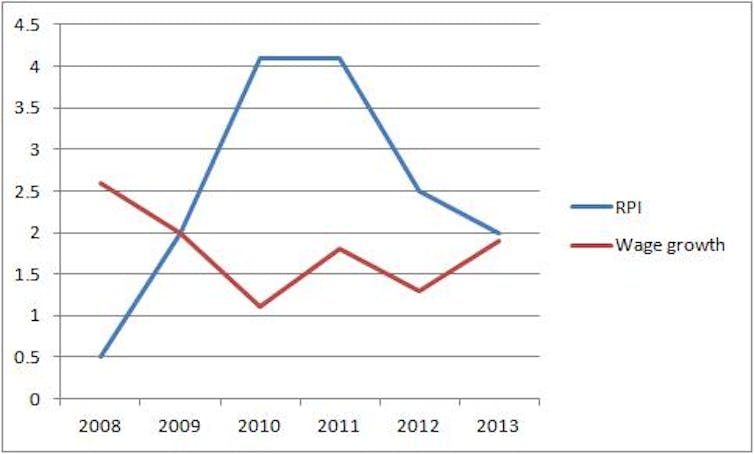

This may be because real wages have been eroded during a period where the rate of inflation has outstripped the rate of wage increases, whereas benefits are protected by a degree of index-linking. Of course, as wage settlements start to exceed inflation and the effect of benefit cuts start to bite, this reduction in inequality may not endure.

Why the upturn?

Our second question is whether the recent economic upturn is due to the austerity measures we’ve endured. Or is it a happy coincidence of falling energy prices, cheap loans and stimulants to the housing market?

Are we repeating the mistakes of the past – a recovery led by the housing market, generated by supply constraints, fuelled by cheap borrowing, and aided and abetted by the Help to Buy scheme? How vulnerable is this to rises in interest rates – quite possibly and for some, unhelpfully, before the next election?

It’s often thought to be a no-brainer that cutting the government deficit reduces the national debt. This is the logic espoused by the coalition. But even if you could achieve this, the logic doesn’t hold.

Cutting spending reduces demand, particularly by the poor, who tend to spend a larger proportion of their income. This adversely affects GDP and employment. This in turn reduces tax revenues, worsening the deficit. If spending is cut further to try and control the deficit, then a downward spiral results.

In fact, there is an inverse relationship between government deficit and the national debt. Cutting the deficit will increase the national debt in years to come. This is borne out in the data over the past 130 years or so for the UK and many other countries. The conclusion is that government investment has a key role in stimulating demand and hence reducing the national debt.

This may explain why, despite the tough talk, the UK government has still run the deficit throughout the post-recession period. Perhaps Nick Clegg was partly to thank for this closet Keynesianism, perhaps reining back the natural tendencies of a Tory administration to cut further and faster, and narrowing the distance to Ed Balls’ calls to cut less and slower.

The bottom line is that there has been a lot less austerity than we might have been led to believe, and austerity is unlikely to have been responsible for the first signs of recovery we see now. Arguably the fact that government spending was not cut as aggressively as some would have liked has actually allowed the recovery to begin.

All the same, it is still too weak and unimpressive to be worth shouting about; and possibly fuelled by unsustainable stimulus to the housing market. With benefit cuts and interest rate rises likely to have an impact down the line, then even this recovery may be in jeopardy before long. Whether it is in time to help Labour at next year’s election is in the lap of the gods.