My last article looked at how social media stocks like Facebook, LinkedIn and Twitter are overpriced unless these companies manage to boost their revenues several times over. Given their business model mostly involves selling online advertising, they have had to sell a lot more ads!

To accomplish this goal, they use a simple yet misleading pitch that’s beginning to lose its punch: their ads are better because they are targeted to the individual tastes and preferences of Internet users. If this pitch were true, the effectiveness of social network ads would be significantly higher than those of other mediums such as television or newspapers.

When we dig into the actual performance of these ads, though, a vastly different picture emerges. Faced with this realization, these companies are increasingly selling our personal data in new and creative ways to support their high valuations and turn a profit.

The basic metrics for evaluating the effectiveness of Internet advertising are the number of times an ad is seen (impressions), the number of times the ad is clicked on (clicks) and the number of sales/sign-ons/leads/etc that follow from those clicks (conversions).

The click-through rate (CTR) is a proxy measure that can be used to assess the effectiveness of online ads. This measure represents the number of clicks compared with the number of impressions, expressed as a percentage.

Banner ads: the staple of online advertising

Banner ads are the picture ads that you see typically at the top or side of the browser page. To assess their effectiveness over time, I put together some data on click-through rates from DoubleClick.

In 1996, click-through rates averaged around 7%, or 7 out of 100 people clicked on them. Today, 0.15% is the norm, or just 1.5 in 1,000.

Why have click-through rates fallen?

Given that the click-through rate is the number of clicks divided by the number of views, it follows that the percentage fell for one of two reasons:

Fewer people see the ads (decreasing the denominator) and, concurrently, fewer people click on these ads.

More people see the ads (increasing the denominator) and, while overall clicks increase, their growth does not keep up with the rise in views.

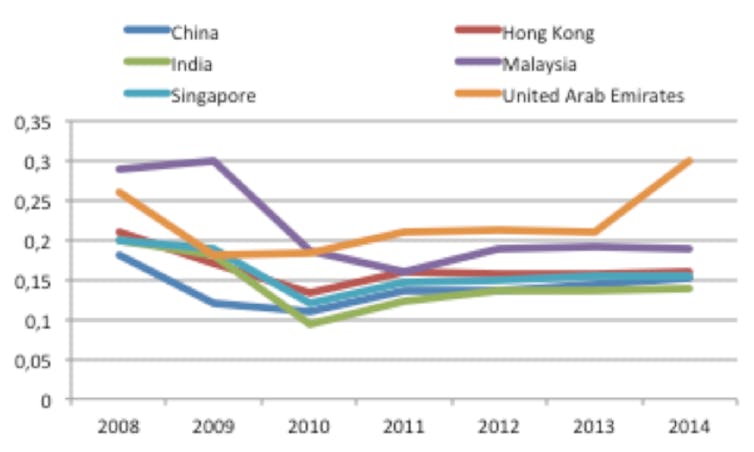

According to ITU statistics, from 2008 to 2013 the number of Internet users has increased in all countries in our sample. Whichever way the numbers are cut, the number of people seeing ads must have climbed during that period, eliminating explanation #1.

That leaves us with explanation #2: more people are seeing online ads, but fewer people are clicking on them, or what economists might call diminishing marginal effectiveness.

Banner ads are yesterday’s news… now we have social networking!

Facebook, Twitter and LinkedIn tell potential clients that their ads are even better than banner ads because they are targeted to individual users based on a large collection of intimate personal details. How well does this claim hold up?

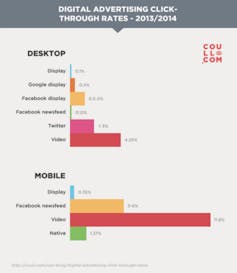

Surprisingly, for a company that is raking in advertising dollars hand over fist, Facebook does not publish its average click-through rates. I therefore had to cobble together some more data from three providers: Webtrends, TBG Digital and Nanigans.

The performance of Facebook ads from 2009 to 2012 averaged 0.08%, worse than banner ads. While the figures trend up to as high as 0.2% in 2012 and 2013, the absolute gain this represents is tiny, translating to around 1 in 500 people clicking on the ads.

The next generation of mobile, video and ‘native’ ads

The great new promise in online advertising is the shift to mobile. Mobile ads consistently garner higher click-through rates than their desktop equivalents. The newest generation of mobile and desktop video ads are getting click-through rates of 11.8% and 4.25% respectively, according to a report by online video ad provider, Unruly Media. Coupled with mobile are “native” ads, which involve dressing up, or hiding, ads as content. The click-through rate for these ads is currently around 1.37%.

These results are impressive at first glance. Remember, though, that banner ads, in their late 90s heyday, had 7% click-through rates. Consider also that the video ads drop down over the content, which forces users to click on the ads to get rid of them (very different to banners, which sit innocently on the page). This click signifies a forced interaction – an annoyance. Native ads involve essentially tricking the users into clicking on them by disguising ads as content.

Over the 1990s and 2000s, users gradually stopped clicking on banner ads after realizing the ads weren’t of any interest. The same is likely to apply for video and native ads. Once users catch onto the game, they will stop clicking and start ignoring the ads once again.

If our data can’t be used for targeting ads, what else could they be used for?

Investors and marketing executives have poured billions of dollars into the social networks based on the belief that, one day soon, online ads will be so finely tuned that internet users won’t be able to resist the products and services on offer. They will increasingly want to see hard evidence of a return on this investment. For the moment, that evidence doesn’t seem to be there.

This is a major dilemma for the social networks. They need to multiply their earnings with a product that is becoming less and less effective. This realization is already taking us in new and concerning directions. Instead of charging users for access to their platforms, the social networks are finding alternative ways to re-package their users’ personal data and sell it. For instance, Facebook now mines user data for media organizations to allow sentiment analysis on political issues.

In the search for return, the social media experience – and thus large swathes of the Internet – are quickly becoming less open and more invasive of individual privacy. Upcoming changes to the business models of some of the world’s most powerful companies are set to have huge political and social ramifications. It’s going to become easier and easier to ignore the ads we’re exposed to online, but harder and harder to ignore how the prevailing internet business model, one where users don’t pay, has turned our personal information into commodity that’s bought and sold beyond our control.

Hard Evidence is a series of articles in which academics use research evidence to tackle the trickiest public policy questions.