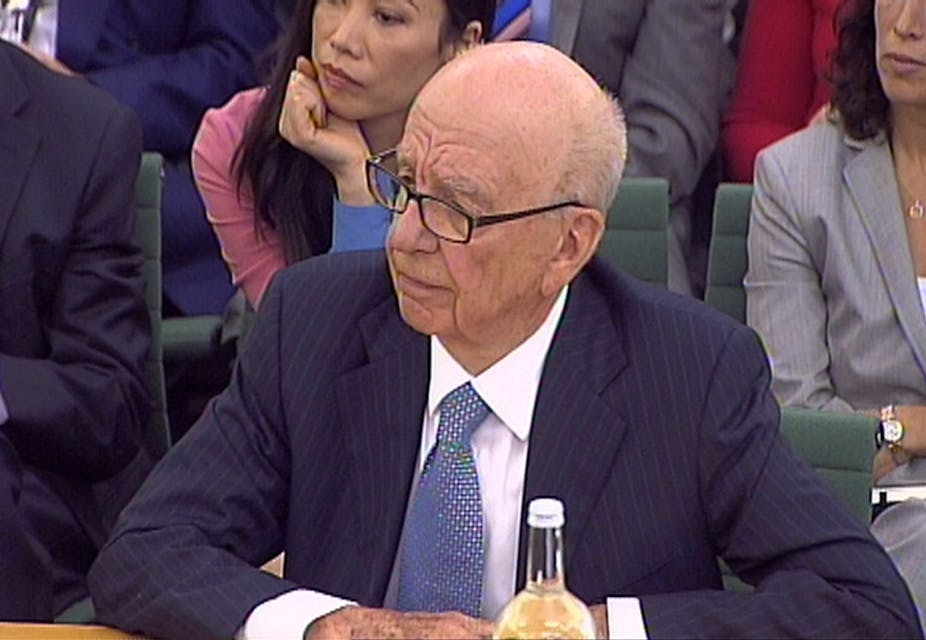

News Corporation shareholders would have been justifiably disturbed when James and Rupert Murdoch told this week’s UK parliamentary committee hearing that they could not be held responsible for the behaviour that led to the scandal currently engulfing their company.

As anybody with a basic understanding of corporate governance will tell you, the buck ultimately stops with with the chairman and chief executive.

Just because Murdoch Snr was not made aware of the claims of wrongdoing early, as both the chairman and chief executive of News Corp he is ultimately responsible. He and his board of directors are there to serve the company’s shareholders, while acting in accordance with all legal and regulatory standards and diligently applying risk management.

Responsibility for the governance and culture of a corporate reside with the board and chair. They must delegate responsibilities to management, but also ensure that management is accountable to them.

But while Rupert and the board can delegate tasks to management but they cannot delegate their own accountabilities. They may be shocked by the behaviour of those who worked for their company, but their governance role means they have to provide monitoring and oversight of management.

Their responsibilities also entail putting in place effective internal controls and ethical codes of conduct, as well as monitoring the effectiveness of such policies and procedures.

The role of the chair and the board is to ask the right questions – too often in cases such as these, complex corporate structures are used to justify why information does not travel up the management chain.

Directors can never know as management about the day-to-management of a company, but they select executives to do the job and fire them, or force them to resign, when they do not.

Too often directors are concerned with their own reputation once the crisis comes to the attention of the public, with little attention paid to procedures that prevent the crisis occurring in the first place.

The duty of the chair and board is to monitor senior management continually, and Rupert and his board have a duty of loyalty to shareholders and a duty of care in making decisions.

They must discover necessary information and consider all alternatives. Why did they not make sure they had all the information as the scandal unfolded? Why weren’t the right questions asked?

Unless directors and managers are engaging in practices that are negligent or self-dealing, they will generally not be targets of civil or criminal court proceedings against their company.

But in this case, negligence and criminal proceedings could be seen to demonstrate poor business judgement and render Rupert’s role difficult to maintain in the future.

The News Corporation board must put in place effective succession planning for the CEO and not leave it to the Murdoch to decide on a departure date for himself.

His dual CEO-chair role seems to have led to a situation where the board may have failed to question senior management staff and provide independent oversight.

In cases such as this, where there are dual CEO-chair roles the management/governance role becomes murky. Who takes on the responsibility to monitor Rupert in his role as CEO? The chair, who is again Rupert. The directors’ passivity seems incongruous in the circumstances.

As for James in his role as a senior manager, he is accountable to the board. His management role makes him responsible for actions of the company and his admission of paying out-of-court settlements has been seen by many as leaving leave him susceptible to prosecution. As the procession of management resignations continues, James may be left exposed.

Rupert and James may seem to be weathering the storm, but it is up to the board to exercise its responsibilities to ensure the culture is set from the top and governance is strengthened through asking the right questions about behaviour and management practices.