Journalism is in an existential crisis: revenue to news organisations has fallen off a cliff over the past two decades and no clear business model is emerging to sustain news in the digital era.

Some of the big news organisations are imposing paywalls on their websites, while others believe in free access to their content. In the latest in our series on business models for the news media, Tom Fell weighs up the pros and cons of paywalls.

There was a time, not so long ago, when newspaper presses may as well have been printing money. A combination of hefty advertising revenues and circulation growth saw huge profits flow into the coffers of owners and shareholders. But those days are long gone. The announcement that the UK’s Independent titles are to cease printing in March came as a surprise, but many with an eye on the newspaper industry had mused that it was not a question of if, but when, the Independent would go. Circulation had dropped to around 56,000 copies daily and print advertising rates remained in long-term decline.

The problem for newspapers – and their owners – is not that news has suddenly become unfashionable, it’s that making money out of news is proving increasingly difficult. The reasons for the collapse in profits are simple: for more than 100 years newspapers controlled the news and advertising markets, but digital technology has changed everything. Staples such as classified advertising, property and cars went quickly online. Newspapers were too slow to react to classified sites such as CraigsList and Gumtree – and lost the market.

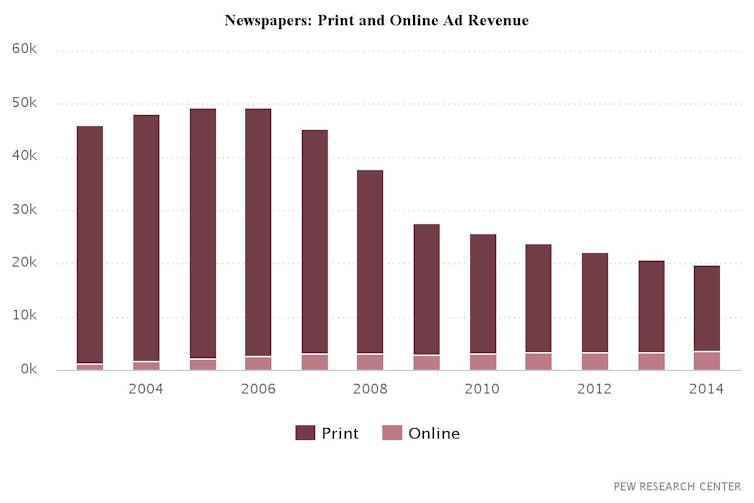

At the same time titles have haemorrhaged circulation as news, once a prized commodity, is now freely available on a diversity of sites. Legacy news organisations initially gave everything away for free online, naively assuming their brands were invincible and that digital advertising would simply replace print loses. However digital revenues have proved elusive, and while online revenues are growing, the growth is nowhere near enough to offset the decline in print advertising and circulation.

Since the mid 2000s US and UK newspapers have lost close to 50% in circulation with few exceptions. Specialist titles, Sunday papers and broadsheets have fared slightly less badly than tabloids, but there is no good news for anyone in newsprint. While there are some examples, such as in Germany and Holland, where print circulation has held up relatively well, most titles are at best managing decline.

Paying for quality

Paywalls, introduced by a number of news companies in recent years in an effort to both put a value on the exclusive content they produced and to try to replace lost newspaper circulation, have worked to varying degrees.

In the US, big brands such as The New York Times and The Washington Post have both struggled with how to monetise editorial content online, however both have now implemented somewhat successful paywall models. The Washington Post introduced its somewhat porous paywall in 2013 after struggling digitally for a number of years.

A similar approach is in operation at The New York Times, though it has had more successes digitally in attracting paying subscribers and in converting print readers to sign up to seven-day delivery and online subscriptions. It now has more than a million digital subscribers.

News UK introduced a paywall for its news brands, including The Times and The Sunday Times in 2010, with The Sun following in 2013. While the strategy has been successful with 170,000 Times subscribers, the company abandoned The Sun’s paywall late in 2015, and announced plans to aggressively grow its digital platform in 2016.

Of all media organisations with paywall or metered models, the Financial Times remains one of the most successful. Of a paid circulation of 720,000 in 2014, more than 500,000 were digital, up 20% on 2013. Half year figures for 2015 showed a year-on-year rise to 737,000 total circulation, with 520,000 digital subscribers.

The German media giant, Axel Springer, announced it was considering introducing paywalls at its Upday app and newly acquired Business Insider last December. It has already introduced a metered paywall at popular Berlin daily Bild and banned readers with adblockers installed on their PCs from accessing its content.

Australian media giant News Corp Australia – which owns The Australian, the Sydney based Daily Telegraph and most of the main regional titles – put its content behind a paywall in 2013. Fairfax, which owns the Sydney Morning Herald and The Age, also introduced paywalls in 2013 – and subscriber numbers are steady while print circulation is falling off.

Dead giveaways

But while media companies are still making significant revenues from print, any revenue from digital, while impressive in growth terms, remains tiny. Digital revenues at The Sydney Morning Herald in 2014 were A$15m, compared with A$242m from print circulation and print advertising. Figures for 2015 from the Times Co (The New York Times parent company) show that digital subscriptions were responsible for just under US$49m of US$365m in revenue during the third quarter of 2015.

And not everyone has made a success of paywalls. Mid-market popular newspapers and tabloids, where a heady mix of “gotcha” journalism, crime stories, and celebrity and entertainment news have proved a recipe for huge popular success in the UK, have in most part steered away from paywalls – favouring instead high-volume mass market free content, with a heavy emphasis on content that plays well on social media.

The Daily Mail’s MailOnline site remains free, and is one of the largest news sites in the world, with a global reach or more than 200m unique users each month.

Other sites, including the UK’s Guardian, have remained free, relying instead on revenue from digital advertising. However the rise of adblockers has severely damaged the ability of such news sites to make money from advertising. The Guardian reported losses of £53m in 2015 and announced it would cut costs by 20%, blaming a sharp decline in print advertising and slower than expected growth in digital revenues.

For smaller players, the market remains challenging. Regional and local newspapers have little or no prospect of introducing successful paywall models. Economies of scale mean their potential audiences are too small to monetise via digital advertising. For now, most are clinging to their print editions (which remain profitable) and using websites to build brands and market share.

ABC1 readership newspapers – in other words, those appealing to the middle classes – and niche brands such as business titles, where content is exclusive and in demand, seem to be making paywalls work. For everyone else the future looks bleak.