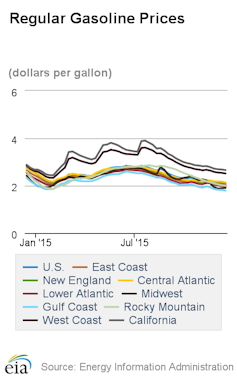

American consumers have been enjoying Christmas since July – that is, July 2014, when the average price for all grades of gasoline peaked at US$3.75 per gallon, according to the Energy Information Administration. Since then, prices have declined substantially, as every motorist knows: to $2.90 by Thanksgiving 2014 and to $2.14 as we approach the end of 2015. In many parts of the country, the price of regular gasoline is well below $2 per gallon today.

For consumers, this is unquestionably a financial windfall. There are losers too, of course, especially across the petroleum and fuels industry.

But from a societal perspective – from consumer behavior to public policy – how should we view this change and the likelihood of low energy prices for the longer term, even if they rebound from today’s lows?

Voting with their wallets

The behavioral response of consumers to falling gas prices has been rapid, and from the perspective of greenhouse gas emissions and the climate, not good.

Gasoline retail sales in the US are up a whopping 28% for the first nine months of 2015 compared to the same period in 2014, according to the EIA. There are longer-term consequences of current consumer choices as well. According to the University of Michigan Transportation Research Institute, the average gas mileage of new vehicles sold in the US has decreased from a record high of 25.8 miles per gallon (mpg) in the summer of 2014 to 25.0 mpg in November 2015.

That translates into a 5% increase in emissions from new vehicles over that period. That may not sound like much, but in the face of the US commitment ahead of the COP21 Paris climate summit to decrease greenhouse gas (GHG) emissions by 28% by 2025, it is clearly a step in the wrong direction.

While consumer response to changes in the energy landscape has been swift, attitudes and policies have been much slower to change. In some ways we are still captive to thinking in terms of energy shortages from the oil shocks of the 1970s and ‘80’s, reinforced by occasional gasoline price spikes including those in 2008 and 2011 above $4 per gallon.

Policy has been slow to recognize this reality as well. Recall that today’s controversial Renewable Fuel Standard mandate for biofuel production was set by the Energy Independence and Security Act of 2007. At the time, emissions reductions were a far less prominent portion of the rationale for this act; growing a supply of domestic alternative fuels was the priority.

Now, we need new supplies of carbon-free energy, not because we face energy insecurity or because our consumption is rising, but because we urgently need to reduce climate-changing GHG emissions.

As we have seen with consumers buying less fuel-efficient vehicles in the past year, this challenge is doubly difficult in the era of relatively cheap and abundant fossil fuels. That is the stark backdrop to the COP21 agreement. Intended nationally determined contributions (INDCs) to GHG emissions reduction would limit the average global temperature to “only” 3.5 degrees Fahrenheit above preindustrial levels in the best of cases.

Fixing roads

Financial windfall or carbon calamity, have we missed an opportunity? Perhaps, but we need not continue to do so.

Imagine that a comparable windfall for typical workers had come not in the form of a drop in fuel prices, but as an end-of-year bonus from employers. Between federal and state income taxes, Medicare and Social Security deductions, the average worker would likely take home no more than 80 cents of each bonus dollar.

What if we were able to capture a similar fraction of the gas price windfall for investment in our energy and transportation future? What could we do with the 32 cents per gallon that represents 20% of the gasoline price drop since July 2014?

In Michigan, the legislature struggled for a year to come up with a formula to generate $1 billion for badly needed road repairs. If that amount were funded entirely from a tax on transportation fuels, it would require a tax increase of about 25 cents per gallon.

Nationally, we could invest not only in roads, but in clean-energy research, and in accelerating the deployment of clean-energy generation and new and improved energy infrastructure. We could complement the requirements imposed by CAFE (corporate average fuel economy) vehicle fuel-efficiency standards and the Clean Power Plan to limit carbon emissions from power plants with incentives and investments that would make both more successful in reducing GHG emissions.

Better yet, the modestly higher price that would result from, for example, a higher gasoline tax could help moderate the trend of purchasing less fuel-efficient vehicles. Regardless of the short-term appeal or the longer-term economics behind consumers’ decisions, the lower mileage vehicles being purchased today may remain on the road for 20 years, making the difficult challenge of significant emissions reductions even tougher.

So the answer to the question whether $2-per-gallon gasoline is a windfall, a calamity or a missed opportunity is “all of the above.” However, we needn’t continue to miss the opportunity provided by low energy prices. We need the will to forego a portion of the immediate benefits and to show the leadership and political courage to enact policies that make sustained investments in infrastructure and in a cleaner energy future. By doing so we will benefit not only ourselves, but our children and our fellow citizens of the earth.