Two US economists have been named the 2011 winners of the Nobel Prize in Economics for their research on how economies are affected by macroeconomic variables such as GDP, inflation, employment and investments.

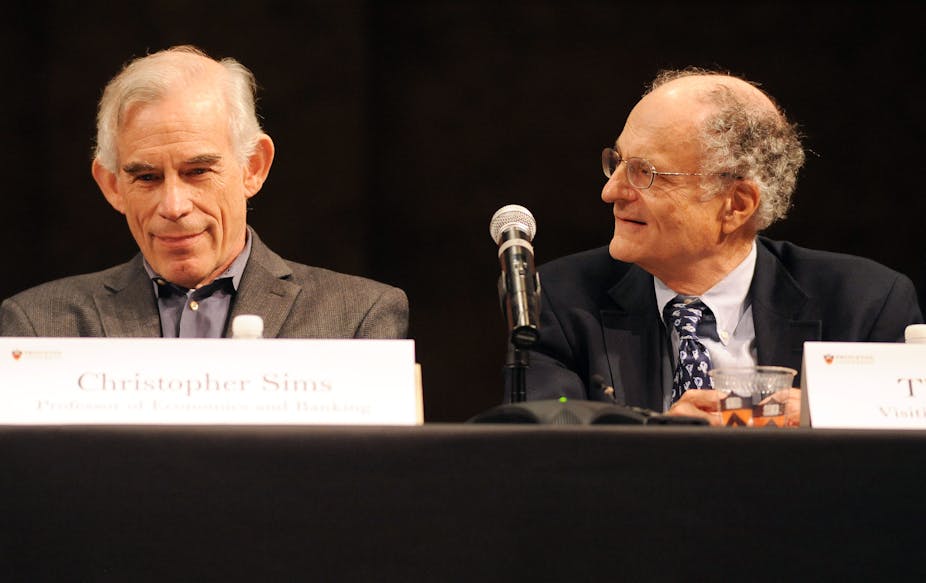

Princeton University professor Christopher Sims New York University economist Thomas Sargent were named the winners in a statement released overnight by the The Royal Swedish Academy of Sciences.

Research undertaken by the economists in the 1970s and 1980s “makes it possible to ascertain the effects of unexpected policy measures as well as systematic policy shifts,” the statement said.

“Today, the methods developed by Sargent and Sims are essential tools in macroeconomic analysis.”

The pair studied together at Harvard University, where they obtained their PhDs.

“Sargent has shown how structural macroeconometrics can be used to analyse permanent changes in economic policy. This method can be applied to study macroeconomic relationships when households and firms adjust their expectations concurrently with economic developments. Sargent has examined, for instance, the post-World War II era, when many countries initially tended to implement a high-inflation policy, but eventually introduced systematic changes in economic policy and reverted to a lower inflation rate,” the statement said.

“Christopher Sims has developed a method based on so-called vector autoregression to analyse how the economy is affected by temporary changes in economic policy and other factors. Sims and other researchers have applied this method to examine, for instance, the effects of an increase in the interest rate set by a central bank. It usually takes one or two years for the inflation rate to decrease, whereas economic growth declines gradually already in the short run and does not revert to its normal development until after a couple of years.”

In an interview posted on the Nobel Prize website, Professor Sargent described himself and Professor Sims as “just bookish types that look at numbers and try to figure out what’s going on.”

“We try to experiment in our models before we wreck the world.”

Professor Sims said he was sleeping when the call came announcing he had won. He said that he welcomed the current media attention on macroeconomics.

“I think it’s good to have people thinking about macroeconomics and careful, quantitative, scientific macroeconomics,” he said.

Quantitative economist Adrian Pagan, Professor of Economics in the School of Economics at the University of Sydney, described Sims and Sargent as “an excellent choice” by the Nobel Prize judges.

“Sargent and Sims have been incredibly important in developing methods for doing empirical macroeconomic research. The macro-economy is a system and some of the first Nobel Prizes were awarded to people who developed methods to analyse the data generated by it, such as Tinbergen, Frisch, Haavelmo and Klein,” he said.

“Early on, the data we had available was yearly but this gradually changed to a quarterly frequency. That then led to the issue of how one models the dynamic adjustments to shocks for variables such as inflation and output growth that come from the system. Sims and Sargent’s work was fundamental to dealing with this.”

Their methods are widely used in central banks, finance ministries and the private sector, said Professor Pagan.