The global civil aerospace market has long been a classic duopoly. The sector has been dominated by European company Airbus and the US giant Boeing, with only limited competition in the regional jet market from Bombardier of Canada and Embraer of Brazil.

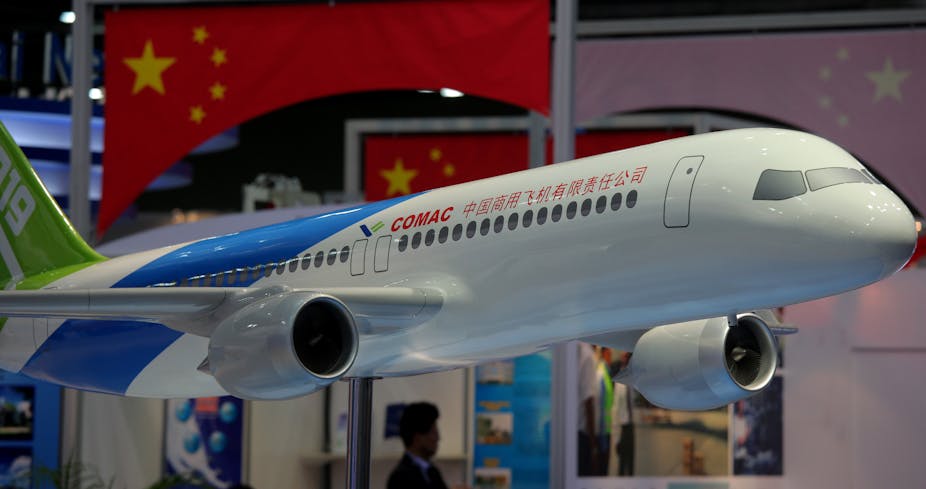

But this could be set to change now that China’s state plane maker, Comac, is speeding up its efforts to launch a commercial passenger aircraft.

A market winner

Comac, with funding from China Merchants Bank, is manufacturing C919 single-aisle commercial jets with a view to achieving first flight in 2015 and first customer deliveries in 2018. At the recent Zhuhai Airshow in China, Comac announced 430 orders from 17 clients for the 168-seat C919, with additional pledges for another 23 of its ARJ21-700 passenger jets, including its first order from Africa.

These orders will make Comac’s new aircraft more attractive to the Chinese market. This will be crucial, given the expectation by both Airbus and Boeing that China will become the world’s largest aircraft manufacturing centre within two decades, as well as the world’s fastest-growing aviation market with a surge in travellers fuelling the expansion. And so Comac poses a clear challenge to Airbus and Boeing’s long-term future in China, where they have already been hotly competing for business.

The ultimate aim will be to supply the lucrative international market too. Forecasts predict that the global civil aerospace market could see demand for around 27,000 new commercial airliners by 2031, with an additional 24,000 regional business jets and 40,000 of smaller, rotary-wing aircraft. Altogether the burgeoning market is expected to exceed US$4.5 trillion over this period, with around half of the new demand coming from emerging economies, including China and India.

A long time coming

China has long been poised to offer new international competition in civil aerospace. In the latest Five Year Plan, which sets out the country’s direction of development, the government expressed a commitment to growing the commercial aerospace sector with investment already exceeding $9bn.

But it has taken China time to develop the expertise to enter this market. The basic technological knowledge was built up through offset agreements that were negotiated between major Western aerospace companies and their Chinese subcontractors. Entry into the high-potential Chinese aerospace market for Western companies was impossible without adopting Chinese partners and these agreements inevitably meant that crucial knowledge transfer took place from prime contractors to Chinese suppliers.

By 2010, China had secured sufficient knowledge and expertise to enter the commercial aircraft market on its own terms and also on an internationally competitive basis. Initially, it will operate in the more competitive regional jet market with its new aircraft, the 168 seat C919 manufactured by Comac. This not only provides immediate competition for Boeing’s 737 aircraft but also offers a foundation on which to build future global competition in medium-to-large-bodied aircraft in the 2020s.

Economic logic

By far the most important explanation for Chinese success in this sector is the capacity to maintain low production costs. Chinese manufacture means potentially higher transportation costs, additional supply chain and management complexity, and considerable risk of supply disruption. Despite these potential extra cost elements, the actual cost of manufacturing aircraft structures (body panels, wings and so on) is 20-25% lower than in the West. Much of this is down to to labour costs which are three to five times lower, which also makes China a desirable place to conduct maintenance and repair work on aircraft.

These cost advantages are only just being explored in China in the aerospace industry and that sector has much to learn from successful experience in automobiles and electronics. In aircraft, for example, just 3% of global aircraft manufacturing currently emanates from these low cost areas compared with 33% in automobiles and 85% for electronics.

Chinese suppliers already manufacture structural components for Airbus and Boeing and fuselages for Bombardier. The Chinese are about to handle the final assembly of the A320 and will doubtless gain much from the experience. And they also have aircraft building experience from their role in developing the Embraer ARJ21 regional jet for the Chinese market.

Essentially, the new entrant to the aerospace manufacturing global market has all the key elements it needs for success – a dedicated government, large funds, opportunities for economies of scale in development and in manufacturing, and, through its long liaison with Western companies, the capability to design, build and market globally competitive aircraft.