About 1 in 6 Americans are age 65 or older, and that percentage is projected to grow. Older adults often hold positions of power, have retirement savings accumulated over the course of their lifetimes, and make important financial and health-related decisions – all of which makes them attractive targets for financial exploitation.

In 2021, there were more than 90,000 older victims of fraud, according to the FBI. These cases resulted in US$1.7 billion in losses, a 74% increase compared with 2020. Even so, that may be a significant undercount, since embarrassment or lack of awareness keeps some victims from reporting.

Financial exploitation represents one of the most common forms of elder abuse. Perpetrators are often individuals in the victims’ inner social circles – family members, caregivers or friends – but can also be strangers.

When older adults experience financial fraud, they typically lose more money than younger victims. Those losses can have devastating consequences, especially since older adults have limited time to recoup – dramatically reducing their independence, health and well-being.

But older adults have been largely neglected in research on this burgeoning type of crime. We are psychologists who study social cognition and decision-making, and our research lab at the University of Florida is aimed at understanding the factors that shape vulnerability to deception in adulthood and aging.

Defining vulnerability

Financial exploitation involves a variety of exploitative tactics, such as coercion, manipulation, undue influence and, frequently, some sort of deception.

The majority of current research focuses on people’s ability to distinguish between truth and lies during interpersonal communication. However, deception occurs in many contexts – increasingly, over the internet.

Our lab conducts laboratory experiments and real-world studies to measure susceptibility under various conditions: investment games, lie/truth scenarios, phishing emails, text messages, fake news and deepfakes – fabricated videos or images that are created by artificial intelligence technology.

To study how people respond to deception, we use measures like surveys, brain imaging, behavior, eye movement and heart rate. We also collect health-related biomarkers, such as being a carrier of gene variants that increase risk for Alzheimer’s disease, to identify individuals with particular vulnerability.

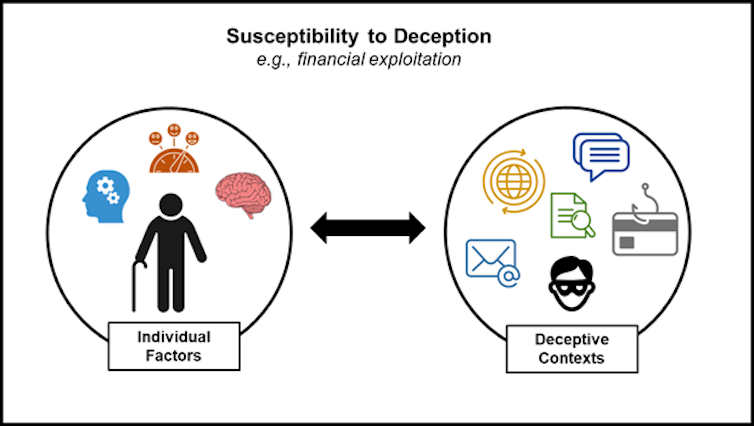

And our work shows that an older adult’s ability to detect deception is not just about their individual characteristics. It also depends on how they are being targeted.

Individual risk factors

Better cognition, social and emotional capacities, and brain health are all associated with less susceptibility to deception.

Cognitive functions, such as how quickly our brain processes information and how well we remember it, decline with age and impact decision-making. For example, among people around 70 years of age or older, declines in analytical thinking are associated with reduced ability to detect false news stories.

Additionally, low memory function in aging is associated with greater susceptibility to email phishing. Further, according to recent research, this correlation is specifically pronounced among older adults who carry a gene variant that is a genetic risk factor for developing Alzheimer’s disease later in life. Indeed, some research suggests that greater financial exploitability may serve as an early marker of disease-related cognitive decline.

Social and emotional influences are also crucial. Negative mood can enhance somebody’s ability to detect lies, while positive mood in very old age can impair a person’s ability to detect fake news.

Lack of support and loneliness exacerbate susceptibility to deception. Social isolation during the COVID-19 pandemic has led to increased reliance on online platforms, and older adults with lower digital literacy are more vulnerable to fraudulent emails and robocalls.

Finally, an individual’s brain and body responses play a critical role in susceptibility to deception. One important factor is interoceptive awareness: the ability to accurately read our own body’s signals, like a “gut feeling.” This awareness is correlated with better lie detection in older adults.

According to a first study, financially exploited older adults had a significantly smaller size of insula – a brain region key to integrating bodily signals with environmental cues – than older adults who had been exposed to the same threat but avoided it. Reduced insula activity is also related to greater difficulty picking up on cues that make someone appear less trustworthy.

Types of effective fraud

Not all deception is equally effective on everyone.

Our findings show that email phishing that relies on reciprocation – people’s tendency to repay what another person has provided them – was more effective on older adults. Younger adults, on the other hand, were more likely to fall for phishing emails that employed scarcity: people’s tendency to perceive an opportunity as more valuable if they are told its availability is limited. For example, an email might alert you that a coin collection from the 1950s has become available for a special reduced price if purchased within the next 24 hours.

There is also evidence that as we age, we have greater difficulty detecting the “wolf in sheep’s clothing”: someone who appears trustworthy, but is not acting in a trustworthy way. In a card-based gambling game, we found that compared with their younger counterparts, older adults are more likely to select decks presented with trustworthy-looking faces, even though those decks consistently resulted in negative payouts. Even after learning about untrustworthy behavior, older adults showed greater difficulty overcoming their initial impressions.

Reducing vulnerability

Identifying who is especially at risk for financial exploitation in aging is crucial for preventing victimization.

We believe interventions should be tailored, instead of a one-size-fits-all approach. For example, perhaps machine learning algorithms could someday determine the most dangerous types of deceptive messages that certain groups encounter – such as in text messages, emails or social media platforms – and provide on-the-spot warnings. Black and Hispanic consumers are more likely to be victimized, so there is also a dire need for interventions that resonate with their communities.

Prevention efforts would benefit from taking a holistic approach to help older adults reduce their vulnerability to scams. Training in financial, health and digital literacy are important, but so are programs to address loneliness.

People of all ages need to keep these lessons in mind when interacting with online content or strangers – but not only then. Unfortunately, financial exploitation often comes from individuals close to the victim.