The world of financial trading remains something of a mystery to the average person. Every day, stocks are traded at a frenzied rate and decisions are made that have wide reaching repercussions for us all. While most of us can never hope to understand the complexities of trade in financial terms, the rise of social media offers us a new understanding of the human impulses that, in part, drive stock transactions.

The news agenda in the world outside banking can make traders collectively rush in or out of specific stocks. There is a positive feedback where activity generates further activity and stocks change hands more frequently than usual. More recently, it has become clear that events in society can also generate a surge of activity on Twitter. Our research shows that, surprisingly, the activity levels in both cases share similar statistical properties.

Activity levels on the stock market and on Twitter are typically intermittent. Long periods of low activity are interrupted by sudden bursts of high activity in both worlds. Twitter rumbles along every day but sometimes, an event will occur that will encourage people to tweet and activity bursts. This is a kind of horde behaviour that reflects a strong tendency for alignment in human behaviour.

The days when the people who most affected our decisions were to be found in our local communities are long gone. Tweeting happens on a global scale and social networks offer a virtual neighbourhood within which otherwise unrelated people share their interests. The crucial difference between the old-world order and this new way of spreading information is that it is out in the open for anyone to see.

One way to analyse the user activity on Twitter is to measure the frequency by which certain words are mentioned. These words might be chosen to have a global appeal. Here the analysis took into account how frequently approximately 100 international brands, such as Apple, IBM, Pepsi, Starbucks or Toyota occurred in messages posted on Twitter. For each of these brand names, the occurrence rate in tweets is characterised by days of steady levels, which are interrupted by spikes of high activity levels.

When a company launches a new product, there will soon be a number of people tweeting about having tried that product. These tweets in turn encourage others to share their experiences of the product. This creates a sort of global awareness of the product – an awareness that can now be quantified. In fact, an analysis of activity levels shows that this awareness, quantified by increased activity levels on Twitter after a product event, has a typical persistence of about 24 hours, after which it fades away. This persistence, or memory effect, is observed both on social media and in financial markets. It is a consequence of the similar statistical behaviour of the activity levels in both contexts.

Activity levels on Twitter and trading volumes in a financial security follow the same power-law probability distribution. That is, the levels or volumes fluctuate between a broad range of values spanning several orders of magnitude. This means that the fluctuations in the activity levels can become exceedingly large and can involve a disproportionate number of users or traders.

The same class of statistical distribution can be observed in many phenomena in nature. On the road, for example, small variations in car density on heavy traffic freeways can lead to enormous fluctuations in the traffic current. The common statistical properties of tweeting activity levels and trading volumes in financial securities can be described in the framework of a simple stochastic point process model. When people suddenly start relating to something (a given security or given product), other people also start relating to it. The fact that someone has already related to something activates other people.

There are of course many subtleties that cannot be captured by a simple point process model, but it may still tell us something about human behaviour. The underlying processes behind the decision-making of market participants and Twitter might be quite similar.

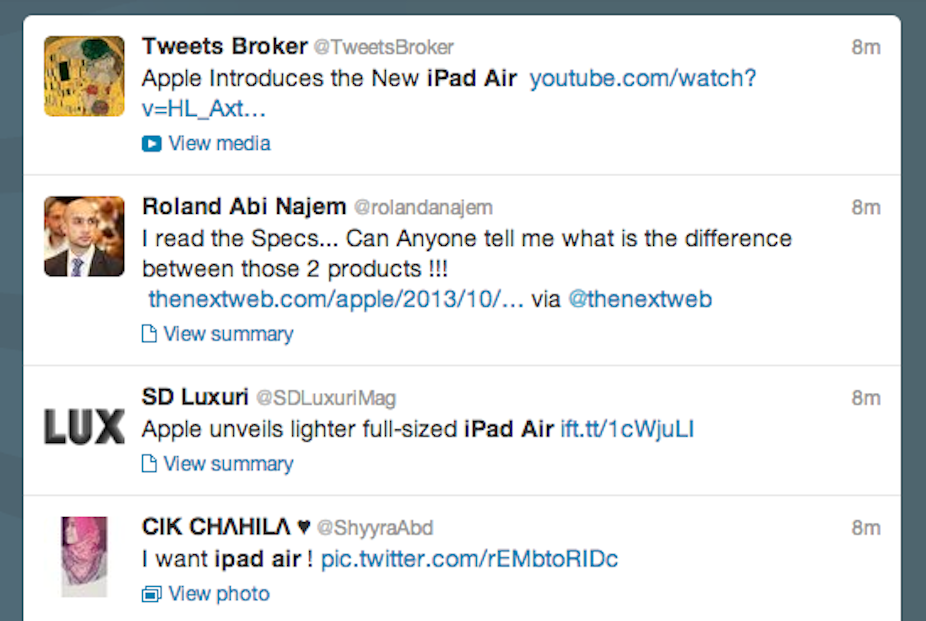

When we look at Twitter after a new product has been launched it can seem like the importance of that product has been blown out of proportion. Take the new iPad announcement of this week for example. Thousands upon thousands of users were keen to respond to the product while others saw that it was “the thing to be talking about” and added their views, feeding off the trending topic. This has happened in trade for years but it has always remained something of a closed world. In the open-to-all age of social media, we gain new insight into the human traits that contribute to “trending”, which, in turn, gives us food for thought about the way financial markets that have such an important effect on all our lives operate.