The long awaited report on combating corporate tax avoidance by the OECD sadly has to deal with a corporate tax system which is unfit for purpose.

It is a follow-up to the G8 meeting last month in Ireland which ended with lots of nice statements on curbing tax avoidance but with little commitment.

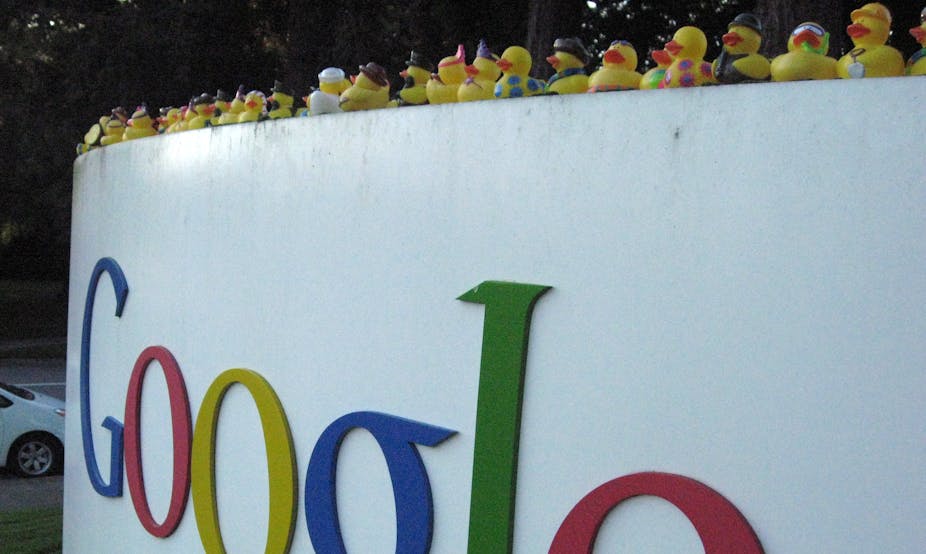

Unfortunately, companies such as Google, Microsoft, Amazon, Starbucks and others are able to use the system to avoid taxes in countries where their sales, assets and employees are located, by creating complex corporate structures and transactions. In fact, a considerable part of corporate profits are not taxed anywhere.

Fault lines

So the OECD plan cannot be evaluated without considering the fault lines in the current rules for corporate taxation which were designed nearly a century ago. Three stand out.

First, the rules, often enshrined in international treaties, specify that companies should be taxed at the place of their residence rather than where the economic activity took place.

Second, companies such as Amazon, eBay and Barclays and HSBC have common ownership, control and strategic direction, but they are not taxed as unified entities. Their hundreds of subsidiaries are treated as separate tax entities. The FTSE100 companies have about 22,000 subsidiaries. Thus, for tax purposes it is assumed that the authorities will deal with 22,000 separate entities rather than just 100 companies.

This encourages companies to arbitrage the global tax systems by devising all sorts of intragroup royalty payments for using intellectual property, management fees, interest payments and other transactions and pass them through subsidiaries located in low/no tax jurisdictions. Through such devices, companies bump up their costs in one country (for example, the UK) but collect the same amount in another place (say, Bermuda) which has a low/no tax regime.

Third, in principle, the artificial relocation of profits could be checked by using an accounting technique known as transfer pricing. Under this method, all intragroup transactions were to be valued at what the OECD calls “arm’s length” principle, or prices set by the free market. However, in the era of monopoly capitalism, finding free market prices or even any remotely comparable to it has become difficult. Around 70% of the world’s trade is controlled by 500 corporations. A handful of companies dominate coffee, pharmaceutical, internet and other sectors and thus “arm’s length” prices cannot easily be obtained.

Reconsidering the rules

The OECD report acknowledges that tax avoidance is disabling government’s ability to stimulate the economy and forcing ordinary people to pay higher taxes for a crumbling social infrastructure. It calls for curbs on artificial shifting of intellectual property to jurisdictions with little trade. It calls for limits on the deductibility of expenses from taxable profits relating to intergroup loans and other transactions.

The report also calls for reconsideration of the rules on “permanent establishment”. A case for this has been made by the Public Accounts Committee’s hearings into the tax affairs of Amazon and Google. Companies have been able to devise structures that use a country’s infrastructure, but escape taxes there. For example, Google claims that its London-based subsidiaries only do marketing, but sales orders are taken by the Irish subsidiary and thus sales/profits are booked in Ireland. Amazon claims to provide customer support in the UK, but online orders are booked in Luxembourg and therefore sales/profits are booked there.

Other proposals include strengthening of various international treaties and transfer pricing rules. The OECD action plan makes lots of references to transparency but shies away from recommending the publication of corporate returns.

A healthy alternative

The real problem is that the report is trying to patch up the current tax system rather than promoting any fundamental reform. The fault lines identified above are not addressed. The OECD has rejected the consideration of alternatives.

But the European Union has advocated the consideration of one such alternative. It is known as the Common Consolidated Corporate Tax Base (CCCTB). In the US, this is known as unitary taxation and has operated for over half a century.

The key idea is that a multinational corporation, such as Amazon, should be treated as a single economic unit rather than a collection of hundreds of disparate subsidiaries. The global profit of the company should be calculated. Thus, all internal transfers and royalty payments have zero effect because companies are effectively paying themselves. The global profit of the company can then be apportioned to each country in accordance with a formula that best describes its wealth creation.

The apportionment of profits can be on the percentage of sales, employees and asset location, or some combination thereof. Each country can then tax its share of profits, as it wishes. Such a system for taxing corporate profits is already used within the domestic context in the USA, Canada and Switzerland. A study of these jurisdictions would have been fruitful, but the OECD says that “moving to a system of formulary apportionment of profits is not a viable way forward”. It will be interesting to see how the EU responds.

The OECD report has intensified the debates, but does not offer any immediate solutions. That will depend on the responses of various nation states as they respond to demands of local politics and also compete to attract corporate investment by offering lower taxes though the OECD warns against harmful tax competition. It will be some time before tangible outcomes, if any, can be delivered.