Apple, famous for its innovative products, is equally creative in its tax structure.

From 2009 to 2012, it successfully sheltered US$44 billion from being taxed anywhere in the world, including sales generated in Australia.

While there are probably some sound reasons for Apple’s CEO, Tim Cook, to claim in a US congressional hearing in May 2013 that his company “complies fully with both the laws and spirit of the laws”, many people may think it is immoral for such a successful company to avoid taxation.

But the company shouldn’t be alone in the being blamed for the low tax it pays around the world.

Concerted government action, including specific provisions inserted into US tax laws in 1997, have made it possible for multinationals with complex structures to funnel profits between the gaps of tax authorities.

And it is unlikely to be a coincidence that Irish tax law has been crafted to allow companies incorporated in Ireland to take full advantage of these gaps in the US.

Mapping the reach of Apple’s iTax scheme and the rules it uses to hide profits is difficult, if not impossible, to discern from its financial statements.

My research on this topic would have been impossible but for information revealed in the US Senate hearing in May last year.

Indulging Apple

The tax structure of Apple is designed to ensure that little income is left to be taxed in non-US markets like Australia.

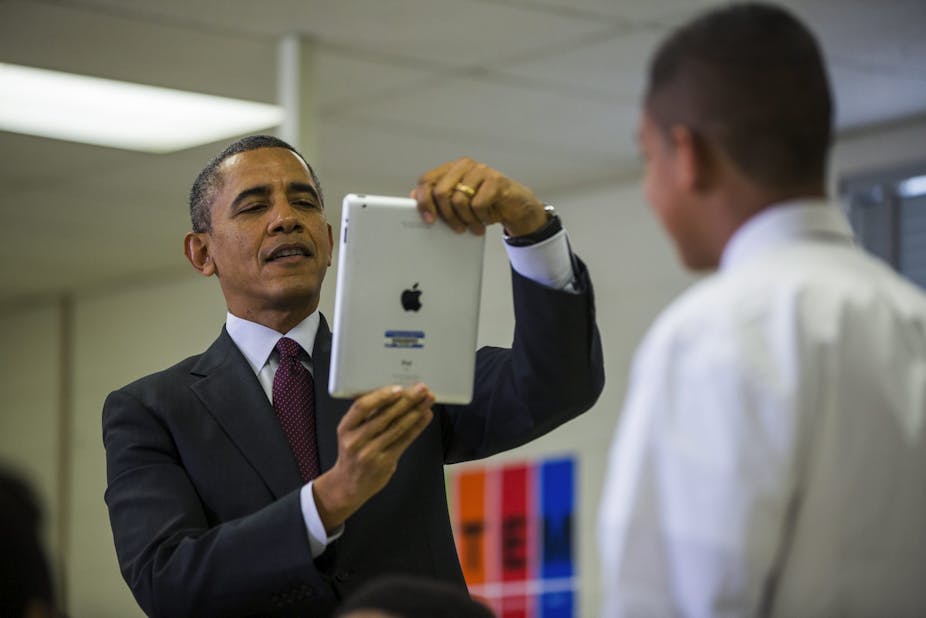

For example, when a customer buys an iPad in Australia for A$600, the sale is recorded as a revenue of Apple’s distribution subsidiary incorporated in Australia.

But this company “purchases” the iPad from another Apple subsidiary incorporated in Ireland for A$550.

The Irish subsidiary is basically a shell company with no employees and no factory. The iPad was manufactured through third party contract manufacturers in China, who shipped it directly to Australia.

Hearings on both sides of the Atlantic have revealed that by effectively disabling one of its major anti-avoidance weapons in its tax law – namely the controlled foreign corporation regime – the US government has been knowingly facilitating the avoidance of foreign income tax by its multinationals.

Originally, under the US anti-avoidance regime called “subpart F”, the kinds of payments made to the Irish shell company by the Australian company would have been considered the income of the US parent.

But changes made in 1997 meant Apple was able to elect to deem the Irish company to have “disappeared” for US tax purposes, thus escaping from the US tax net.

Apple’s tax structure not only takes advantage of gaps and loopholes in tax laws around the world, but also highlights the key role that politics can play in shaping these tax policies.

The US government’s indulgent attitude towards the tax avoidance of its multinational firms’ is all done in the name of “promoting competitiveness” of national champions, including hugely successful companies like Apple.

Ireland also plays a key role in the avoidance structure. It provides the perfect complementary tax provisions to the US, allowing firms to create tax-free income. This has successfully attracted Apple, among others, to incorporate subsidiaries in the country.

A reading of US tax history suggests that the US government is unlikely to strengthen its tax laws any time soon. The corporate lobby in the US is too powerful for Congress to ignore.

Sympathy for the authorities

So what can other countries like Australia do to protect their tax bases?

This is a difficult and complex issue requiring international consensus to reform the current cross-border tax rules. The OECD has already embarked on an ambitious project targeting “base erosion profit shifting” by these firms.

But given the divergent political agenda of the G20 countries involved in the project, it’s difficult to predict an outcome.

Regardless of what progress is made by the G20, countries like Australia should consider implementing a properly designed country-by-country reporting regime.

Under the regime, a multinational would have to disclose essential tax information – like turnover and profits, tax payments and the number of employees – separately for each country where it operates.

At present, tax authorities around the world often suffer from information asymmetry.

While multinationals operate as one single enterprise, it is a challenge for tax authorities to obtain relevant information about these firms’ tax affairs in order to identify targets for further investigations and audits.

It is easy to sympathise with tax authorities who find it challenging to obtain even the most basic information, like the group structures of these multinationals.

If a country-by-country reporting requirement had been in place, tax authorities would have been alerted to the extremely low effective tax rate paid by Apple in Ireland much earlier and could have taken appropriate actions promptly.

Besides this “identify-the-target” function, the country-by-country reporting system has another more important function: the deterrent effect.

If a multinational knows there is a disclosure requirement for detailed country-by-country information, it may have less incentive to pursue aggressive tax avoidance schemes.

The potential tax benefit may be outweighed by the increased risk, not only of tax investigations and audits, but also of possibly damaging its reputation.

Apple might have thought twice before implementing its iTax structure if it had known that country-by-country reporting could disclose its dark side to the public.

This article is drawn from research, authored by Dr Ting, to be published in a forthcoming issue of the British Tax Review.