It has become a common complaint among some Labour supporters that Keir Starmer and shadow chancellor Rachel Reeves are being too cautious about their spending commitments in preparing for a future Labour government. At a recent national policy forum, the leadership clashed with the party’s left, which argued against “fiscal conservativism”. Starmer’s reply was that he doesn’t mind being described in these terms.

At the forum, a majority of the participants were on his side in rejecting proposals for “unfunded” spending commitments made by the Unite union. Unite’s position on spending was not shared by other trade unions, notably the GMB, which supported Starmer’s economic strategy.

There is a logic to the criticism levelled at Starmer. If the party does not separate itself from the Conservatives’ austerity policies, then it could falter in the election campaign next year. If potential Labour supporters are not enthused by an alternative vision for the future, they may not vote at all.

However, those opposed to Labour’s economic plans, would be well advised to listen to the comment made by James Carville, Bill Clinton’s chief political strategist. He said: “I used to think that if there was reincarnation, I wanted to come back as the President or the Pope or as a .400 baseball hitter. But now I would want to come back as the bond market. You can intimidate everybody.”

Carville recognised that any politician who loses the confidence of influential financial players soon finds themselves in trouble. For example, one need only look at the financial crash which occurred following former prime minister Liz Truss’s ill-advised budget proposals.

Financial markets reacted very badly to her unfunded proposals for tax cuts and this affected interest rates and the costs of mortgages. The markets were powerful enough to trigger her resignation.

Who are Britain’s financial players?

For a potential Labour prime minister, there is even more to worry about, as can be seen using data from two sources.

The first is a detailed classification scheme of occupations originally created by the International Labour Organization – the International Standard Classification of Occupations. This includes more than 350 different occupations from “legislators and senior officials” to “doorkeepers and watchpersons”.

Among these are people who work as managers, traders and investment advisers in the finance industry. They are the financial decision-makers in Britain. They give advice on loans, mortgages and finances to the public. Those who work in banks make decisions about who can have a credit card and, as the recent row about Nigel Farage’s bank account shows, they even decide who can have a bank account.

The second source is the European Social Survey, a cross-national collaboration of researchers examining the political and social attitudes and behaviour of Europeans over a period of more than 20 years. Conveniently, it contains questions needed to identify occupations in the ILO scheme.

We can look at the voting records of individuals working as financial decision-makers in Britain. The country has participated in all ten survey rounds over the last 20 years.

So if we bundle these together there are close to 21,000 respondents and 254 of them are financial decision-makers. That makes it possible to chart their voting behaviour in comparison with people working in other occupational groups over the period of the surveys.

How do financial players vote and why does it matter?

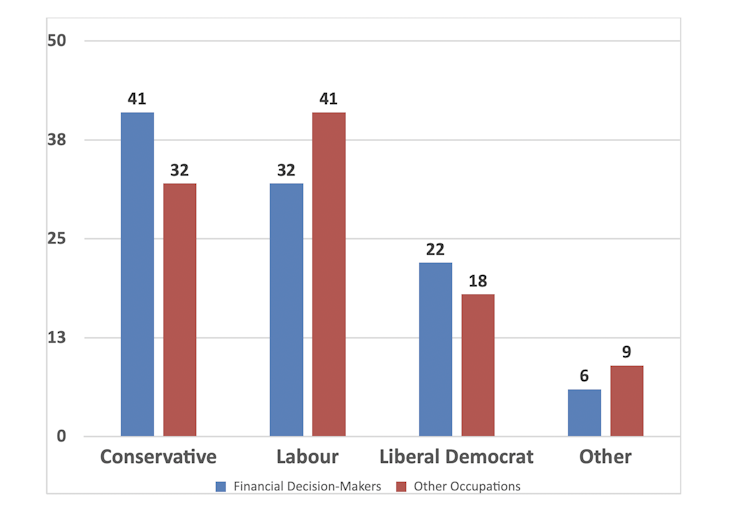

Data from these two sources combined tell us that the people who influence the British financial sector skew more Conservative than the rest of the population. The chart below shows the voting behaviour of the 254 financial decision-makers over the whole period (in blue), compared with the rest of the population (in red).

It turns out that 41% of them voted Conservative compared with 32% of the rest of the population. Labour have a right to be nervous because only 32% of them voted Labour compared with 41% of the rest of the population. One is a mirror image of the other.

Voting behaviour of financial decision-makers and others in Britain 2002 to 2020

To be fair, these people are unlikely to make financial decisions based on their party preferences. They are much more likely to try to maximise returns for themselves and their clients, whatever the political context of the time. Their adverse reaction to Truss’s budget shows this to be true since if their Conservative leanings were what mattered they would not have reacted so badly to her economic plans.

That said, it probably means they are more likely to react even more badly to Labour making unfunded spending promises than the Conservatives, since their political leanings are likely to encourage them to be more wary of a Labour government than a Conservative government.

This helps explain Starmer’s caution about announcing spending plans ahead of the election. If he promises large-scale spending without showing where the money would come from to pay for it, then a Labour win in the next general election could cause a financial crash and a run on the pound.

The prudent strategy for Starmer is to repeat what Tony Blair promised to do before the 1997 election. He committed the Labour government to stick with Conservative spending plans for the initial years in power. This neutralised concerns by the financial decision-makers about Labour winning power at that time.

Starmer’s critics have to recognise that it would be a serious blow to Labour’s chances if the party spooked the markets. If they started a new term in power with a financial crash it would derail Labour’s plans to change the current government’s economic strategy.

On the other hand, the prudent strategy produces a serious dilemma for the party. If promising pretty much the same as the Conservatives on spending, they risk not being able to encourage potential supporters to vote for them in the general election.