Facing an unprecedented global crisis, it’s natural to turn to taxes for comfort. As strange or unwanted a claim as this seems, our tax system reflects our societal wants and needs, and the behaviours we wish to encourage or discourage.

Governments amend taxes for good times and bad, and this coronavirus crisis is no different.

The Canadian federal government’s COVID-19 Economic Response Plan includes tax-related measures. Although these measures may update, let’s examine the tax supports for individuals and how these measures could benefit society — by considering the past, present and future.

The past: Tax extensions

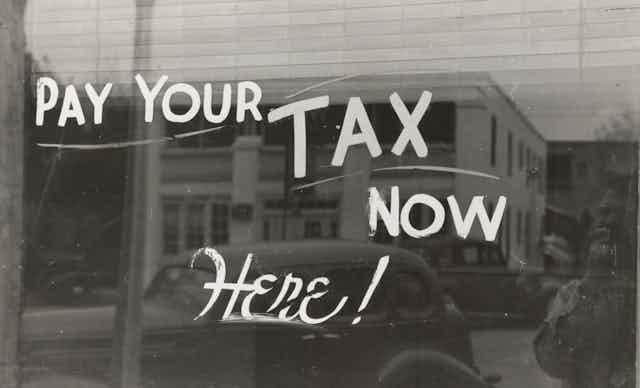

The government’s COVID-19 plan helps past behaviour because individuals have until June 1, 2020 to file 2019 tax returns.

Also, Canadians have until Aug. 31 to pay — without interest or penalties — 2019 taxes, or 2020 instalments based on 2019 information.

We can’t actually travel back in time to change our past, aside from access to special DeLoreans, hot tubs or Quantum Realms, but these tax extensions help.

Disrupted information providers now have more time to send us tax forms. And although many taxpayers psychologically enjoy getting a refund, owing a little tax is better economically — and payment deferral makes interest-free tax loans available to Canadians for perhaps the first time ever.

However, like 75 per cent of 2019 returns already processed, refunds are common. File your tax return as soon as possible to claim it (or qualify for some of the plan’s tax subsidies that I highlight next).

The present: Income support

Honestly, though, 2019 is easy. It’s 2020 that’s off the charts. To survive disruptions that include social distancing, employment slowdowns and layoffs, we need economic relief now. The government’s plan provides two primary forms of cash support.

First, $2,000 a month, for four months, in tax benefits are available to individuals who have stopped working because of COVID-19 (whether employed or self-employed and whether eligible for Employment Insurance (EI) benefits or not).

All qualifying individuals apply online. The current portal will guide individuals toward applying for either the support or for EI.

However, an individual cannot receive both amounts in the same period. After receipt of the $2,000 income support ends, an individual can continue to apply for regular EI.

Second, additional amounts are available for low and modest income families through enhancements to the GST credit (up to $600) and Canada Child Benefit (up to $300 per child). These amounts are administered by the CRA just by filing a 2019 tax return.

Highlighting the importance of these amounts, having access to more than a one-time source of support could be critical for many individuals during or following this coronavirus crisis. According to market research half of Canadians barely cover their monthly bills. Furthermore, U.S. academic research found that following the 2008-09 financial crisis, tax transfers softened the blow of reduced income driven primarily by lost employment.

I’ll highlight two other “present” elements of the plan. For those repaying student loans, there’s a six-month, interest-free break from payments. Normally it’s a smart move to borrow now for higher future earnings. So extending an interest-free loan period helps to compensate for the unexpected disruption in earnings potential.

For seniors using a Registered Retirement Income Fund, minimum withdrawal levels for 2020 are reduced by 25 per cent.

Read more: How to determine what’s better – RRSPs or TFSAs?

Many investment plans have been hurt by market lows. Lower withdrawals mean more assets remain tax-sheltered for longer, allowing time to rebound and generate more income for future withdrawals.

Less obvious, lower withdrawals mean less clawback of Old Age Security; clawbacks are one of several stealth taxes that disproportionately hurt seniors.

The future: Additional support

Again, we’ve seen some adjustments to the federal government’s COVID-19 economic plan since it was announced. I expect more adjustments to existing support, but I also expect new support. Traditionally, Canadian governments provide tax incentives or cuts around budget time. Budgets for 2020 budgets have obviously been delayed, and 2021 budgets won’t be released until at least January 2021.

I’m not aware of governments normally using the kind of measures I’m about to suggest, but hey, these are not normal times.

Some options for future budget measures:

– Treat income support, currently labelled a taxable benefit, as non-taxable

– Make the basic personal tax credit for 2020 temporarily and/or partially refundable (the federal government has already announced plans to gradually increase the amount by 2023)

– Introduce a universal basic income

Read more: Job guarantees, basic income can save us from COVID-19 depression

As we live through COVID-19 shutdowns across the country and around the world, we’d all like to get back to a sense of normalcy, whatever that normal will be. Economic stability is a critical feature to recovery, and a tax system assists with that.

Certainly tax stimulus is not costless, but effective tax measures mitigate the burden. When the dust settles, I hope these measures help put cash into our pockets that we otherwise wouldn’t have, and make our future brighter.