There is no one way of understanding the bases of, or justification for, austerity. If there was, there wouldn’t be such voracious debate around the topic. A recent televised discussion provides a perfect example of this.

In it, Labour National Forum’s Grace Blakeley drew an analogy with a business that fails to invest in the resources necessary to operate successfully: “It would be like a bar [saying], I’m going through hard times, so I’m selling all my bar stools, I’m going to close an extra day a week and I’m going to stop selling more expensive beer.” For Blakeley, austerity is short-sighted and fails to recognise that businesses need investment to generate profits.

Former Conservative minister Michael Portillo responded, “[That] is like a family saying, well we don’t have any money, we are living beyond our means, so what we ought to do is … borrow a whole lot of money and spend it on this, that and the other and pretend that is going to raise our productive capital.” For Portillo, if the economy is conceived as a family, then continuing to spend money that you don’t have just digs an ever deeper hole.

Blakeley countered: “Let’s take that metaphor further shall we? … we are spending more than we are earning … we are going to stop feeding our children, and … stop paying our rent. Eight years down the line, the kids are dead, and we have been kicked out of our house, but at least we are not spending more than we are earning any more.”

In a sense both Blakeley and Portillo are “right” on their own terms but they are talking past each other. Such arguments are commonplace in economic debates and morality is often invoked to lend emotional weight to the speaker’s viewpoint. But should morals even be a part of economics?

Understanding ‘economic morality’

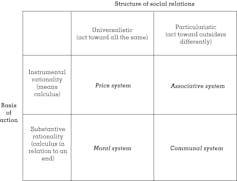

Our Systems of Exchange (SOE) framework is useful in making sense of competing economic arguments. It organises views into four types, based on the importance of individuals or groups, and types of rationality.

The first dimension considers two types of rationality in economic decisions. Both are rational, but while “instrumental” looks for the most economically efficient outcome, “substantive” calculates the most efficient means for achieving a moral or value-based result.

The second dimension looks at social relations. Neoclassical economics assumes that everyone making their own independent rational choices will lead to the best outcome. An “invisible hand” will guide us towards maximum overall social benefit. In other economic settings, the group, not the individual, is considered the critical unit for decision making and the identity of the people involved matters.

Portillo’s argument features an economically rational argument: one must spend within one’s means. However, applying the framework, Portillo’s logic becomes confused. The metaphor fails to recognise that the family is made up of people who care about what happens to each other. This is the weakness that Blakeley picks up – “the kids are dead”.

But Blakeley’s bar metaphor does not acknowledge that businesses cannot borrow forever. And her framing of Portillo’s “family” as a group bound by affection and obligation does not work when referring to something as complex and rule-based as the UK economy.

New thinking for old problems

Debates like this are age old. For the last few decade,s there has been a clearly dominant perspective – at least in the UK and US – that the efficiency and prosperity driven by “economic man” (an ideal person who acts rationally and with complete knowledge) and unfettered markets will deliver for the common good. But there is increasing evidence that this belief may be unfounded (or at least comes with significant downsides for large parts of society).

There are alternatives, however, and the SOE framework helps us think through these. In his new book, economics professor Paul Collier has set out an “alternative in which the means are infused with a moral purpose”. Steeped in the values of philosophers David Hume and Adam Smith, this form of capitalism reconnects Smith’s arguments about markets and moral sentiments in understanding the economy. Collier argues:

Smith recognised that seeing a person from the inside not only enables us to understand them, but induces us to care about them and to assess their moral character. These emotions of empathy and judgement he saw as the foundations of morality, driving a wedge between what we want to do, and what we feel we ought to do.

While economic thinking has a powerful simplicity at its heart, Collier’s work is a timely reminder that economic ideas often get over simplified and misrepresented. As we see from analysing the Blakeley/Portillo debate, understanding economic exchange is complex. There are social relational aspects, acting as critical foundations or impediments, and alternative rationalities orientated to economic outcomes or substantive values such as fairness or happiness.

There are debates to be had about the place of morals or social values in economic decisions. But productive discussions require understanding of the assumptions of each perspective. There is no “correct” economic argument, all positions entail trade-offs. And economic policy decisions remain political as well as moral.