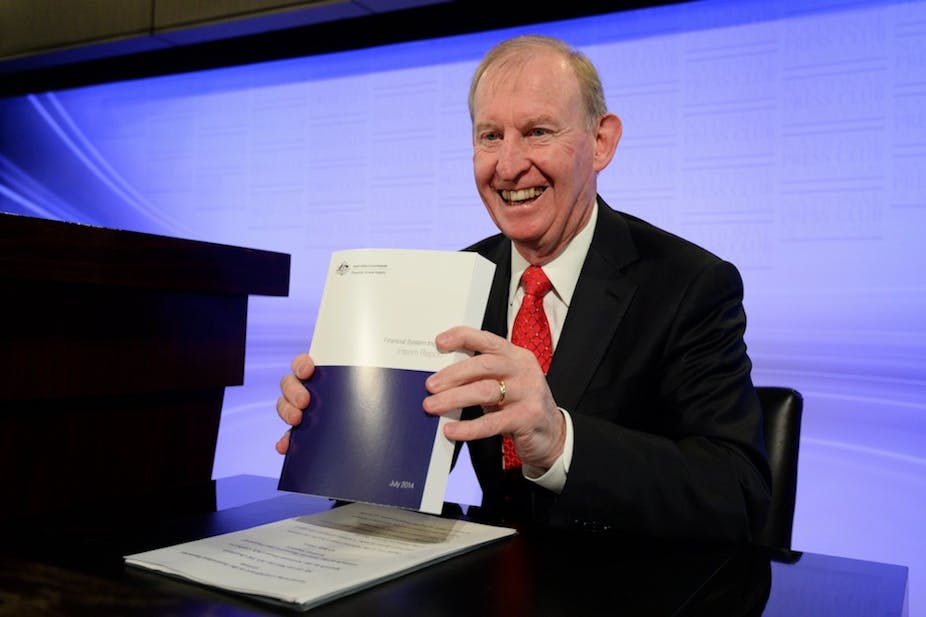

Australia’s Financial System Inquiry chairman David Murray dropped something of a bombshell in suggesting he may recommend the separation of Australian retail banking from investment banking.

The carefully cultivated mythology is that while such structural reforms need to concern regulators in the US, UK and Europe, since the Australian banks sailed through the financial crisis relatively unscathed (with the benefit of a government guarantee) they have proven their mettle. As they have never engaged in speculation in derivatives and other risky securities with quite the abandon of their overseas banking counterparts, there is no need for intervention.

Now one of their own, the former long-standing CEO of the Commonwealth Bank is thinking the supposedly unthinkable. At least Murray is being consistent, since he felt it was appropriate to separate retail and investment banking at the time of the 1997 Wallis Inquiry, telling the Australian Financial Review, “It was a good structure because it allowed clarity of regulation of the component parts of the group”.

Glass-Steagall

His statements intimate the famous US Banking Act of 1933 - known by the names of its two Southern democrat Congressional sponsors, Glass-Steagall - which responded to a huge wave of bank failures during the Wall Street Crash by separating commercial retail banking from investment banking.

As this graph shows, during the ensuing 50 years there were scarcely any bank failures in America.

With Ronald Reagan administration’s enthusiasm for deregulation, the Glass-Steagall began to be dismantled (followed almost immediately by the Savings and Loans crashes of the Bush presidency). In the over-confidence of the Clinton years, Glass-Steagall was finally abolished, an invitation for super conglomerate banks to form combining retail, investment, private equity and hedge funds. Governments were convinced that lightening the burden of regulation was the means to promote more dynamic financial markets and business development.

The global financial crisis which ensued and its aftermath consisted of multiple and compounding failures in financial markets, institutions, regulation and governance. The “animal spirits” unleashed in unfettered securities markets, massive incentivisation of risk taking and leverage, and the abandonment of effective governance and ethical commitments occurred in a regulatory vacuum.

Re-regulation

Realising the consequences of unchecked systemic risks, national governments and international agencies have been prompted into a major series of regulatory reforms and interventions in financial markets and institutions, the effect of which remains to be discerned.

Famously, Sandy Weill, former Chairman and CEO of Citigroup who had built the first of the financial super-conglomerates, broke ranks in 2012 to essentially call for a return of Glass-Steagall:

I’m suggesting that they be broken up so that the taxpayer will never be at risk, the depositors won’t be at risk, the leverage of the banks will be something reasonable, and the investment banks can do trading…

In fact though the US conglomerate banks including Citibank, JP Morgan, Goldman Sachs and others (now known as strategically important financial institutions) have grown even larger since the financial crisis owing to further consolidation in the industry.

The enormous wave of regulation from the G20, Basel Bank of International Settlements and even the passage of Dodd-Frank in 2010 have not changed the banks in any substantial and meaningful way. The Wall Street banks are now larger and more remote than before, and continue business as usual, and have not fundamentally changed their behaviour.

The Dodd-Frank Wall Street Reform Act in the United States is still being implemented (828 pages in itself, with 398 rules running to 14,000 pages, every page wrestled over by the lobbyists of the big banks). Part of the Act, the 882 page Volcker Rule was intended to update the (27 page) Glass-Steagall by restricting banks from engaging in speculative investments using customers’ deposits and risking their funds, while providing no benefits.

Though passage was finally achieved in December 2013, the outcome of this legislative initiative remains in doubt. Meanwhile other countries are considering splitting up the banks.

Volker, Vickers and the European stuff

As Murray sagely remarked from Washington “Having Volcker, Vickers and the European stuff in response to the crisis, you would have to consider whether it should apply to Australia”.

John Vickers chaired the Independent Commission on Banking in the UK following the financial crisis, which reported in parallel with the UK Financial Services Banking Reform Act 2013. He suggested UK banks should ring-fence their retail banking divisions from their investment banking to safeguard depositors funds from the risks of speculative investment.

In France and other European countries, ring fencing has also been argued for and the European Commission’s Liikanen Report accepted that mandatory separation of high-risk trading activities, or the ring-fencing of proprietary and third-party trading activities, without breaking banks up was required.

“The trading division will have to hold its own capital, meaning that it stands or falls by its own activities and cannot, in theory at least, knock over the bread-and-butter retail banking operations.”

While the UK and Europe continue slowly their efforts to restructure the banks, in the US, as UNSW Professor Justin O'Brien recently commented, a clear reform mandate has become “informed by waves of exceptions that undercut legislative intent and undermine regulatory authority”.

Frustrated at the lack of progress in the US, the unlikely combination of the radical Elizabeth Warren and conservative John McCain have proposed a 21st Century Glass-Steagall Act, which received 600,000 signatures in support.

In Australia we need to dispel the notion we live in the best of all possible banking worlds, and begin the process of separating retail from investment banking, to prepare for the shocks of the future that the international financial system is no doubt gearing up to provide.