For most of us, banks represent a trusted and safe harbour for our money. Investing in fixed term deposits for example, is widely seen as a low-risk strategy. The global financial crisis changed that view for some, as it became apparent that banks could fail and put savings at risk. But governments, including Australia’s, moved to insure deposits and those investors with large savings reacted by shifting money around between banks to spread that risk.

For Europeans and the Cypriots in particular, the ongoing financial crisis has been a stark reminder that governments, as well as banks, can fail — and that once that happens, people’s life savings can fail and disappear with them.

As an alternative to taking money out of the bank and stuffing it under the mattress (not necessarily a low-risk strategy), it seems that Europeans at least may be taking a more radical approach to protecting their money and removing it from the clutches of bankers and governments.

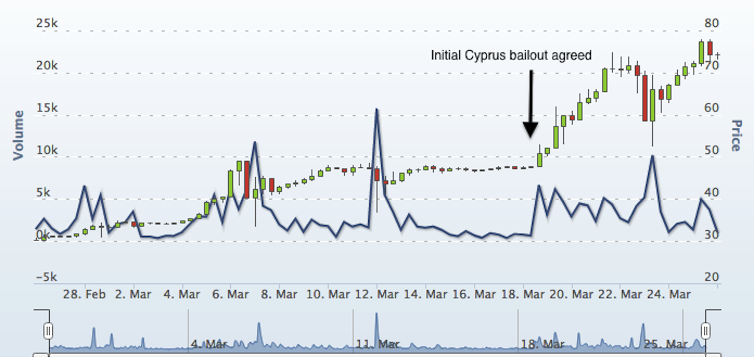

When the initial bailout was announced on the 16th March, all Cypriot bank deposits were at risk. A few days later, and likely related, there was a surge in the value of the virtual crypto-currency Bitcoin. There has even been talk of opening the world’s first Bitcoin ATM in Cyprus.

From the point of the bailout announcement, Bitcoin has increased in value from about USD$48 a Bitcoin to about USD$75 a Bitcoin, a 1.6-fold rise. This has been met with an overall increase in the volumes of trades in Bitcoin as well.

For those in the know about Bitcoin, its attractiveness is plain to see. For Europeans, the main driver in moving to Bitcoin away from the Euro would be the fact that it is not centrally controlled. Bitcoins can be manufactured by anyone with a large enough computer, according to a set of rules and also exchanged between parties directly without the need for a “central bank”. Computer algorithms control the overall maximum number of Bitcoins in circulation unlike regular currencies where governments are free to simply print more money. For this reason, the total capital value of Bitcoin depends solely on its market price. Currently the total value of Bitcoins is about USD$850 million.

Whilst the move to Bitcoin may be appropriate for smaller investors, some have questioned this strategy as a solution for those who have hundreds of thousands or even millions of dollars in investments. It is not clear that there is sufficient liquidity in the Bitcoin market to deal in large volume transactions. This wouldn’t necessarily stop investors wanting to trade large sums, they simply would have to do the trades over a longer period of time.

The interest in Bitcoins from the public and media, coupled with the ongoing tarnishing in the reputation of “mainstream” financial institutions has served to enhance the credibility of the virtual currency. This would represent a major shift for Bitcoins that have to-date, been largely seen as the preserve of hackers and drug-dealers due to its anonymous nature.

The other thing boosting Bitcoins’ credibility, somewhat ironically, is that the US Department of the Treasury Financial Crimes Enforcement Network (FinCen) last week announced money-laundering rules around virtual currencies as a whole. Exchanges like Mt Gox will now be subject to the same reporting rules and regulation as more traditional money services businesses like Western Union for example. But the FinCen will have its work cut out enforcing this, as the rules still don’t really accommodate the nature of Bitcoins which can be manufactured — in theory at least — by individuals and exchanged anonymously with others for cash without the need for a central bank.

Ultimately, the interest in Bitcoins reflects the deepening public distrust in central political and financial institutions. With the lessons of the GFC seemingly conveniently forgotten by those running the finance industry globally, the move to decentralised finance and governance is an obvious one. Technologies like Bitcoins are still not well known or accessible to the wider general public and are still not supported widely enough to be a truly viable alternative investment strategy.

Given Europe’s ongoing crisis and political shortcomings, that may just be a matter of time.