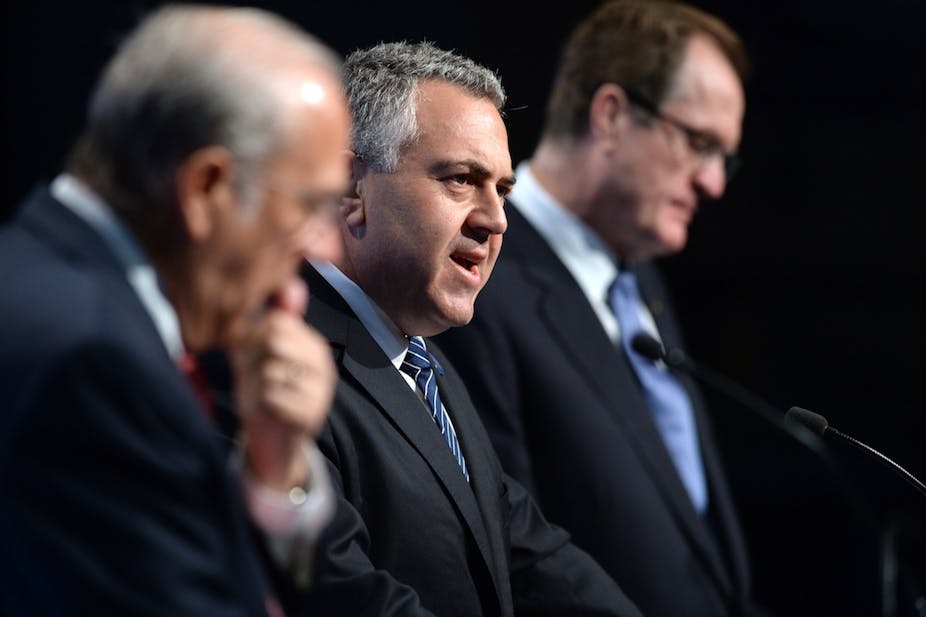

Despite Treasurer Joe Hockey’s continued statements that the government is doing “everything we can … to ensure that companies that earn profits in Australia pay tax in Australia”, the federal government has offered no effective policy response to reduce corporate tax avoidance.

The result of this can be seen in this week’s report commissioned by the Tax Justice Network and United Voice. The report found a third of ASX200 companies have an effective tax rate of less than 10%.

Some of this can be explained by the use of previous tax losses that have been carried forward. However, the use of abnormal items by some companies appears to be timed to create tax losses that then produce a future tax benefit. The report states:

If the largest Australian listed companies paid taxes at the statutory corporate tax rate of 30%, it would produce an additional A$8.4 billion in annual revenues.

Action to date

Prime Minister Tony Abbott initially declared that measures to reduce tax avoidance would be at the top of the agenda for the G20 events taking place in Australia this year. More importantly, Australia would take the lead on the issue.

In reality, the government has sent mixed messages leading up to the November G20 leaders’ meeting in Brisbane. For a time after the prime minister’s speech, the Abbott government rarely discussed tax avoidance.

Only recently, during the G20 meeting in Cairns, has the Treasurer picked up the pace. He made a significant announcement that Australia will be a part of an information-sharing treaty between more than 40 countries, albeit with at least a one-year delay in implementation.

Despite that announcement, it would be fair to say that no plans exist for any inquiry into corporate tax avoidance within Australia, let alone a specific legislative agenda to rein in tax avoidance by the ASX200 companies.

What’s required

Reducing corporate tax avoidance is not a trivial exercise and would require commitment by the government on three fronts.

The most critical aspect of reducing corporate tax avoidance is regulatory resources. The ATO needs the necessary resources to recruit experienced staff in numbers to monitor and audit Australian companies.

Unfortunately, government policy has been the exact opposite. Thousands of experienced staff have been made redundant as part of the government drive to reduce the public service.

As a result, it’s questionable if the ATO has the resources to, 1) monitor and audit companies at risk, 2) advise government on policy issues and, more importantly, 3) litigate major cases.

At one point, there was even the suggestion that in order to reduce ATO costs, the corporate tax audit function could be outsourced to the accounting firms. Many of them are responsible for creating these tax avoidance schemes and marketing them to companies in the first place.

Information sharing between tax authorities in different countries will reduce the ATO’s workload, but that will not start for at least four years due to Australia’s decision to delay implementation of the treaty discussed above.

Next, in Australia companies do not have to report, by jurisdiction, where profits are generated or where tax is paid. This makes it difficult for the public at large and the ATO to establish exactly how much revenue is earned and tax paid by Australian companies with overseas operations, in Australia and other jurisdictions.

Having access to such information would help the ATO in assessing tax risk. More importantly, in providing the public with definitive data on tax avoidance, it should deter companies from aggressive tax strategies for fear of damaging their reputation.

This issue is high on the agenda for the G20 leaders meeting in Brisbane and has been recommended by the recent OECD report into tax avoidance. Unfortunately, no concrete proposals are on the table at this stage in Australia and internationally.

The final factor that can also reduce corporate tax avoidance is to tighten existing tax legislation and/or create new legislation. The main areas that have been exploited to reduce tax liabilities have been profit-shifting through transfer pricing, thin capitalisation and debt loading.

Legislative measures to combat these threats have only been partially effective. As Mark Zirnsak from Australia’s Tax Justice Network stated in response to recent changes to the thin capitalisation rules, these “changes are worth a small celebration, but the problem of artificial debt loading will only suffer a small dint as a result of these changes and will remain a significant means of tax dodging in Australia”.

A further issue is the use of stapled securities in combination with Real Estate Investment Trusts. This allows entities to have the protections of a corporate structure but the taxation benefits of a trust. This is achieved through capital gains being in the hands of individual investors who can gain the benefit of the 50% CGT discount not available to companies.

Any new legislation would have to be part of a coordinated, international effort, as corporations take advantage of arbitrage between tax jurisdictions to artificially create entities that exist in low-tax jurisdictions or, in some cases, no-tax jurisdictions. Tax treaties need to be re-negotiated as corporations are using existing treaties to have income classified as exempt from both tax jurisdictions.