Cuba is going through its worst economic crisis in 30 years. Since 2020, Cubans have suffered falling wages, deteriorating public services, regular power outages, severe shortages and a growing black market. Hundreds of thousands of people have fled the country.

Some place the blame for this desperate situation at the door of the Cuban government and its mismanagement of the economy. Others point to the damage caused by longstanding US economic sanctions that, to varying degrees, have been in place since 1962.

But which of these is more true? Both have inflicted economic damage. The US has done so deliberately, while the Cuban government’s flawed policies spring from inertia and miscalculation.

The case against the government

In January 2021, the Cuban government introduced major currency and price reforms. The reforms, which involved devaluing the Cuban peso from one to the US dollar to 24 per dollar, were supposed to begin a process of aligning Cuban prices with international markets.

The hope was that the move would incentivise economic restructuring and innovation to improve efficiency, reduce dependence on imported goods, and eventually stimulate exports.

But things did not turn out as planned. State sector salaries had been more than trebled in December 2020 to protect living standards in anticipation of price rises that would result from the higher cost of imports. However, this salary increase was quickly overtaken as higher costs and consumer spending power pushed up prices and started an inflationary spiral.

The rate of inflation has eased since then. But the official annual rate is still alarmingly high, at around 30% (more than twice the Latin American regional average).

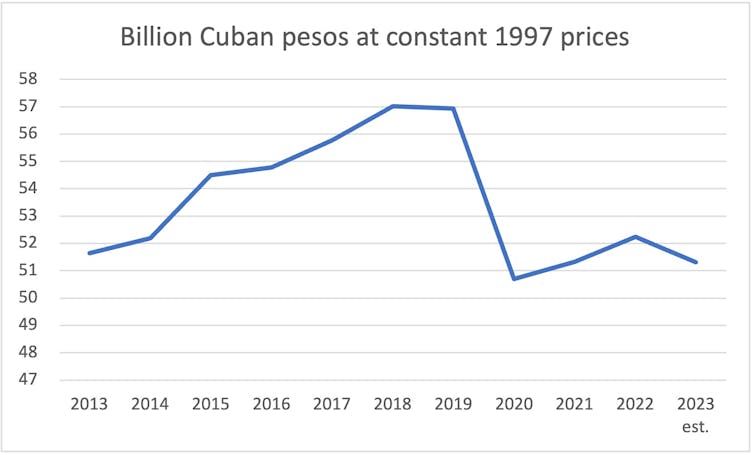

The Caribbean has generally experienced strong post-pandemic economic recovery. But Cuba’s national income remains well below its pre-COVID level and, with export earnings still depressed and import dependency unchecked, there is little sign that any restructuring has occurred.

The effect of US sanctions

The effect of US economic coercion is less obvious, but no less significant. Cuba has been under a US trade embargo for the past 60 years, but a new stream of measures was introduced under the presidency of Donald Trump (2017–21). Trump’s policies cut earnings from services, interrupted fuel supplies, blocked remittances and deterred foreign investment.

Growth was subdued and shortages were already starting to emerge in 2019. But the most devastating action came in January 2021. One of Trump’s final acts in office – occurring just days after the currency reform – was to add Cuba to the US list of “state sponsors of terrorism”.

The effect of this has been huge. Interviews that I conducted with representatives of foreign companies doing business with Cuba and with Cuban officials responsible for managing international trade confirm that foreign businesses delayed payments and abruptly cancelled shipments of imports, export contracts and investment plans in the months that followed.

The resultant supply bottlenecks and loss of foreign exchange supercharged inflation, adding to frustration and uncertainty, and preventing recovery.

But perhaps Cuba’s greatest error was to give credence to Joe Biden’s rhetoric in his 2020 US election campaign. Biden spoke about Trump’s “failed Cuba policy” and vowed to reverse his “harmful” policies. If that had happened, a less tight foreign exchange constraint would have allowed some possibility of a positive supply response to the monetary reforms.

Despite his campaign promises, Biden has left Cuban sanctions in place. This has obstructed Cuba’s access to foreign exchange, putting the investment required for restructuring out of reach.

Bad timing

The pandemic has also contributed to Cuba’s economic turmoil. Cuba responded to COVID by closing its borders and imposing strict lockdowns. This resulted in a sharp economic contraction and a severe depletion of its foreign currency reserves.

The pandemic also had a dramatic impact on the world economy. High fuel and food prices served to worsen Cuba’s foreign exchange shortage, and supplies were further disrupted by logistical bottlenecks and inflated shipping costs.

Cuba had actually performed exceptionally well in containing the virus throughout 2020. But a major shock came in 2021 when Cuba grappled with a surge in cases of a new COVID variant.

US sanctions blocked access to sources of COVID support that helped to ease hardships in other nations. As a result, the government had no choice but to cut investment and was unable to prevent the decline in real salaries.

Looking for a way out of crisis

Discontent fuelled by COVID restrictions and widespread shortages resulted in protests, revealing dissatisfaction with how Cuba’s leaders had responded to these challenges. Officials are seen as having been slow to fully acknowledge the government’s miscalculations or the degree of hardship that is being experienced by Cuban households.

As the rate of inflation gradually eases, the government is starting to outline a recovery strategy. With no end to US sanctions in sight, the focus is on reforming the economic system.

The reforms are wide-ranging, aimed at tackling the economic distortions and inertia inherited from decades of strict centralised control. They include a gradual reduction in price subsidies, more targeted welfare, improving the efficiency and responsiveness of state bureaucracy, and opening up to private businesses.

The aim is to stimulate innovation, boost investment and improve public services, which should eventually lift growth and boost living standards.

But the process of restructuring will be difficult. There will be both winners and losers, and resistance to change is inevitable. The reform and recovery process also hinges on rebuilding the shaken confidence of the public and investors, as well as avoiding further external shocks – or deliberate blows from the US.