Standard financial advice for businesses and individuals is to reduce risk by diversifying investments. One way to do this is through investing in fine art. But how does art stack up in terms of returns against the other three main asset classes - shares, bonds and property?

A recent working paper uses the Citadel Art Price Index to examine whether art is a good way to diversify an investment portfolio in relation to movement of three South African indices - a share index, a house price index and a government bond index.

Contrary to the popular view, the findings indicate that investing in art is the most risky of the four asset classes and produces limited returns. Buying art because you enjoy it seems to be the best motivation.

Nevertheless, investing in art remains fascinating for two reasons: the possibility of making a big return if talent can be spotted early; and the simple pleasure of owning art.

The fine art market

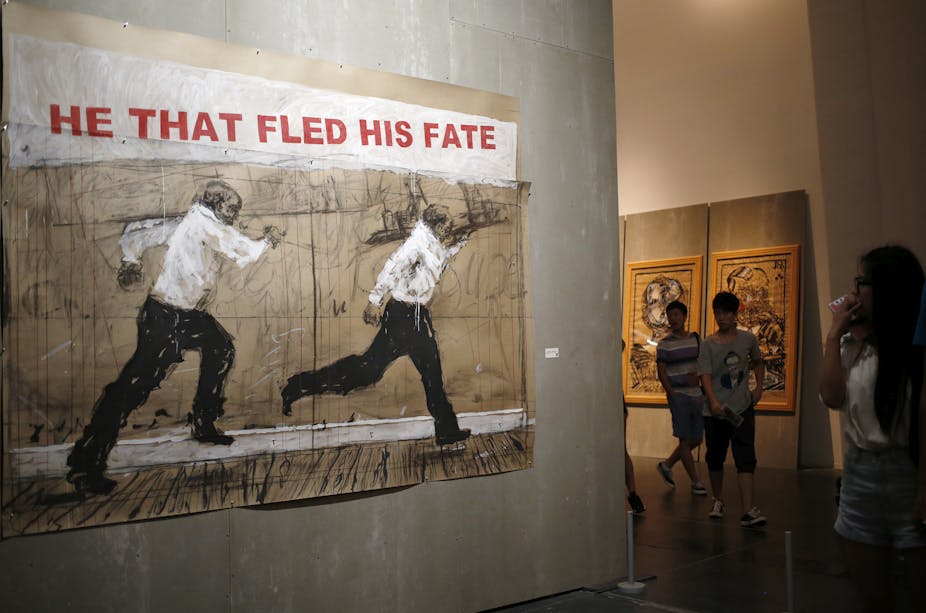

South Africa’s art market is small but has seen substantial growth in the past few years with the establishment of new art fairs and galleries. The country boasts a modest number of famous artists, such as William Kentridge, Walter Battiss, Gerard Sekoto and Irma Stern, who have made international fame and substantial commercial success. But this does not mean that there are not lucrative opportunities for investment.

In an efficient market, prices reflect all available information, making future returns unpredictable. This is not the case with art.

Returns calculated from an index of art auction prices do not reflect all available information. This is because the seller fixes a reserve price, which only the seller and the auctioneer know. If the art work does not reach the reserve price, the work is reported as unsold and this information is not incorporated into the index.

Risk and return on art investment is also atypical in that art has both investment and consumption components to it. In addition to financial return, art also provides a “utility dividend” in the form of the aesthetic pleasure that the owner gets from looking at it.

The difference in return between art and other investments may be capturing the value that the owner receives from owning an asset that is also a consumption good. Thus an art asset’s payoff will be increased by the utility dividend and art investors will not need to be compensated by as much in financial terms as conventional financial assets.

The fact that art has the potential for resale and that prices can fluctuate over time means that art has some of the same features as financial assets. This is because it can be used to protect against inflation, as a source of capital gain and a store of wealth.

But the way that artworks derive their value is different to other financial investments. Stocks represent a claim on the asset that provides a monetary return to the owner over a period, while an artwork provides a monetary return at the end of the ownership period as well as providing aesthetic value and social prestige to its owner.

Another aspect of an artworks’ price that distinguishes it from other financial assets is that the supply of art from any particular artist, when they have stopped producing, is fixed. This means that the price is fully determined by demand.

What we found

Our research showed that when compared to indices of shares, house prices and government bonds, the art price index is the most volatile of asset classes and hence the most risky to invest in.

Although the art price index moved with the share price index, there was a lag of three months. For example, when there are increased returns on the stock markets in the previous quarter and wealth increases, there is a change in the art price in the same direction.

The fact that share prices and art prices are significantly positively correlated suggests that there is little value for investing in art as opposed to shares. Since art is a luxury good it would be expected that when people become wealthier they invest in art as a means of savings or for status.

There is no statistically significant relationship between the art price index and the house price index. But the art price index is negatively related to the South African government bond price index. This suggests that art offers a way of diversifying a bond portfolio, but the relationship is also not statistically significant.

In sum, the results of this study suggest that art does not seem to offer a good way to reduce risk in an investment portfolio dominated by shares. Investing in art is the most risky of the four asset classes, followed by shares.

The riskiness of art as investment choice is also reinforced by the fact that the art market is found to be inefficient. Buying art because you enjoy looking at it, rather than because you hope for a big financial return, still seems to be the best motivation for the purchase.

Internationally, art markets are growing with some record prices achieved at auction for old masters, driven particularly by interest from developing countries, like China. But as growth begins to slow, the Citadel Art Price Index entered negative territory this year, and it remains to be seen how resilient art prices will be.

Brett Scott co-authored this article. He recently completed his MA in Art Business at the Sotheby’s Institute of Art, with a specific focus in art finance.