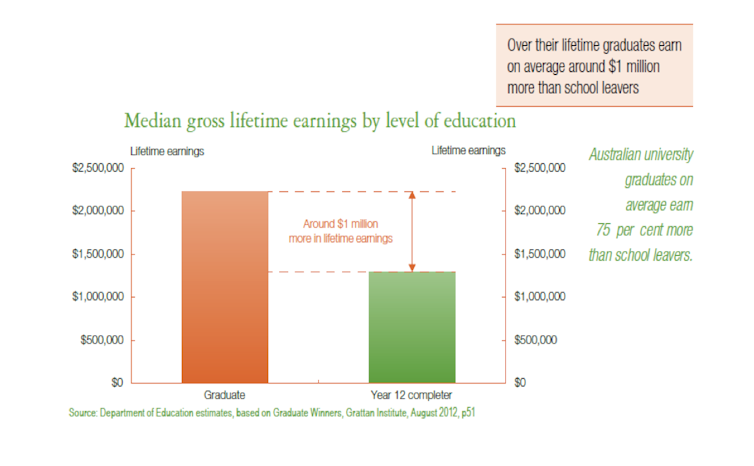

The main reason given for planned subsidy cuts to university courses has been that, with a degree, graduates will earn “a million dollars more”. Figure 1 shows how the May Budget compared graduate incomes with those of school leavers.

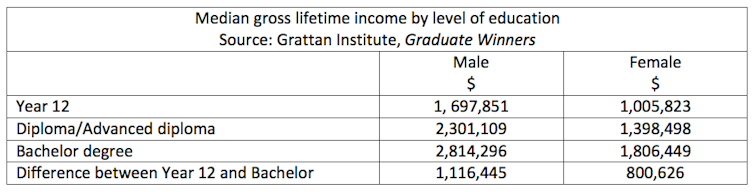

An ABC Fact Check concluded that the claim of this 75% graduate premium exaggerated the real private benefits of study, although different reports showed a range of estimates. The government’s arithmetic in Figure 1 drew directly from a 2012 Grattan Institute analysis of 2006 data in its report, Graduate Winners, shown in Table 1.

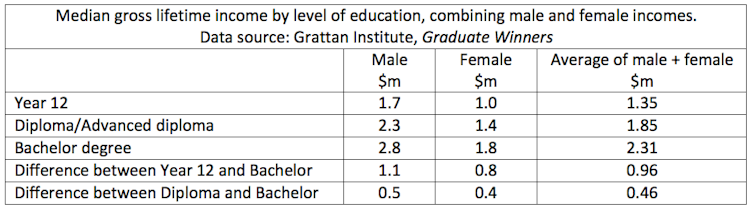

Clearly, the government estimate came from adding the Grattan estimates for males and females and dividing by two. This calculation, for school leavers and also for those with diplomas, is shown in Table 2.

Should we compare gross or net income?

One thing the government did not do was estimate net income differences, after tax. While there’s still a significant income premium for graduates, the extra tax they’d pay does alter the equation of costs and benefits. The Grattan Institute’s recent update of its annual Mapping Australian higher education report confirms this, with new income calculations using 2011 data.

In net terms, the new report says that compared with school leavers, median male graduates can expect to earn a premium of about A$900,000 and females A$700,000. On this view, a net median graduate premium is about A$800,000, after around A$400,000 in additional taxes has been paid from gross income.

Should we compare graduates with school leavers?

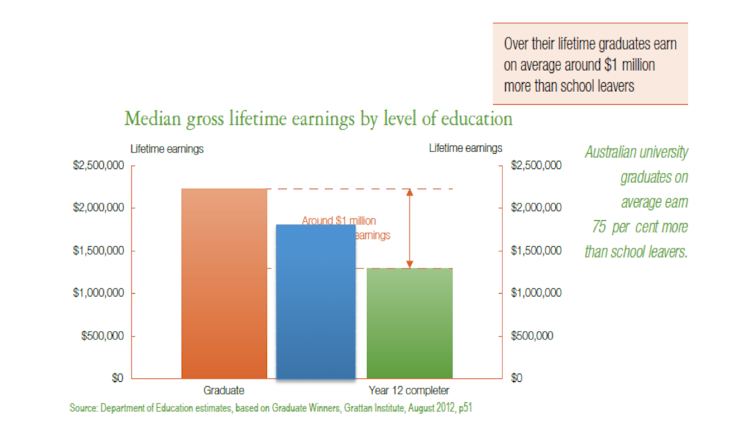

An unexplored aspect of this debate is how diplomas fit into the income comparison. If the government had put all of the Graduate Winners data from Table 1 into Figure 1 it would have shown that bachelor degrees provide only a 25% gross income premium compared with a diploma, as seen in Figure 2.

And while government rhetoric has highlighted the 60% of taxpayers without degrees, the fact is that 60% of the workforce today has some form of post-school qualification. This level will keep rising.

A 2013 report from the Australian Workforce and Productivity Agency looked at four economic growth scenarios, what kinds of skills the nation now has and what it will need. One of its findings was that:

In the three higher-growth scenarios, qualification holding is expected to exceed 70% by 2025.

As post-school qualifications become unexceptional, how much sense will it make to argue that students should pay more so that general taxpayers can pay less?

Should we only compare males with males, and females with females?

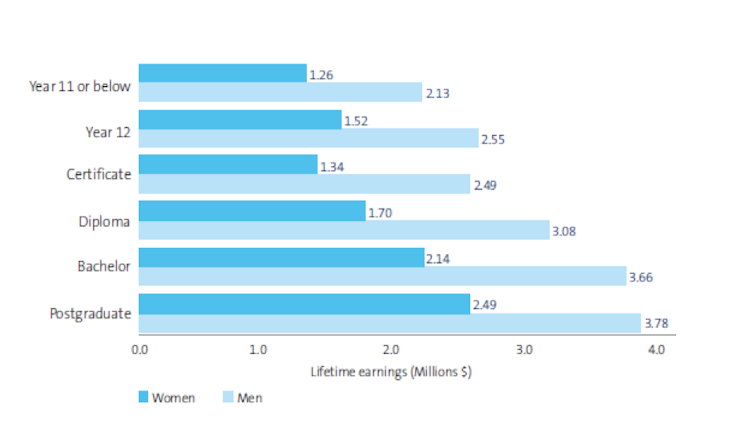

Another aspect of the million-dollar-degree debate is that the income differences between graduates and non-graduates are often confounded by workforce participation differences. These often reflect gender differences. A 2012 AMP-NATSEM report on Smart Australians looked at lifetime earnings in 2011 dollars, by level of qualification and by gender, as shown in Figure 3.

On this view, a 25-year-old male who completes Year 12 or a certificate can expect to earn more over a lifetime than a 25-year-old female with a bachelor degree. And a male with a diploma can expect to earn more than a female with a postgraduate qualification. Since female graduates often work part-time or intermittently, how much sense does it make to insist that their degree is worth a million dollars more compared with Year 12? This question is particularly pertinent when, according to another recent Grattan Institute report on student debt, 30% of today’s female graduates in nursing, education, IT, commerce and engineering won’t clear their HELP debts, along with 40% in architecture and science, and 50% in the humanities.

With fee deregulation in prospect, the point has been made repeatedly that the more fees rise, the greater the risk of debt traps for women. Many will earn half the expected median lifetime earnings attributed to a degree.

Taking the private financial benefits of study as a basis for user-pays policy to its logical extreme, it could be argued that male students should pay more for their degrees than female students. But this would be absurd: a radical reframing of the Australian idea of a fair go in access to study.

What does seem clear is that each attempt to make policy settings mirror the public and private costs and benefits of study encounters more and more exceptions. And as post-school qualifications become mainstream, the simple school leaver versus graduate comparison is becoming less and less relevant as a basis for any policy that frames the issue as a zero-sum contest between student interests and taxpayer interests.

At some point, policy makers will find that many of the private risks of student-financed study are better met by government, with the majority of provision costs financed more simply and directly through general taxation.