The degrowth movement has become very popular in recent years, particularly among younger people who appreciate its critique of the endless pursuit of economic expansion. The problem with growth, advocates argue, is that it implies the use of more and more resources and energy, as well as ever larger quantities of waste.

Well, the good news for the movement is that one of the world’s leading economies has offered itself up as a case study. If you look past the debate about whether the UK’s recent technical recession is going to deepen or peter out, the economic situation is pretty dire.

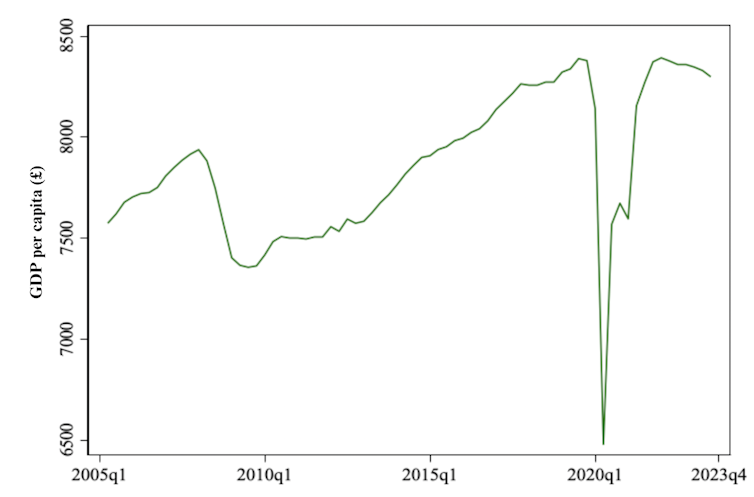

The UK’s GDP per person (or per capita), which economists view as the best measure of the wealth of a country, has declined in seven out of the most recent eight quarters. At the end of 2023, GDP per person was still lower than before the COVID pandemic. In contrast, the US equivalent is up 7%.

UK GDP per capita 2005-23

One main reason for the UK stagnation is a lack of investment in productivity, which advocates of degrowth would argue is an essential part of moving away from a resource-hungry economy. So what can we learn from the UK’s experiences so far?

The degrowth perspective

Degrowth has become the latest element in a long line of critiques of economic growth. One leading proponent, the Spanish ecological economist Giorgos Kallis, defines it as the “socially sustainable reduction of society’s throughput”, which is “incompatible with further economic growth, and will entail in all likelihood economic (GDP) degrowth”.

Pursuing GDP growth is criticised, both because of its increased use of resources and for “unrealistic expectations” that technological improvement and productivity growth would allow us to stay within so-called “planetary boundaries” (meaning the limits beyond which humanity will be unable to continue to flourish).

Kallis argues that degrowth implies reduced spending on goods and new technology, while distinguishing “good” and “bad” investments:

We will have to do with less high-speed transport infrastructures, space missions for tourists, new airports or factories producing unnecessary gadgets, faster cars or better televisions. We may still need more renewable energy infrastructures, better social (education, and health) services, more public squares or theatres, and localised organic food production and retailing centres.

Yet this fails to appreciate that a reduction in GDP implies lower investment in technologies across the board, including those underpinning renewable energy. It also misunderstands that modern economic growth is not driven by accumulating and using more resources, but by innovation through investment. Witness what has happened in the UK.

The UK situation

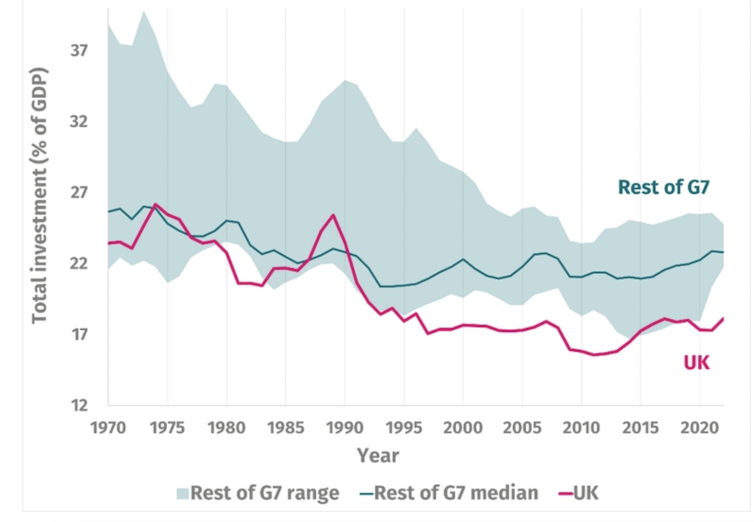

The chart below shows the continual decline of investment in the UK relative to other major economies:

Total investment as a % of GDP

This reflects both a decline in UK private investment and a decision to poleaxe public investment since the beginning of the 1980s (spending has improved a little since the global financial crisis of 2007-09).

This has meant that the UK’s rate of productivity growth has lagged the competition, not yet even returning to its level before the global financial crisis:

Growth in productivity, 1950-2023

This goes a long way to explaining the UK’s weak GDP per capita, along with the effects of Brexit, which the underperforming economy had encouraged voters to support in the first place.

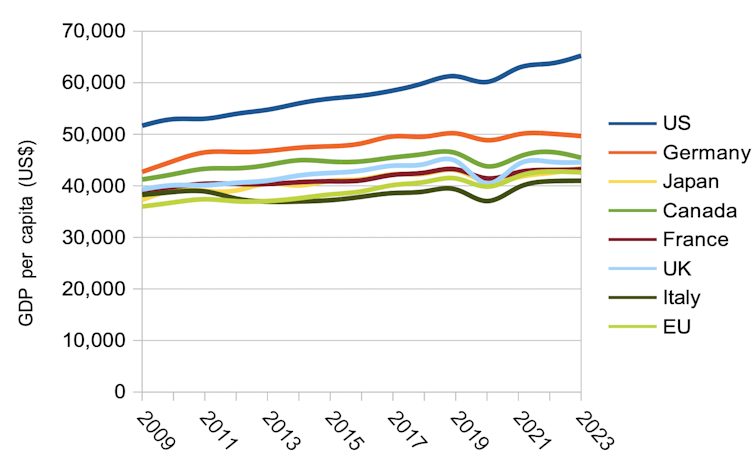

GDP per capita, G7 nations

The UK hasn’t been the worst G7 performer since the pandemic – Canada and Germany have fared even worse – but it fits the degrowthers’ model particularly neatly in some respects (they do also call for various pro-equality measures, so the comparison only works up to a point).

Degrowthers are clear to distinguish their proposals from a recession, portraying it more as a planned “coherent policy”. The planned disinvestment in the UK has helped to bring about some developments that they would presumably welcome. Carbon emissions have fallen substantially, while unemployment has not risen and inequality has only increased slightly.

On the other hand, the weakness in GDP per capita shows it hasn’t been great for living standards. Also, when GDP growth is lower than the interest rate that the state pays on outstanding debt, the state has less money to spend. This is why tough choices have had to be made in the UK about public services including the NHS and education – and the situation is likely to only get worse.

This goes some way to explaining the high dissatisfaction rates among people in the UK, though of course the long period of Conservative rule and the government’s perceived mishandling of things such as the pandemic and the economy are also major factors.

Nonetheless, it does suggest that people don’t like the effects of degrowth as much as the concept. Degrowth advocates might well counter that this is the price we have to pay for a better environment. They would also argue that the UK has not adopted their pro-equality agenda. Equally, however, their failure to recognise that investment in technology can drive both growth and climate change solutions is a major weakness in their arguments.

That doesn’t mean there’s a simple “off-the-shelf” solution to fixing the UK’s investment problems – the Truss premiership found this out the hard way. Replicating Thatcherite reforms without the support of oil funds to finance government spending will not work: North Sea oil was about 5% of GDP at its peak, and was a significant contributor to government spending.

Any step change will therefore need to rely mainly on private investment. Business confidence will be key to spurring this, and has not been helped by chops and changes to public policy in recent years – HS2 being an obvious example.

Degrowth advocates will not welcome this kind of approach, but technological improvement is ultimately likely to be a better way of achieving their goals than impoverishing people.