Puerto Rico’s bankruptcy problem is complicated — but the various ways the crisis hurts most Puerto Ricans is unmistakable.

Since Puerto Rico declared bankruptcy in 2017, it’s become harder for people to decide where they can afford to live and where their children can enroll in school.

The island declared a form of bankruptcy in 2017. At the time, the island faced historic levels of debt, topping $72 billion. But Puerto Rico’s debt crisis, far worse than Detroit’s $18 billion bankruptcy claims in 2014, has now reached a potential turning point.

U.S. District Judge Laura Taylor Swain approved a large-scale debt restructuring plan on Jan. 18, 2022, that would cut $33 billion from Puerto Rico’s debt and work to pay back its creditors.

Because Puerto Rico has been a territory of the United States since 1898, the bankruptcy plan unfolded in a unique way that has limited residents’ say over financial cuts to public programs that directly affect them, angering many Puerto Ricans.

As a scholar of Puerto Rican politics and a native Puerto Rican, I believe that the island’s recently announced debt agreement will not make it easier for citizens to find homes, schools, and jobs. But it will fuel and test Puerto Ricans’ ability to mobilize politically.

Puerto Rico’s controversial bankruptcy crisis

Puerto Rico’s money problems, which have grown over the past two decades, are the result of many factors: Years of borrowing to cover budget deficits, poor economic growth, political corruption and a population decline all play a role.

Since Puerto Rico is a U.S. territory, and not a state or city, it does not have the right to officially file for bankruptcy.

In 2016, Congress passed the Puerto Rico Oversight, Management, and Economic Stability Act, a law known as PROMESA, that created a new government agency. This agency, the Financial Oversight and Management Board for Puerto Rico, was responsible for laying out Puerto Rico’s debt repayment strategy.

But local people had no say in the creation or composition of this board, known simply as the Junta – meaning council in Spanish. None of its current seven board members are from the island. Puerto Ricans have also not been involved in the Junta’s financial decisions.

Puerto Rico’s debt was never publicly audited, which lent to public concerns about lack of transparency in managing this crisis.

The Junta primarily made financial cuts, or austerity measures, to address the debt. They achieved an agreement with the Puerto Rican government to partially pay back its debt.

But, for everyday people, these cuts have worsened their quality of life.

One unpopular austerity measure the Junta took was freezing public school teachers’ pension plans. Financial cuts also limited Puerto Rico’s Medicaid spending and have threatened funding for people’s pension plans and public universities.

Thousands of teachers, earning a starting salary of $1,750 a month, have taken to the streets in protest. Puerto Rico Governor Pedro Pierluisi announced on Feb. 8, 2022, that teachers will receive a temporary monthly raise of $1,000 starting in July.

The teachers’ demands echo the sentiment of many Puerto Ricans, who do not like these austerity measures.

Public schools take a hit

Puerto Rico’s Department of Education has regularly closed public schools over the last few years because of financial cuts, at a pace that was previously unseen for decades.

Since 2016, 523 schools have closed in Puerto Rico. The education department has plans to close 83 schools by 2026, affecting 18,644 students.

Julia Keleher, the former secretary of education in Puerto Rico, is an advocate of school closings.

Keleher was a polarizing public figure — she was also a mainland American official in Puerto Rico — a reminder of the island’s colonial history. Keleher pleaded guilty to federal fraud conspiracy charges over mismanagement of public funds in June 2021.

Puerto Rico’s Department of Education has new leadership. But some specialized arts schools, such as the Central High School in San Juan, have continued to shut down, prompting online petitions for change.

School closings more broadly sparked significant protests in San Juan by parents, students, teachers and politicians over the last few years. Many working-class students needed to travel farther to reach open schools that were outside of their communities, disrupting their learning experience.

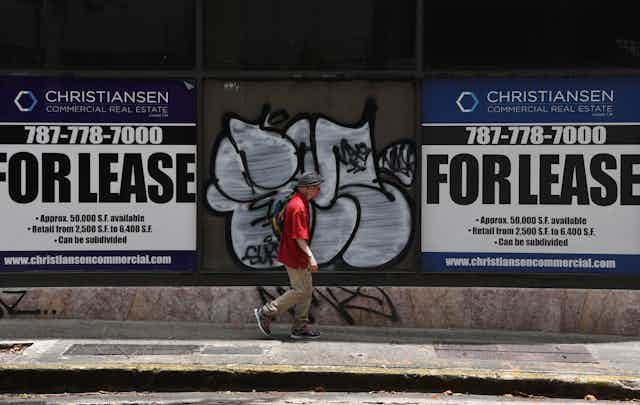

Gentrification amps up in Puerto Rico

Rising housing costs compose the latest chapter of Puerto Rico’s layered financial saga.

The housing problem coincides with Puerto Rico attracting foreign investors with new tax breaks.

Economic development experts have argued that the arrival of new investors, combined with the Puerto Rico government’s tax relief measures, create new gentrification concerns about affordable housing. This is particularly true along the coastal regions — that may hurt Puerto Ricans.

American financier John Paulson is one example of a growing wave of outsiders who have purchased property in Puerto Rico, seeking to receive tax breaks.

This investment was made possible by a new law, which aims to attract wealthy foreigners to the island. It does this by providing new Puerto Rican residents with exemptions from paying income tax on all “passive” income, meaning money from investments, for example.

[Over 140,000 readers rely on The Conversation’s newsletters to understand the world. Sign up today.]

The net result is significant local resistance to foreign investors.

Now that a judge has approved Puerto Rico’s debt restructuring, the austerity measures cannot be changed on paper. But Puerto Rico’s public still has the chance to push back and lobby for change, as they continue to do through protests to advocate for their political demands.